Tesla shares fell on Tuesday after the company reported a drop in vehicle deliveries in the first quarter, the first annual decline since 2020, when the global pandemic disrupted production. The decline followed a long period of underlying ramp-up and spooked investors. The worry is that Tesla is facing increasing headwinds in markets around the world, not least in the shape of cheap EVs coming out of China from the likes of BYD. There’s still a price war on in China that makes life difficult there for premium EV makers. Meanwhile, in the US, Fisker has decided to slash prices also…

MORE: Tesla stock price falls after lower Q1 deliveries

In terms of vehicle markets, there were a clutch of markets with positive news this week. The US is a big positive right now, monthly sales numbers meeting or slightly exceeding expectations.

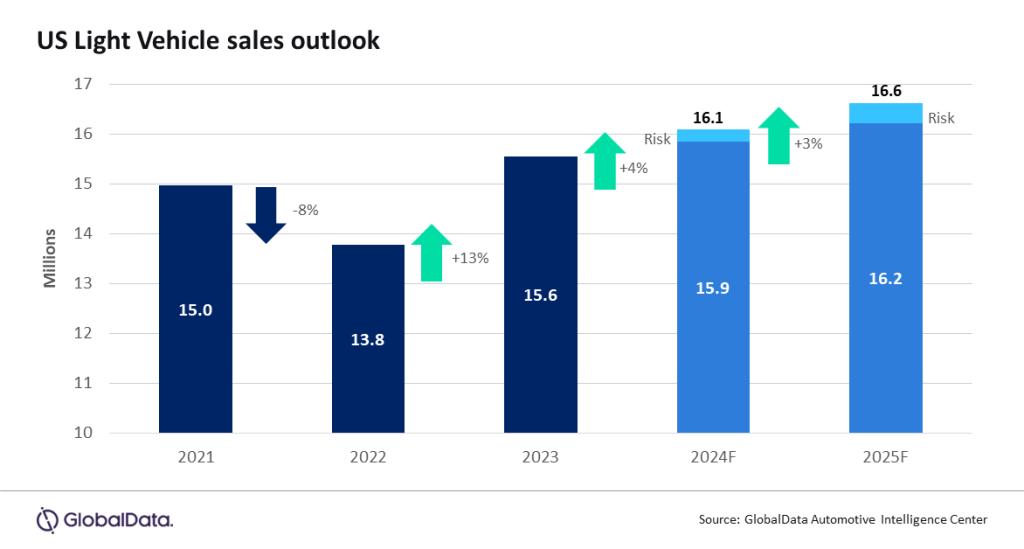

The topline outlook for US auto sales remains at 16.1 million units for 2024, as pent-up demand is met, and growth begins to ease.

According to preliminary estimates, US Light Vehicle (LV) sales grew by 5.5% year-on-year (YoY) in March, to 1.44 million units. The market delivered another month of YoY growth – a streak which now extends to 20 consecutive months – but year-ago sales were still relatively low, making the gain easier to achieve. For Q1 as a whole, sales were up by 5.1% YoY, reaching 3.75 million units.

MORE: Solid March results round out quarter of growth in US auto market

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

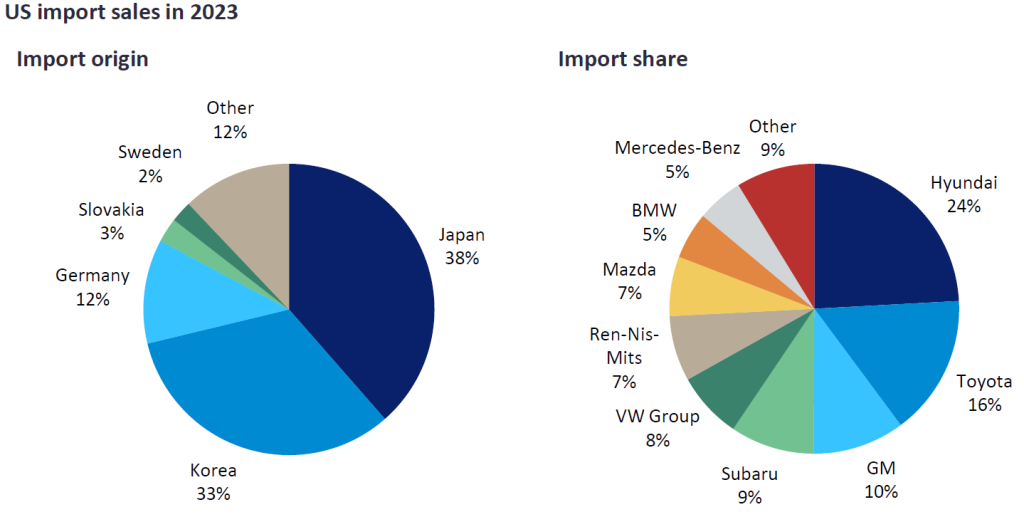

By GlobalDataWhat will be the US market impacts of the Baltimore bridge collapse (the Port of Baltimore handled 850k maritime vehicle shipments last year – highest volume of all US ports)? There will inevitably be some short-term disruption to manufacturer logistics, but GlobalData’s view is that the challenges are largely manageable.

MORE: Auto industry braces for potential disruption from Baltimore bridge collapse

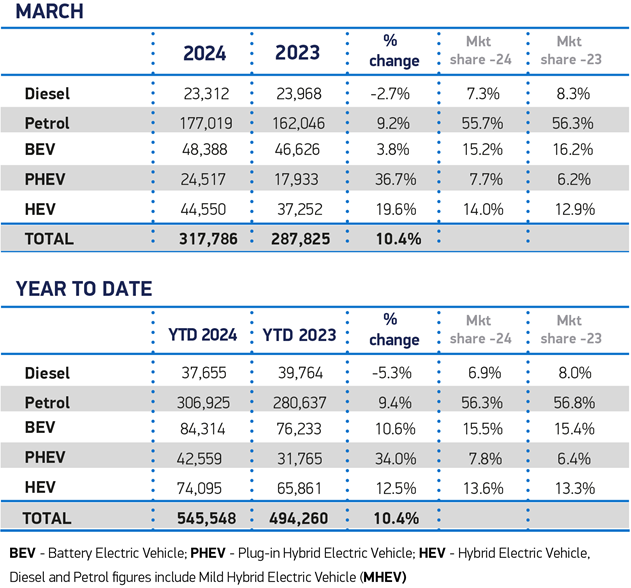

The UK was another car market that notched up a 20th consecutive month of year-on-year growth in March. A notable aspect of the UK car market results issued by the SMMT was the strong performance of hybrids.

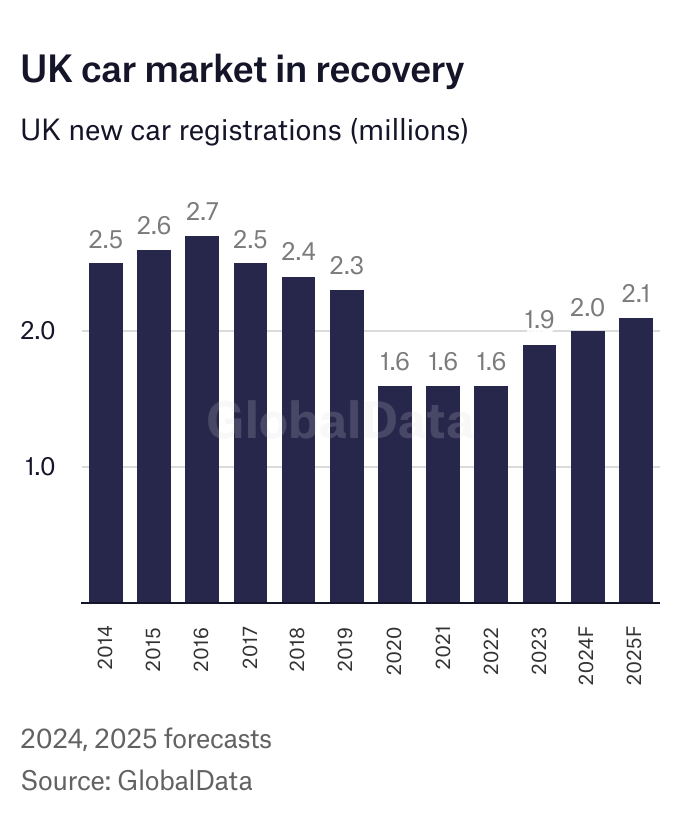

Lest we get too carried away with the positive picture for the UK's car industry, the drop from pre-pandemic levels provides something of a reality check.

GlobalData forecasts the UK car market will grow by around 3% to 2m units in 2024. That would follow an 18% rebound in 2023 as supply constraints caused by the global semiconductors crisis eased.

GlobalData analyst Jonathon Poskitt told Just Auto: “We expect a recovery in household real incomes to help vehicle sales in 2024. The market pace is expected to be dictated by underlying demand once again. It’s a moderate recovery though, with interest rates still at high levels, even as they are expected to edge down.”

MORE: UK car market up 10% in March

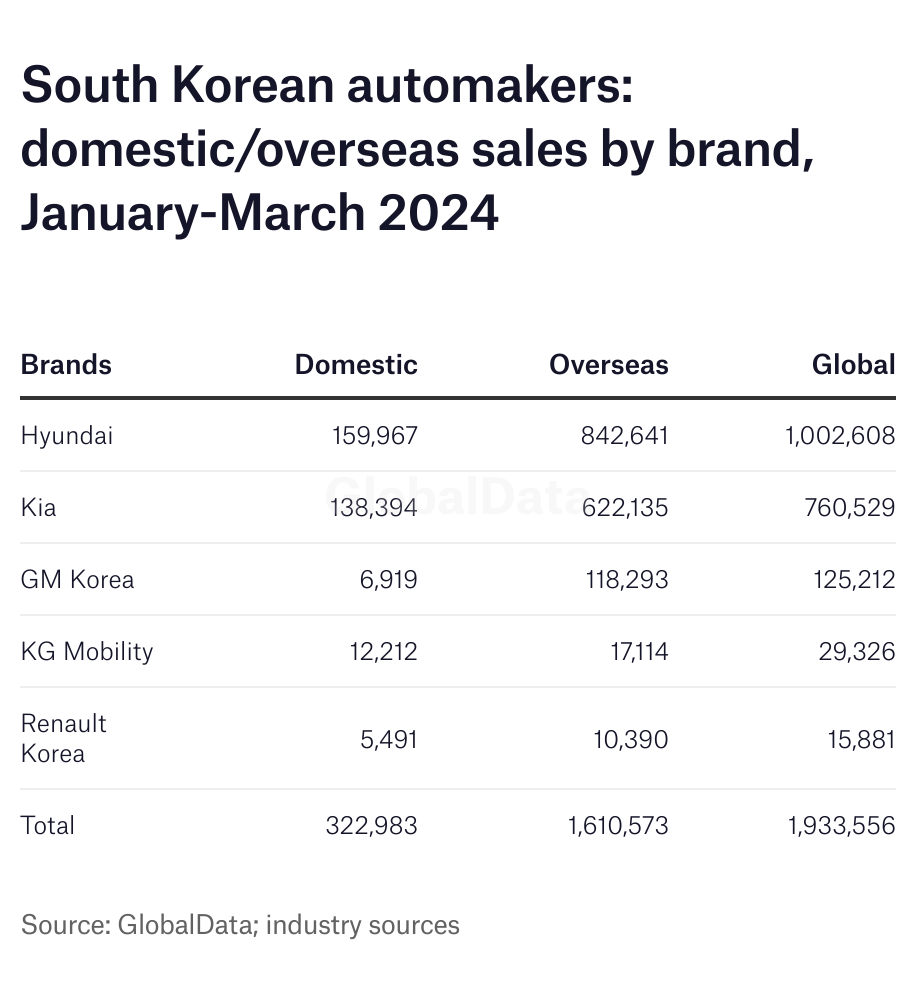

A market looking less positive lately: South Korea.

Domestic sales by South Korea’s five main automakers combined fell 15% to 120,604 units in March 2024 from 141,138 year earlier, according to preliminary data released individually by the manufacturers.

The data, as usual, did not include sales by low volume commercial vehicle manufacturers while import brands will be covered in a separate report later this month.

The 15% March fall followed an 18% year on year decline in February which was blamed in large part on Hyundai production stoppages due to plant refurbishment and production line maintenance plus fewer working days due to the Lunar New Year holidays.

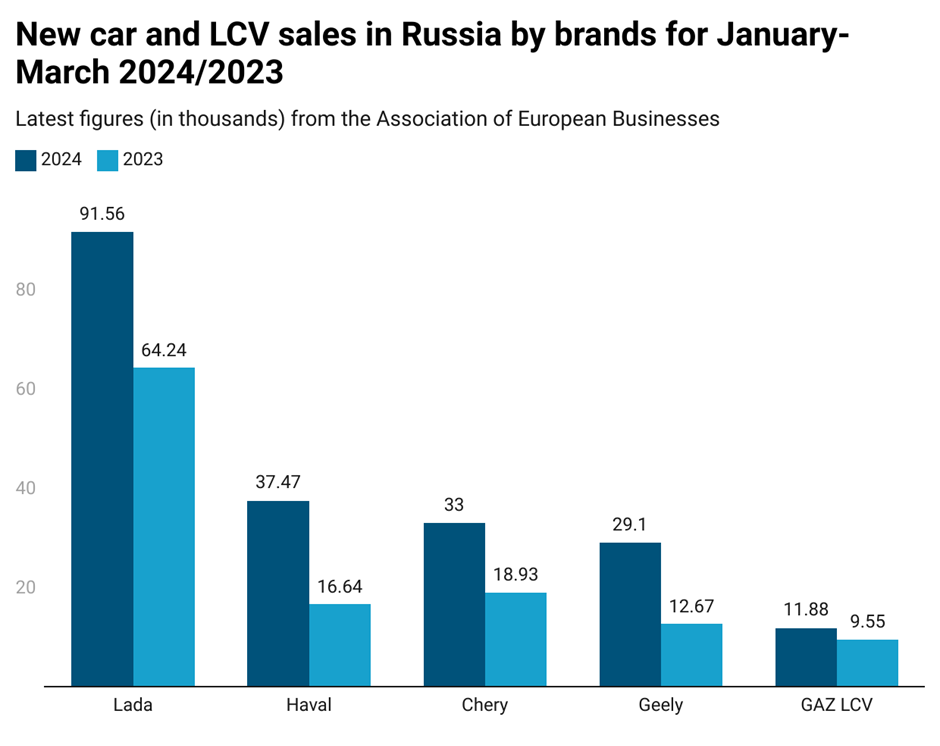

Data on Russia's vehicle market shows that Russian and Chinese brands dominate. The Chinese have filled the gap caused when Western brands exited Russia in the wake of Russia’s military action in Ukraine. Lada, Haval, Chery, Geely and GAZ LCV maintained their top positions in the absence of Western automakers, according to data issued by the Moscow-based Association of European Businesses (AEB).

Latest figures from the AEB suggest Russia's vehicle market is growing - albeit from a low base and numbers still way down on where they were before Ukraine related sanctions.

In the AEB data, we noticed that a 'new' domestic brand has arrived in Russia this year. AGR Automotive Group (formerly Volkswagen Group Rus) has launched its Solaris brand. It is a newcomer to the domestic market, apparently continuing to make Hyundai Motor Group models after HMG left the St Pete plant. In January to March this year, some 750 vehicles were sold under the Solaris brand name. The AEB suggests that more new domestic brands will emerge from Russian factories vacated by Western OEMs and transferred to Russian owners. Supply chain management and parts procurement must be something of a challenge.

More: Russia launches new car brand Solaris