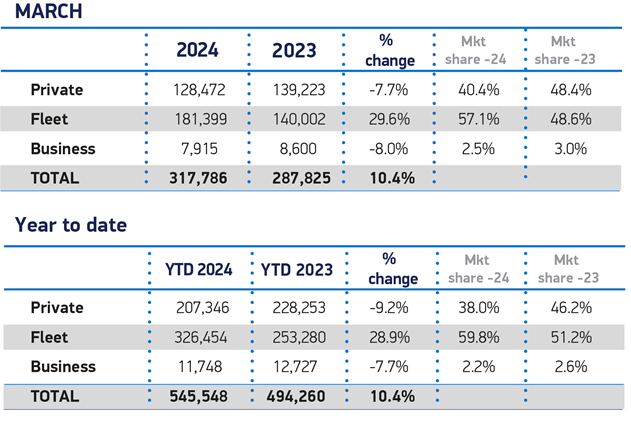

The UK new car market clocked up its 20th consecutive month of growth in March, with a 10.4% rise in new registrations.

In what is typically the busiest month of the year due to the new numberplate, 317,786 new cars reached the road with a 24 plate – the best March performance since 2019, although still 30.6% below pre-pandemic levels.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Growth was again driven by fleets, up 29.6% as the sector continues to recover following the constrained supply of previous years. Registrations by private buyers fell by 7.7%, with a challenging economic backdrop of low growth, weak consumer confidence and high interest rates. The small business registration segment, meanwhile, declined 8.0%.

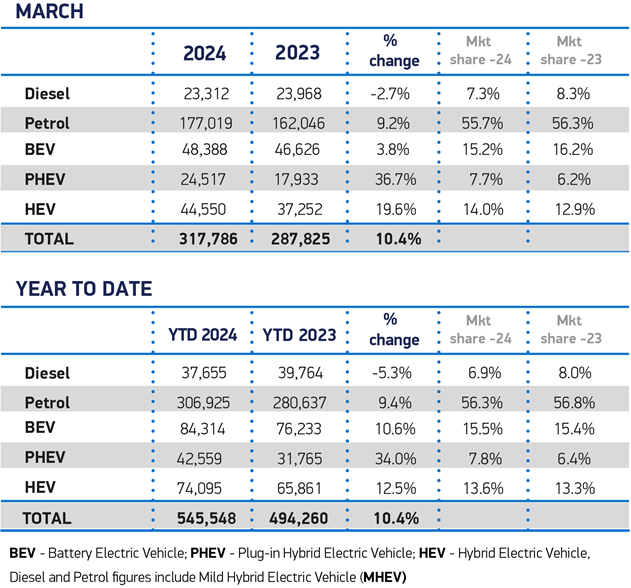

Petrol cars retained the largest share of the car market, at 55.7%, with registrations up 9.2% year on year, as diesel volumes fell 2.7% to account for just 7.3% of demand. Uptake of hybrid electric vehicles (HEVs) reached record levels, rising by 19.6% to 44,550 units and 14.0% of the market, while the biggest percentage growth was recorded by plug-in hybrids, up by more than a third to 24,517 units, or 7.7% of all new registrations.

Conversely, while battery electric vehicle (BEV) registration volumes were at their highest ever recorded levels, market share fell by one percentage point from the same month last year, down to 15.2%. Registrations rose 3.8%, with only fleets showing any volume growth.

Mike Hawes, SMMT Chief Executive, said: “Market growth continues, fuelled by fleets investing after two tough years of constrained supply. A sluggish private market and shrinking EV market share, however, show the challenge ahead. Manufacturers are providing compelling offers, but they can’t single-handedly fund the transition indefinitely. Government support for private consumers – not just business and fleets – would send a positive message and deliver a faster, fairer transition on time and on target.”

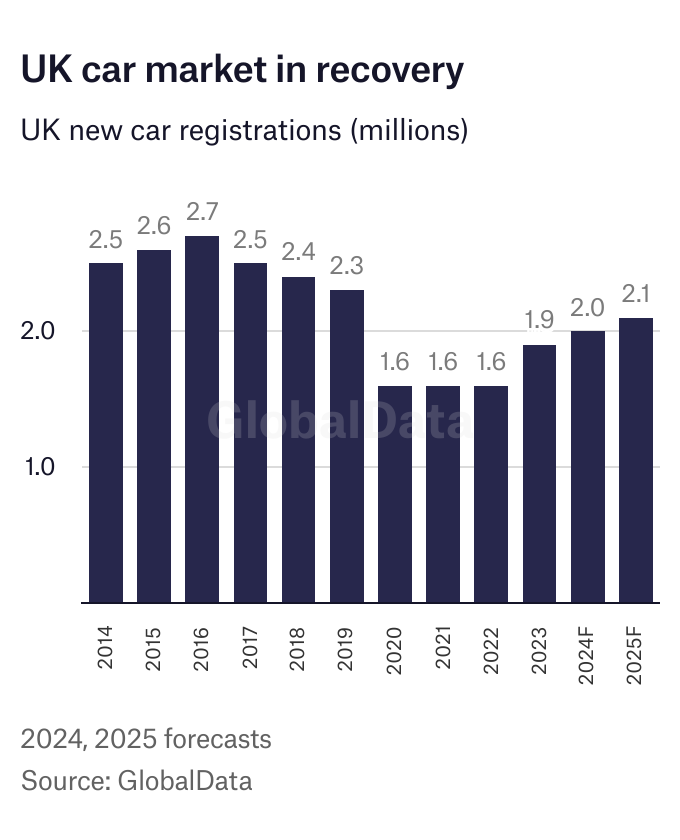

GlobalData forecasts the UK car market will grow by around 3% to 2m units in 2024. That would follow an 18% rebound in 2023 as supply constraints caused by the global semiconductors crisis eased.

GlobalData analyst Jonathon Poskitt told Just Auto: “We expect a recovery in household real incomes to help vehicle sales in 2024. The market pace is expected to be dictated by underlying demand once again. It’s a moderate recovery though, with interest rates still at high levels, even as they are expected to edge down.”

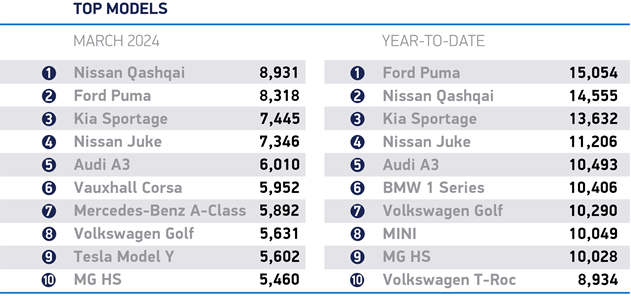

The top selling model in March was the Nissan Qashqai, although the Ford Puma was top in the first quarter as a whole.