The tragic collapse of Baltimore’s Francis Scott Key bridge in the early hours of 26 March 2024, after being struck by a cargo ship, has shut down the busiest port in the US for automotive shipments for the foreseeable future. The loss of the Baltimore port threatens to disrupt the state of the recovery for vehicles imported into the US, as well as automotive parts.

Expected plan of action:

- Salvage operation led by the US Army Corps of Engineers to remove debris, stabilize the cargo ship and move it to safety, in order to free up the channel and reopen the port to two-way traffic. The timeline is unclear but could last weeks.

- Diversion of cargo ships to other ports has already begun. There are several ports on the US East Coast capable of handling and transferring automotive cargo, including in Georgia, Virginia, New York, New Jersey, Pennsylvania, and South Carolina.

- Additional measures may be taken in relation to the shipment of inbound and outbound vehicle parts, including air freight if necessary. Parts traveling via cargo ship are typically long-lead parts, so any impact to production would not be visible in the near term as there would be a level of local inventory maintained.

GlobalData Assessment:

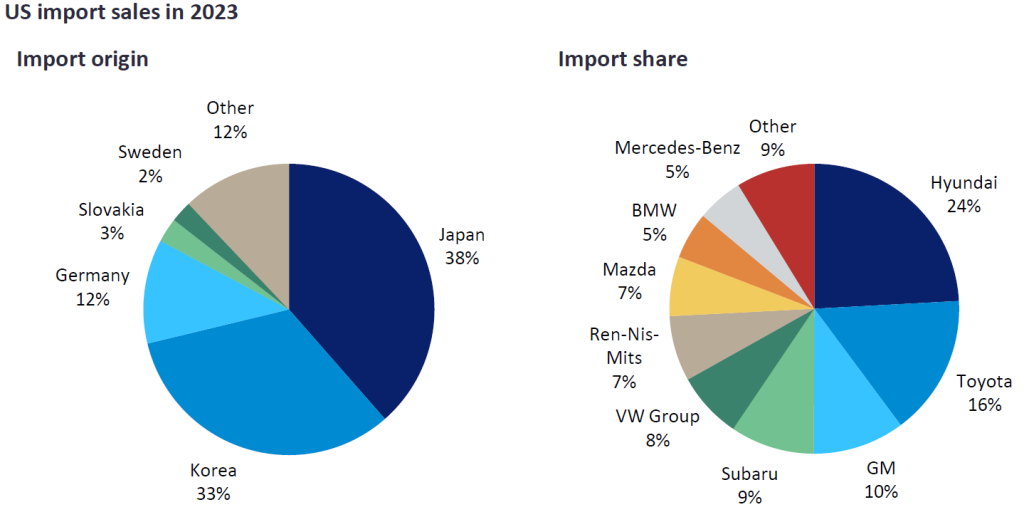

In 2023, 22% of the vehicles sold in the US were imported (27% in Canada), so the shutdown of the largest port for autos has the potential to affect the volume and share of sales by import brands.

As illustrated below, Japan, Korea and Germany are the main origins for vehicles entering the US market, so brands with heavy production concentrations in those locations have the potential to be impacted more significantly, especially those in Europe. It is no surprise that Hyundai and Toyota were the top importers, though General Motors (GM) was the third largest, with vehicles coming from Korea and China. VW Group is among the top 5 importers, while BMW, Mercedes-Benz, Volvo and Stellantis are also exposed to potential disruption.

The diversion of ships to other viable ports will likely cause some bottlenecks, given the limited number of available options; however, it should be manageable with minimal delays once ships are rerouted. It will likely require coordination between OEMs, suppliers, shipping companies and port authorities to minimize the disruption at any given alternative location.

It remains possible that certain vehicles will be in short supply, affecting consumer choice and brand model sales, depending on what models are on the diverted ships and how long a delay lasts. There could also be isolated plant shutdowns due to parts delays, although the industry has experience in managing part shortages and minimizing the impact. While not perfect, supply chain visibility and management has improved significantly since the beginning of the pandemic.

Opening the Baltimore port is a top priority, but it is still a very early stage and the timeline for a resolution has not yet been set. That said, we do not expect any material impact on vehicle availability, sales volumes of brands importing vehicles into the US and Canada, or automotive production in North America, Europe, and Asia.

Jeff Schuster, Vice President Research and Analysis, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.