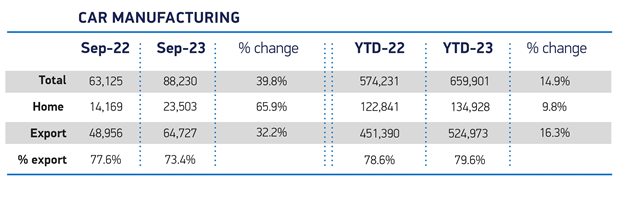

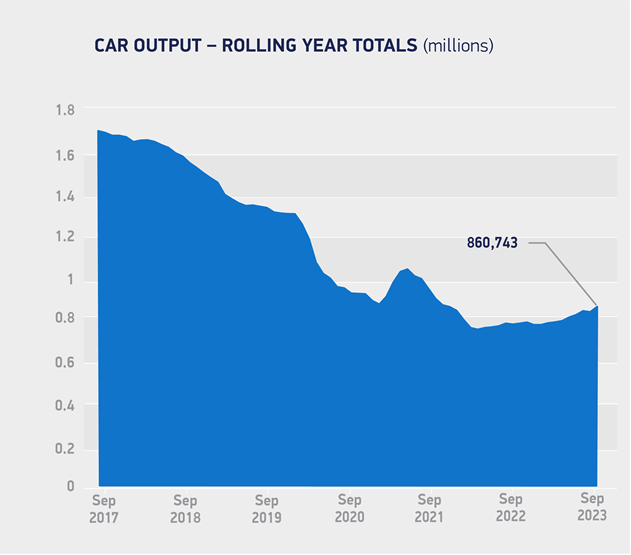

UK car manufacturing grew 39.8% year on year in September 2023, the strongest month of growth so far this year, as 88,230 units left British assembly lines.

The Society of Motor Manufacturers and Trader said last month’s rise was driven by a 32.2% export increase to 64,727 vehicles with almost six in 10 units going to the EU, while domestic market deliveries surged 65.9% to 23,503 in a (twice-yearly) ‘plate change’ month.

Electrified vehicle output rose 41.5% but the SMMT added “urgent action” was needed “to ensure UK and EU trade remains competitive from 2024”.

Year to date output was up 14.9% to 659,901 units.

Notable output growth for export markets included the US up 19.8% to 6,591 units; China up 28.2% to 4,776 units; and Turkey up 212% to 4,162 units. The EU remained the biggest customer with 37,563 cars shipped to the bloc last month, up 46.1% and accounting for 58% of total exports.

YTD shipments rose 16.3% to 524,973 with electrified vehicles accounting for 37.5% of those exports, up from 26.4% a year ago.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“Given the increasing importance of EV trade with mainland Europe in particular – bilateral trade which has more than doubled in value in the last three years – the tariff free trade set out in the UK EU Trade Cooperation Agreement (TCA) must be maintained,” the SMMT said in a statement.

“This is under threat, however, from January 2024 when tougher rules of origin for batteries come into force. Given the value of batteries to the total cost of an EV, the rule changes threaten the competitiveness of both UK exports to the EU and EU imports to the UK market.

“Failure to comply will result in a 10% tariff which if fully passed on would raise the average cost of UK built battery electric vehicles (BEVs) by GBP3,600 in Europe while EU-made BEVs sold in the UK would see an average GBP3,400 price hike.

“A three year delay to the implementation of these new requirements would, however, maintain competitiveness, supporting British and European manufacturers, and is readily achievable through the existing TCA framework with no need for formal renegotiation.”

Mike Hawes, SMMT chief executive, said: “A particularly strong period of car making is good news for the UK, given the thousands of jobs and billions of pounds of investment that depend on the sector.”