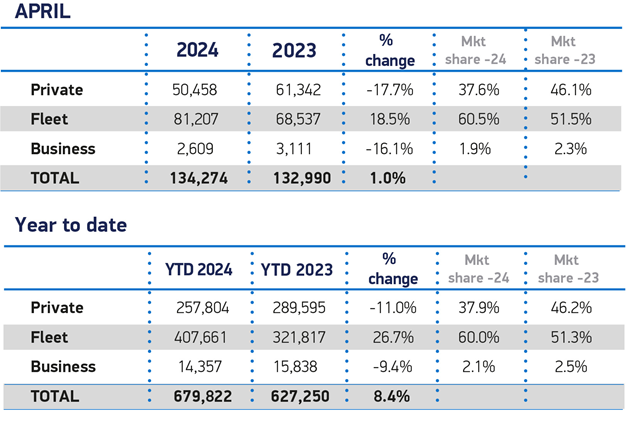

UK new car registrations grew for the 21st consecutive month in April, rising by a modest 1.0% to reach 134,274 units, according to the Society of Motor Manufacturers and Traders (SMMT).

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

As a result, this was the market’s best April since 2021, although uptake was still 16.6% below the pre-pandemic level in what is traditionally a low volume month following the March plate change.

Continuing the trend seen throughout the year so far, growth was driven entirely by fleets, where registrations rose by 18.5% to reach 81,207 units – more than six in 10 of all new cars registered in April.

Private buyer uptake fell by 17.7% to 50,458 units, while business registrations declined by 16.1%, to 2,609.

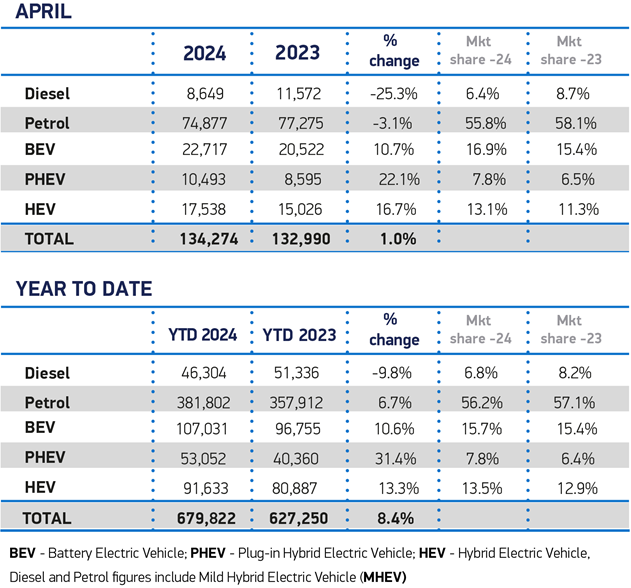

Electrified vehicles continued to be the main drivers of market expansion. Plug-in Hybrids (PHEVs) recorded the strongest growth, rising by 22.1% to account for 7.8% of the market, followed by Hybrid Electric Vehicles (HEVs), up 16.7% with a 13.1% share of demand. April was a brighter month for battery electric vehicle (BEV) registrations, predominantly due to ‘compelling fiscal incentives for businesses’. Overall, BEV uptake rose 10.7%, pushing up market share to 16.9%, a significant uplift on last April’s 15.4%.

The SMMT said that ‘urgent action is needed to re-enthuse private buyers into switching’ to BEVs. Fewer than one in six new BEVs bought in April went to consumers, whose uptake volumes fell by -21.9%. SMMT said the lack of government incentives for private motorists remains a barrier that cannot be overcome by industry alone.

The SMMT said a temporary halving of VAT (value added tax) on new BEV purchases would help more than a quarter of a million drivers to switch from fossil fuel to electric over the next three years. Similarly, altering the threshold for the ‘expensive car’ supplement to Vehicle Excise Duty – due to apply to EVs from April 2025 – would send the message to the market that zero emission vehicles are necessities, not luxuries.

The SMMT also said action is also needed on infrastructure, with nationwide chargepoint installation essential for consumer confidence. While last year saw more chargepoints installed than ever before, there is currently just one standard charger available for every 35 plug-in cars on the road – a negligible improvement on 2022 when the ratio was one for every 36. With current levels of infrastructure insufficient to inspire more consumers to go electric, there is a clear need for measures to accelerate chargepoint rollout.

Mike Hawes, SMMT Chief Executive, said: “The new car market continues to grow even in the quieter months, driven primarily by fleet demand. This is particularly true of the electric vehicle sector, where the absence of government incentives for private buyers is having a marked effect. Although attractive deals on EVs are in place, manufacturers cannot fund the mass market transition single-handedly. Temporarily cutting VAT, treating EVs as fiscally mainstream not luxury vehicles, and taking steps to instil consumer confidence in the chargepoint network will drive the market growth on which Britain’s net zero ambition depends.”

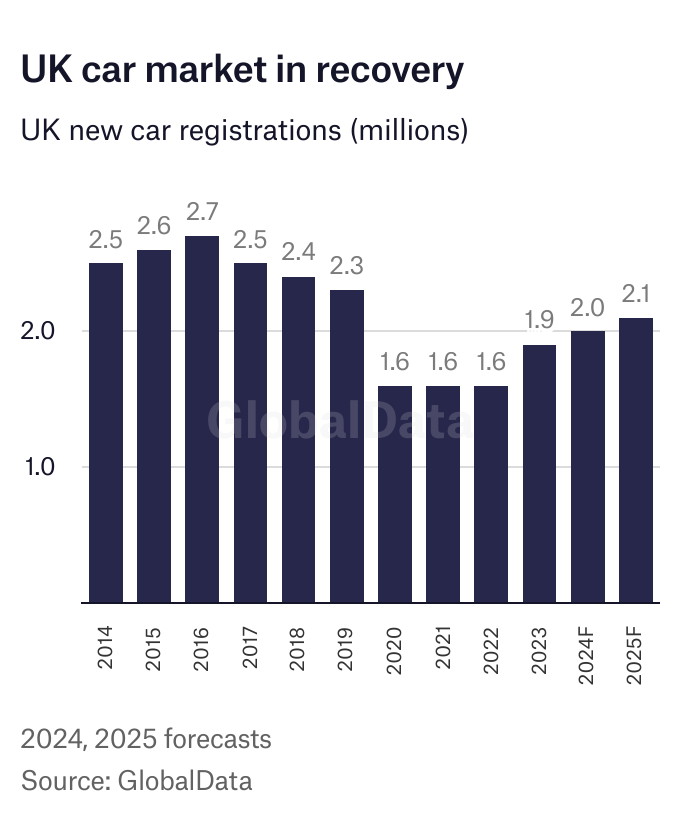

GlobalData forecasts the UK car market will grow by around 3% to 2m units in 2024. That would follow an 18% rebound in 2023 as supply constraints caused by the global semiconductors crisis eased.

GlobalData analyst Jonathon Poskitt told Just Auto: “The UK car market pace this year points to a continuing moderate recovery. Interest rates are still at historically high levels, although they are expected to edge down significantly later this year.

“Weak private buyer demand is a real concern though, particularly as fleets hit high renewal rates for electrified vehicles. Fleet sales could start to dry up later this year.”