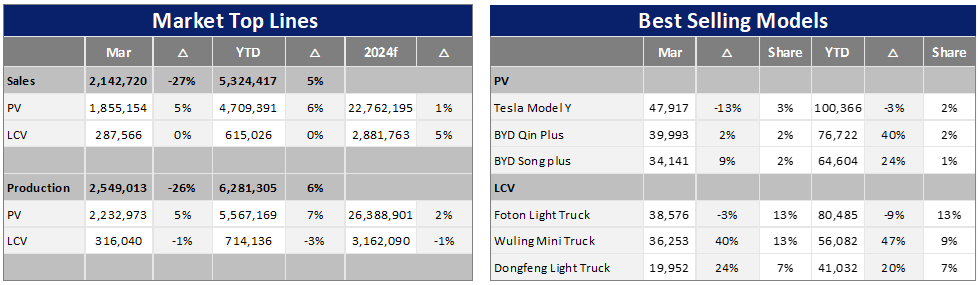

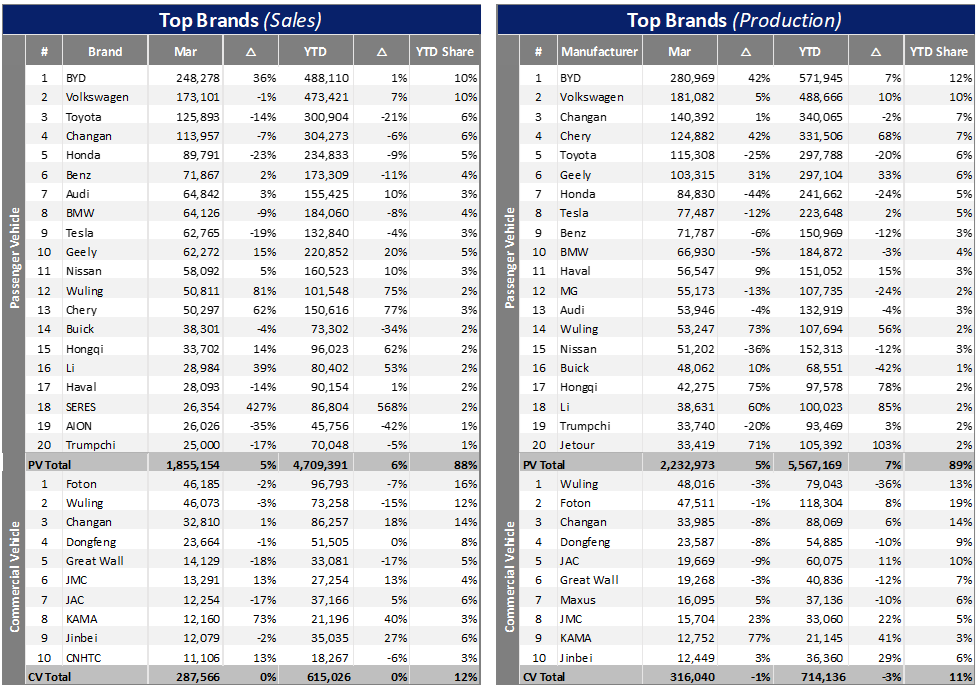

China’s automobile market experienced flat growth in the first quarter of 2024, with intensifying competition. In March, domestic sales of Light Vehicles (LV), excluding exports, reached 2.1 million units, reflecting a 4.6% year-on-year (YoY) increase.

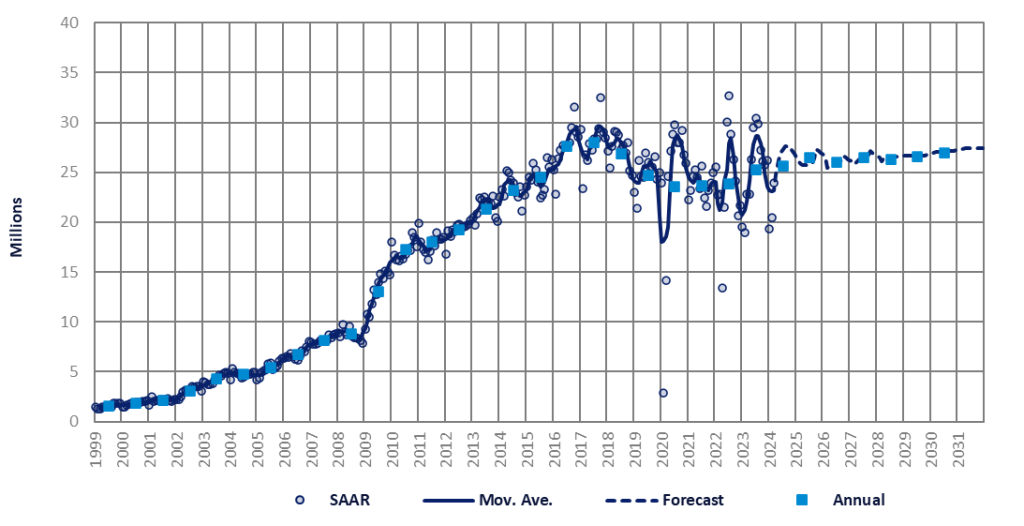

Specifically, Passenger Vehicle (PV) sales in March saw a YoY increase of 5.4% to 1.9 million units, while Light Commercial Vehicle (LCV) sales reached 288 thousand units, experiencing a slight YoY decrease of 0.2%. This growth can be attributed to post-holiday consumer spending and an intensified price war, resulting in a 79.1% month-on-month (MoM) increase in PV sales and an 87.0% MoM boost in LCV sales. After a poor performance in February due to the impact of the Chinese New Year long holiday (fewer selling days), sales in March returned to a steady growth trend. Overall, in the first quarter of 2024, domestic sales of Light Vehicles (LV) reached 5.3 million units, showing a 5.3% YoY growth. Passenger Vehicles (PV) reached 4.7 million units, with a 5.9% YoY growth in the first quarter. Light Commercial Vehicles (LCV) sold over 0.6 million units in Q1 2024, experiencing a 0.4% YoY growth. However, the average selling rate for the first quarter of 2024 stood at 21.3 million units per year, compared to 23.6 million units per year for the same period last year. This indicates that although growth was achieved in the first quarter of 2024, the growth rate was lower than expected. This may be attributed to consumers’ wait-and-see attitude due to the ongoing price war. However, market demand is expected to increase after the Beijing International Auto Show in April, as numerous new models and generations will be launched at that time.

In terms of production, the total LV production in March was 2.5 million units, which increased by 4.0% compared to the previous year and 77.9% compared to the previous month. The year-to-date volumes for 2024 reached 6.3 million units, showing a slight growth of 5.8%. At a vehicle type level, PV production, which accounts for 90% of the total LV production, reached 2.2 million units in March, representing a year-on-year increase of 4.7%. On the other hand, CV production in March was 316 thousand units, showing a slight decrease of 0.9% compared to the previous year.

In March, the PV exports in China reached 417 thousand units, showing a year-on-year growth rate of 39.9%. These exports accounted for 18.7% of the total PV production. It is worth noting that the proportion of exports in passenger car production has increased from an average of 15% in the previous year to an average of 20% in the first quarter of this year. This indicates a growing impact of exports on overall production. Currently, the significant potential of the overseas market has prompted an increasing number of Chinese car companies to consider establishing factories abroad to reduce costs further. However, based on cautious projections derived from current trends, it is expected that the annual export volume of light vehicles from China will exceed 5 million units within the next 2-3 years.

The penetration rate of new energy vehicles experienced a slight increase in March, reaching 36%. The growth rate of pure electric vehicles has decelerated, with a year-on-year growth rate of 6%. Conversely, PHEV and EREV are demonstrating robust growth, particularly in the EREV segment. We believe that extended-range electric vehicles present a more astute technological pathway for consumers in light of the prevailing market conditions. In March, the price war becomes a crucial factor driving market growth. The price of Qin L is approximately 100 thousand RMB (14 thousand USD), posing a significant threat in this segment. Moreover, the usage cost of Qin L is considerably lower compared to Polo, Lavida, and other similar models. As a result, the penetration rate in the compact segment is expected to be the second highest, reaching 100%.

In terms of policy, in order to stimulate the sales of automobile terminals, following the official implementation of the old-for-new program, the government issued adjustments to the automobile loan policy, encouraging financial institutions to independently determine the loan ratio and increase the loan ratio to meet the demand for car purchases. The loan ratio for traditional fuel vehicles and new energy vehicles has been adjusted from the previous limit of 80% and 85% to “determined by the financial institution”. That is to say, in theory, the loan ratio can reach 100%, which will be achieved to buy a car with “0 down payment” in the true sense. Moreover, OEMs have launched a new round of price cuts. Whether they are domestic brands or joint venture brands, they are grabbing market share and boosting sales at all costs. At present, independent new energy brands are leading the price reduction trend and are gradually eroding the market share of joint venture brands mainly focusing on fuel vehicles. In particular, joint venture car companies such as GAC Honda have seen a significant year-on-year decline in sales since 2024.

Xiaomi launched its inaugural model, the SU7, on March 29th, garnering considerable attention from the market. In 2023, Xiaomi sold approximately 146 million smartphones, and by December 31st of the same year, the Xiaomi AIoT platform boasted an impressive 740 million connected devices (excluding smartphones, tablets, and laptops), marking a year-on-year growth of 25.5%. Furthermore, there are over 13 million users who possess five or more Xiaomi IoT devices. This extensive user base and interconnected ecosystem encompassing “people, cars, and homes” bestow upon Xiaomi Auto a significant competitive advantage that no other OEM can rival. During the Beijing Auto Show, Xiaomi’s founder, Lei Jun, went on to propose the establishment of a unified ecosystem in collaboration with companies such as BYD, NIO, Xpeng, and Li Auto. This strategic move has the potential to position Mi-Ecosystem as a formidable contender in China’s intelligent automotive market, thereby reshaping the competitive landscape of the industry.