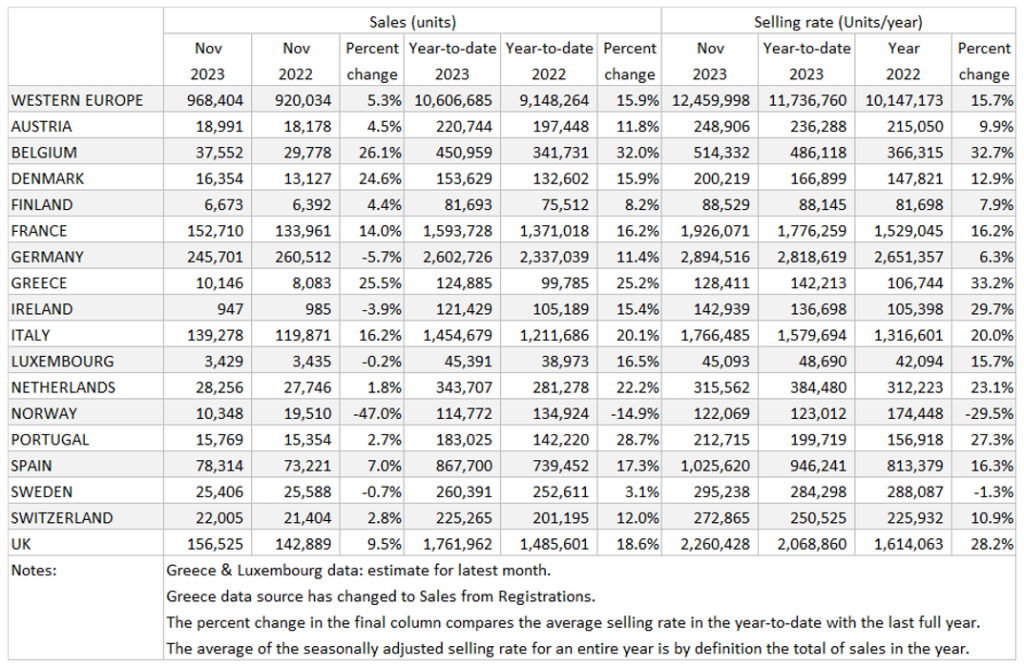

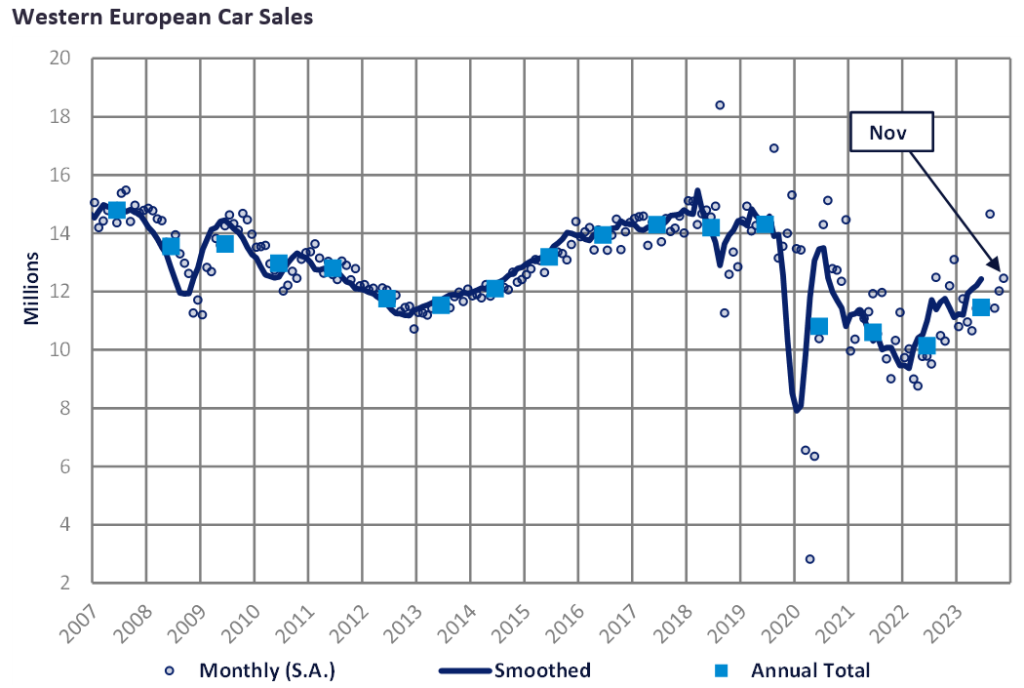

- The Western Europe PV selling rate rose slightly in November to 12.5 million units/year, from 12.0 million units/year in October. The region registered 968k vehicles in November, 5.3% higher YoY, with 10.6 million units sold year-to-date – almost 16% higher than YTD November 2022.

- Germany was the only major West European country with negative YoY growth at -5.7%, but this is due to November 2022 being a strong month as consumers brought forward their purchases before the government reined in EV incentives from the start of 2023. France and Italy, however, continue to recover strongly with double digit YoY growth thanks to improved supply conditions.

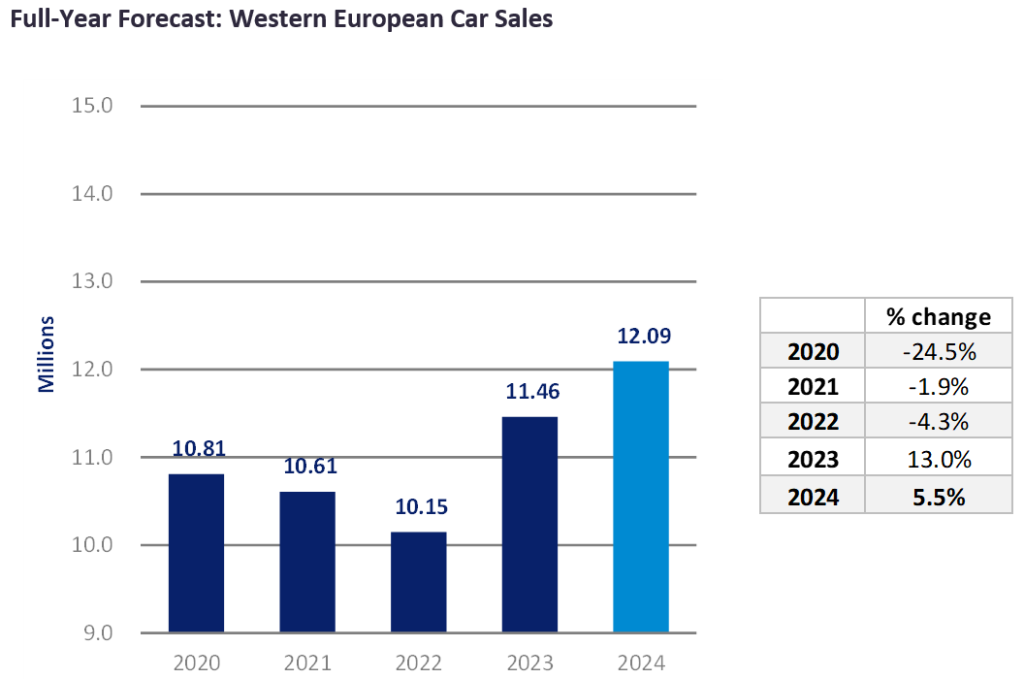

- Western Europe’s PV market sales have been benefiting in 2023 from easing supply constraints, helping OEMs tackle backlogged orders. Looking ahead, we expect to see more growth, albeit at a slower pace than the recent YoY results. 2024 will see supply shortages make way for a market that better reflects underlying demand. However, constraints on household budgets, including high interest rates, are set to limit more meaningful growth and market recovery. With the economic outlook looking more muted next year, the PV forecast for 2024 has been adjusted downward.

The Western Europe PV selling rate rose slightly in November to 12.5 million units/year. The region registered 968k vehicles in November, 5.3% higher YoY with 10.6 million units sold year-to-date – almost 16% higher than YTD November 2022. Germany brought down the region’s YoY performance in November, however, the remaining major West European countries continued to recover strongly.

The German PV market registered close to expected at 246k units, which is 5.7% less than November 2022. While this is the largest YoY reduction in 2023, November 2022 was a strong month as consumers brought forward their purchases before the government reined in EV incentives from the start of 2023. With a selling rate of 2.9 million units/year, the market accumulated 2.6 million vehicle registrations YTD (+11.4% YoY). The UK PV market selling rate was slightly under 2.3 million units/year in November, registering 157k units (+9.5% YoY). This market result highlights how the supply side constraints have diminished and helped fulfil backlogged orders. There have been 1.8 million vehicles registered YTD, 18.6% higher than YTD November 2022; however, 2023 is projected to fall some way short of the 2.3 million units registered in pre-pandemic 2019.

France’s PV market registered 153k units, close to October’s result and 14% higher YoY. The selling rate was slightly higher than October’s, at 1.9 million units, with the market accumulating 1.6 million units YTD – 16.2% higher than November 2022 YTD. The Italian PV market grew slightly in November with a selling rate just under 1.8 million units/year, with 139k vehicle registrations (+16.2% YoY). The PV market accumulated 1.5 million units YTD, up 20.1% to YTD November 2022. Spain’s PV market registered 78k units, close to October and 7% higher than November 2022. The selling rate was similar to October’s at 1 million units/year, with the YTD market registering 868k vehicles, which is 17.3% higher than YTD November 2022. Again, the PV market is being supported by improved vehicle production.