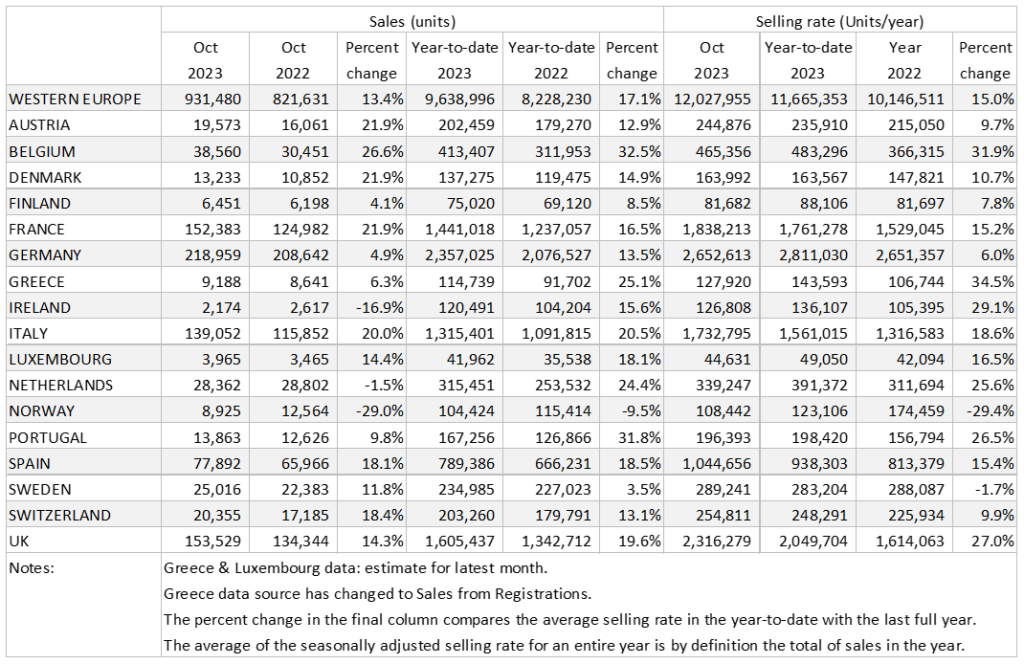

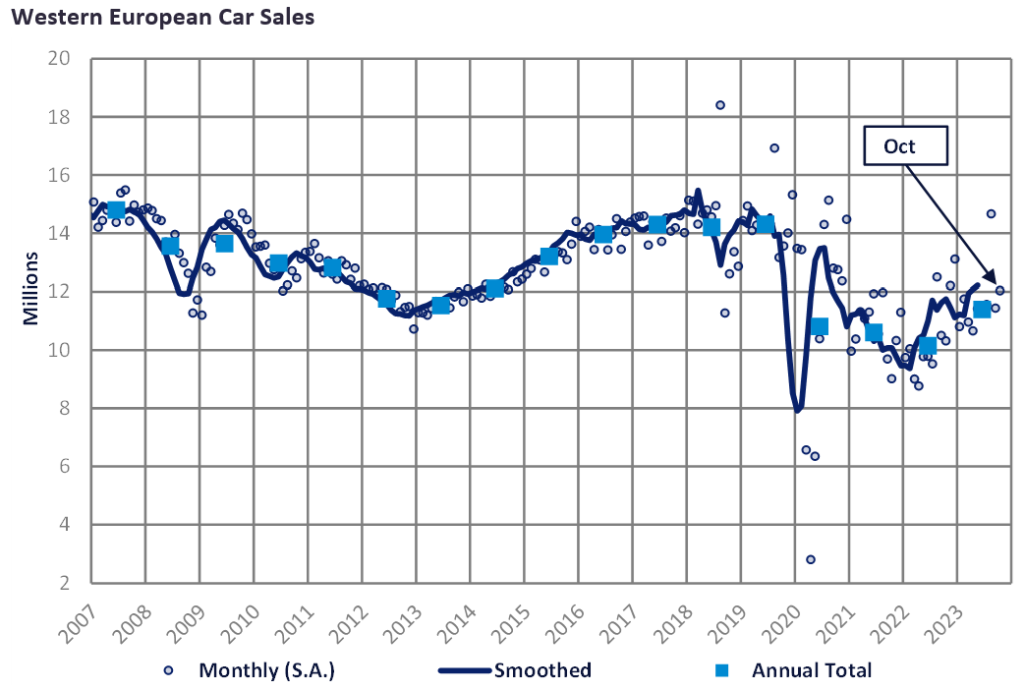

- The Western Europe PV selling rate rose to 12 million units/year in October; in YoY terms the market was up 13.4%. The region has sold 9.6 million units year-to-date, which is 17.1% higher than YTD October 2022.

- Germany continued to perform weakly, with a selling rate of 2.7 million units/year; YoY the market was up 4.9% though thanks to easing supply and despite economic headwinds. France and Italy, however, both are recovering well with above 20% YoY growth rates, along with Spain that grew 18.1% YoY on the back of improved vehicle production.

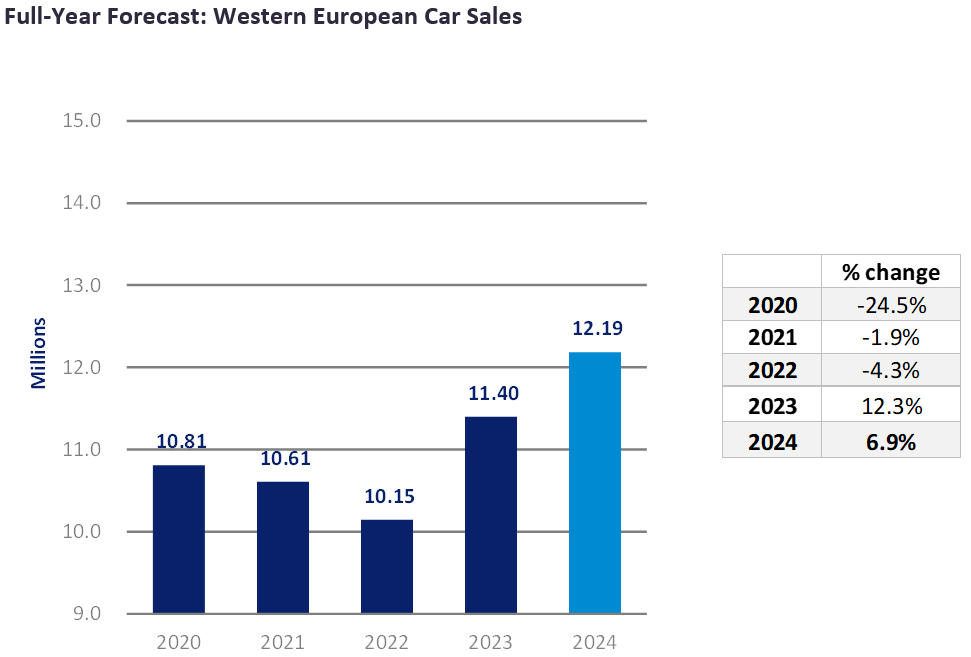

- The five major West European countries are generally recovering well as the easing of supply bottlenecks help raise deliveries. However, worsening macroeconomic conditions are negatively impacting underlying demand. The region is forecast to sell 11.4 million units in 2023, the best result this decade, with more (albeit slower) growth forecast into 2024 as supply distortions dissipate — a key risk to next year’s forecast will be any further deterioration in the economic outlook.

The Western Europe PV selling rate rose to 12 million units/year in October (+13.4% YoY). The region has sold 9.6 million units year-to-date which is 17.1% higher than YTD October 2022. While Germany performed weakly in October, the remaining major West European countries continued their strong recovery, recording double-digit YoY growth.

The German PV market recorded slightly lowered than expected sales, at 219k units, though this was almost 5% higher than the same month last year. The market registered a selling rate of 2.7 million units/year, with 2.4 million units sold year-to-date – 13.5% higher than Oct 2022 YTD. The market continues to improve as supply issues ease further but macroeconomic headwinds present concerns going forward. The UK PV market selling rate rose to 2.3 million units/year in October from a September figure of 1.6 million units/year. The raw monthly registration figure eased back to 154k units (though +14.3% YoY), as September is a seasonally strong month in the UK. While year-to-date (YTD) registrations are up 19.6% YoY at 1.6 million units, the market is still down 20% from the pre-pandemic 2019 level.

France’s PV market recorded 152k units, lower than September’s result of 156k units but almost 22% higher than the same month in 2022. The selling rate was close to September’s at 1.8 million units/year, with 1.4 million units sold YTD – 16.5% higher than Oct 2022 YTD. The Italian PV market grew slightly in October with a selling rate of 1.7 million units/year, following a MoM increase in the raw monthly registration figure of 139k units (+20% YoY). Despite the strong growth this month, and the YTD figure of 1.3 million units up 21% YoY, the market is still performing almost 12% below pre-pandemic 2019 levels. Spain’s PV market recorded 78k units (+18.1% YoY), with a selling rate of 1 million units/year. The market has accumulated 789k units YTD which is 18.5% higher than the YTD October 2022 total. The PV market’s growth has exceeded expectations as supply eases and despite a challenging macroeconomic environment.