Leading international developer and manufacturer of advanced silicon anode materials for lithium-ion batteries, Nexeon, has developed battery materials that it says enable a significantly higher cell energy density.

Higher density allows for the design of smaller and more cost-effective batteries which, in turn, leads to enhanced performance for several applications, including EVs where range and charging times can be improved.

We spoke to Scott Brown, CEO, Nexeon, to learn more about the battery technologies the company is working on and the benefits they can potentially bring to the EV space.

Just Auto (JA): Could you tell me about the company?

Scott Brown (SB): We are a company that was spun out of Imperial College London [part of London University] in 2006. At that time, pioneering work into battery materials had been undertaken in the engineering department. We were formed to develop silicon anode materials for lithium-ion batteries - that's been our focus ever since.

We moved off the Imperial College sites around 2008 to Oxfordshire, where we found suitable facilities. I joined in 2009 and back then we were about 15 employees; now we have over 150 employees. We've never lost our focus: we've been focused on silicon anodes throughout and I'm happy to say that we've got technology that's market ready, as well as a market that's ready for our technology now. We're in full commercialisation mode.

Tell us more about the battery materials that you are working with?

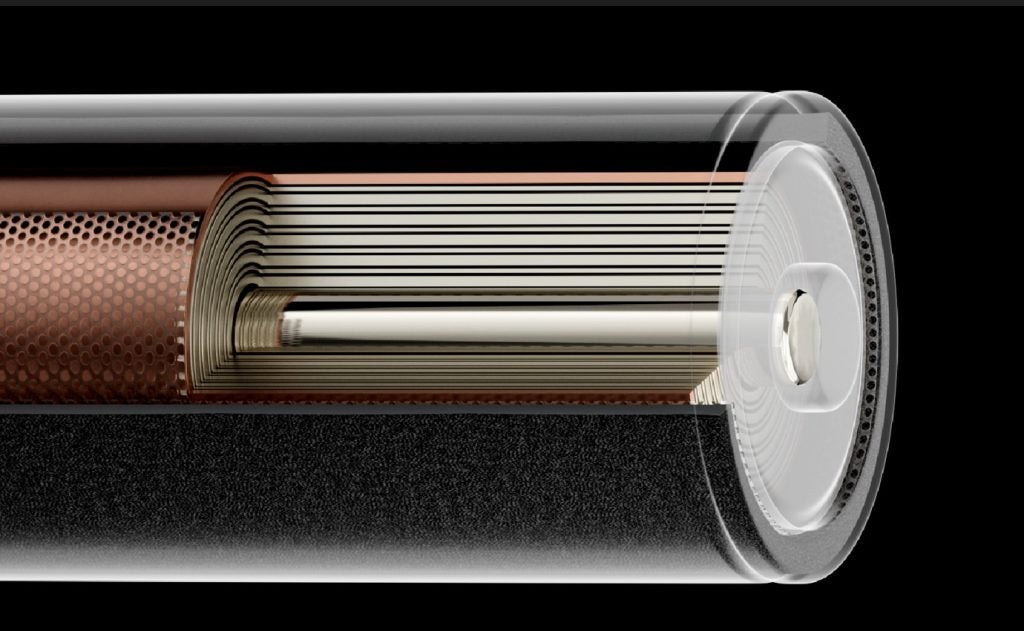

A lithium-ion battery typically has a mixed metal oxide cathode, where the lithium-ions start, and an anode with an active material that receives the lithium ions when the battery is charged. Today, most cells would have graphite as that active material. Some cells have a little bit of silicone in there and the incumbent silicon technology is silicon oxide (SiOx). That is what you'd find in some Tesla vehicles today, where higher energy density is required or desirable for the lithium-ion battery.

The graphite that's used today is really operating at its technical level limit, so anybody that wants higher performing cells needs to look at replacing the graphite with a silicone material. Silicone is the material of choice because it has a very high affinity for lithium-ions.

Our technology allows more silicone material to be introduced, because we have found a way to mitigate that expansion problem.

The problem has always been that silicone expands when it's lithiated, when it's charged, so you can only use a small quantity normally. SiOx, is currently being used, but typically at 5% to 6% by weight in a silicon graphite hybrid electric.

Our technology allows more silicone material to be introduced, because we have found a way to mitigate that expansion problem.

What are the benefits of using more silicone material within batteries?

There are various silicone materials you can use. If we look at the SiOx material there are some costs associated with that because it's got oxygen in it, which reacts with lithium-ions. When the cell maker first makes the cell and first charges it, some lithium-ions are lost and that has a cost. You sacrifice some capacity through that last lithium; the cell maker has to compensate by adding more cathode at the beginning.

Our material avoids that because we have better ‘first cycle efficiencies’. There are fewer lithium-ions lost when the cell is first charged, so there's a significant cost benefit there for sure. Then as you add more of our silicone material, you can get more energy density out of the cells. For a given energy density, you're using less of the other materials like electrolyte binders and separators.

If you look at total dollars per kilowatt hour, adopting our material at the cell level can result in significant cost savings. If you look at cell makers' fixed costs, their factory costs, they are designed to kick out a certain gigawatt hour of cells. By adopting silicone, you can get more out of your factory effectively in terms of energy. Your fixed assets are therefore put to better use, so there's also a cost saving there.

Then at battery pack level, if you're an automotive OEM and you want to sell a car with a certain range, you can get that same range with fewer cells if you adopt silicon anode materials at the battery pack level. Of course, you might decide to use the same number of cells and extend the range of the vehicle, and sell the vehicle at a higher price because it goes further. That's the beauty of silicon anodes; you can decide what strategy you want to what to follow.

So this solution enhances EV performance in a number of ways?

I would say from a strict performance point of view, you can extend the range by putting silicone into the anode and having a higher energy density cell. The other benefit of silicone is fast-charge.

If you look at the three pain-points as an EV adopter - range, charging and cost - by adopting silicon anode materials you can address all three of those.

There are problems with graphite and fast-charging which can be avoided with silicone. With this tech you can charge a battery from something like 20% state of charge to 80% state of charge in just ten minutes.

If you look at the three pain-points as an EV adopter - range, charging and cost - by adopting silicon anode materials you can address all three of those.

What is in the pipeline for the company?

We've been working with a number of automotive OEMs, and most of the major cell makers globally for a number of years and we have been working on sampling of materials to those companies.

We are at various stages of qualification with each of them. Some of them we've been sampling for longer and we are coming to the end of the qualification period. A good example, for us, is Panasonic. They have qualified our material and we have signed a commercial contract with them, and that's public information.

There's a number of others following behind. We want and need to supply at volume, of course. We have a process that we believe is truly scalable and cost effective. Otherwise, we wouldn't have customers like Panasonic signing commercial contracts. We now need to deliver on higher volumes. We are well into construction of a mass and volume production facility in South Korea to deliver commercial quantities to customers, to cell makers and automotive OEMs.

I can't mention the automotive OEM name just yet, but we have a joint development project with a well-known automotive company that's been underway for some time. We are also looking – with them - at going beyond traditional lithium-ion batteries to solid-state lithium-ion batteries. The progress has been tremendous and that customer has selected our silicon anode material as the preferred material for a solid state battery. I think even beyond traditional lithium-ion battery cell designs, we've got to the stage of onboarding.

What do you see the future holding for this space?

People often ask me what my thoughts are on the slowdown in EV adoption. I'm not worried about the EV adoption slowdown, because that trend to slowing is also easing. The reason it's slowing, though, is down to the well-known factors mentioned already in terms of the final market; vehicle range, charging concerns, cost-of-ownership concerns.

We have commissioned an independent report to look at the market and assess certain technologies. The main conclusion was that the market opportunity is not shrinking or slowing down for silicon anodes because silicon anodes address those relevant EV take-up pain-points.

We are therefore very excited about the future. We see an acceleration of silicon anode adoption and that will help boost EV adoption through better performance and lower costs.

Of course everybody needs better batteries for many applications - portable devices, aviation, robotics, health care. We are excited about the future and excited to see the acceleration of silicon anode adoption. It seems to be on everybody's roadmap.

We think the market opportunity, the total addressable market for silicon anodes is just getting bigger. Our prediction for 2030, 2035 is several hundred thousands of tonnes of silicon anodes being needed. Nexeon is one of the companies that is well positioned to supply that kind of material in the quantities needed. We're not the only one, but there is more than enough opportunity for several companies in this space.