Some grounds for a half-full, rather than half-empty, glass

As the early part of the year progresses, it’s becoming clear that the sharp market rebound of 2023 – which helped lift profits across the industry – is fading rapidly. That’s good news in terms of manufacturers being able to get their products out to customers, of course. Transaction prices will also be edging down and inventory levels gradually replenished.

It also means we’re back to underlying demand conditions, rather than exceptional supply-side factors, being the main determinant of global automotive market size.

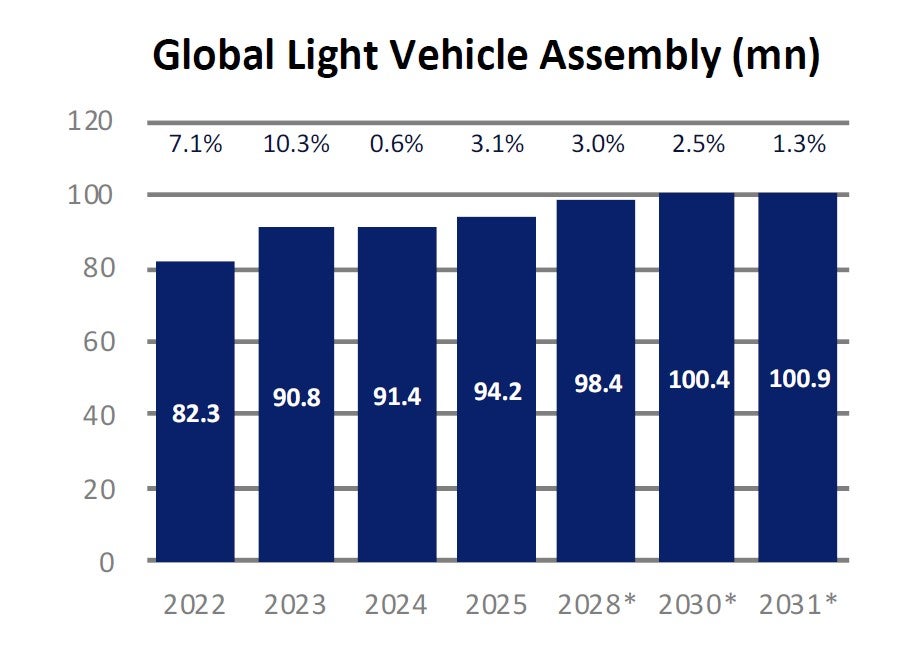

In its latest analysis, GlobalData (Just Auto’s parent company) says the global light vehicles (LV) production outlook for 2024 remains broadly on track with the aggregate full-year forecast remaining virtually unchanged on the previous one (91.4m units, +0.6% YoY).

Nevertheless, GlobalData analyst Justin Cox told me: “The global economy is expected to experience a soft-landing following the period of tight monetary policy and higher inflation.” Yes, that’s right: a “soft-landing”. I think we'll take that.

MORE: GlobalData world light vehicle forecast for 2024 ‘on track’

The February market numbers out so far and published this week have given grounds for cautious optimism.

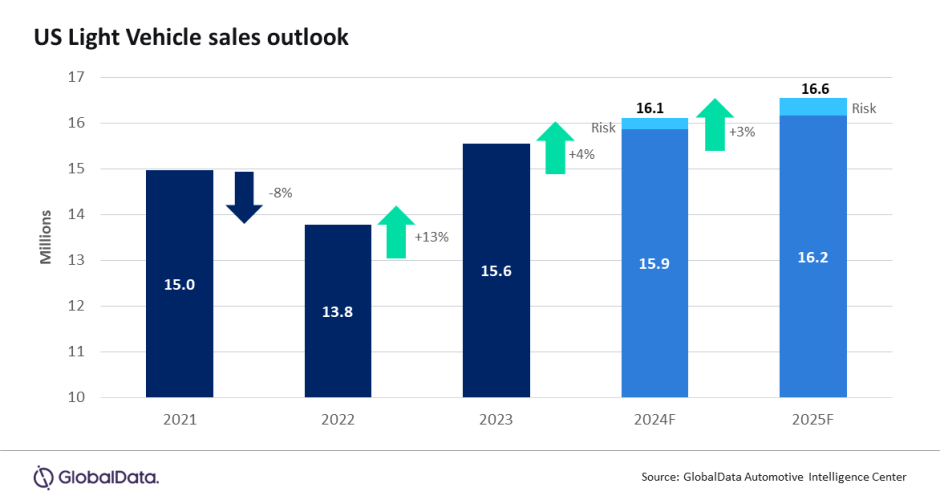

The US market has now been growing in year-on-year terms for 19 consecutive months. According to preliminary estimates, US Light Vehicle (LV) sales grew by 9.2% year-on-year (YoY) in February, to 1.25 million units. The latest GlobalData forecast is for 16.1 million sales this year. That's not too shabby.

MORE: US light vehicle market keeps on growing in February

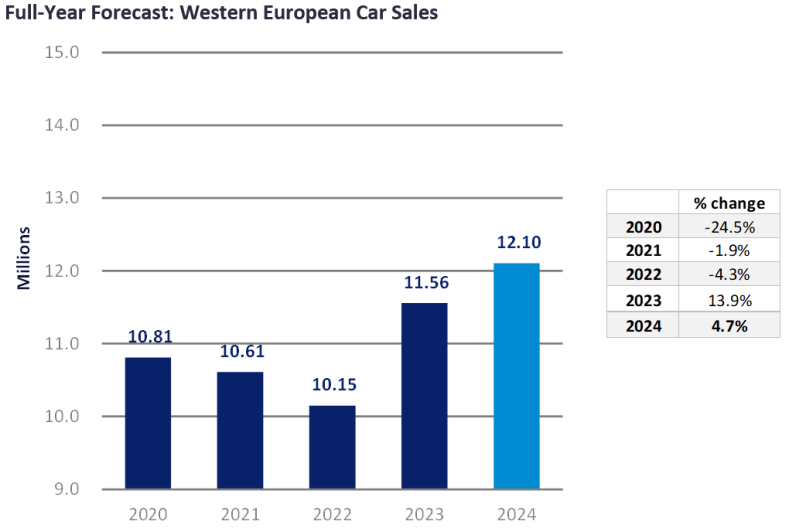

Good news in Europe, too. The Western Europe car market selling rate rose to 12.8 million units/year in February, with 870k vehicle registrations.

Compared to 2023, February grew by 8%, helped by strong year-on-year (YoY) growth in France and Italy, along with solid improvements in other major Western European countries. However, compared to pre-pandemic February 2019, the PV market is down almost 17%. The market is forecast to pass 12 million units in 2024, the highest total since the onset of the pandemic.

MORE: Western European car market begins to rise in February

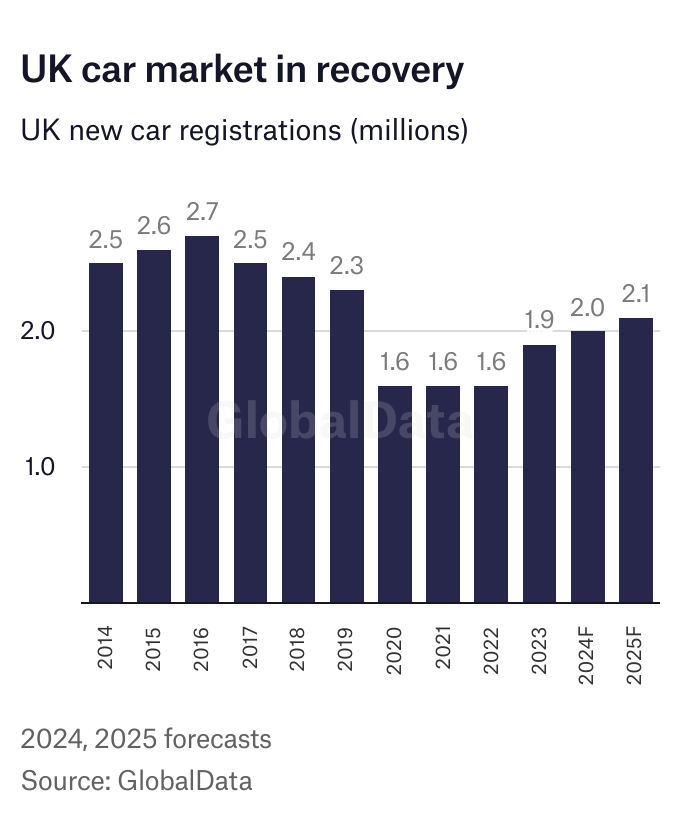

Within Europe, the UK new car market has recorded its best February performance for two decades as registrations rose 14.0%.

GlobalData forecasts the UK car market will grow by around 3% to 2m units in 2024. That would follow an 18% rebound in 2023 as supply constraints caused by the global semiconductors crisis eased.

GlobalData analyst Jonathon Poskitt told Just Auto: “We expect a recovery in household real incomes to help vehicle sales in 2024. The market pace is expected to be dictated by underlying demand once again. It’s a moderate recovery though, with interest rates still at high levels, even as they edge down.”

MORE: UK car market up 14% in February

Turning to South America, Stellantis announced a major investment programme for the region. Stellantis is building on its strengths in region with plans for bio-hybrid models. Where is most of the investment going? Yes, Brazil - it is by far the biggest market down there.

MORE: Stellantis announces €5.6bn investment in South America

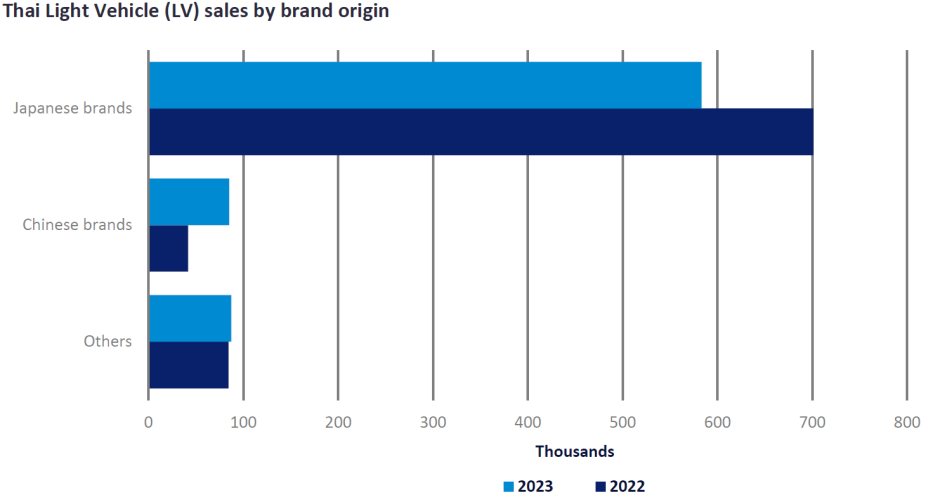

Turning to Thailand. Chinese light vehicle sales in Thailand increased dramatically in 2023, but questions remain in the long-term.

MORE: Thailand market analysis