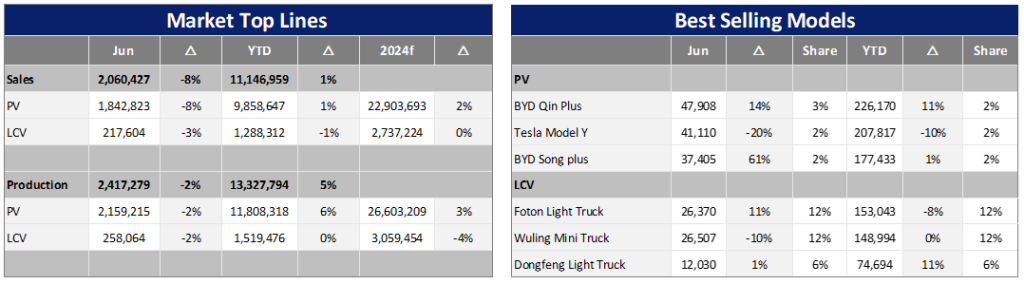

In June 2024, the Chinese Light Vehicle (LV) market demonstrated resilience amidst economic uncertainties, achieving commendable month-on-month (MoM) growth. Domestic LV sales, excluding exports, reached 2.1 million units, marking a 7.5% year-on-year (YoY) decrease but a 6.9% MoM increase.

The Passenger Vehicle (PV) segment, influenced by a high base from the previous year, saw a YoY decline of 8.0%, yet still accounted for 1.8 million units with a significant MoM increase of 8.1%. Meanwhile, Light Commercial Vehicle (LCV) sales totalled 218k units, with a minor YoY decline of 3.1% and a decrease of 2.1% MoM. For the first half of this year, LV sales amounted to 11.1 million units, a 0.9% YoY increase. Within this, PV sales contributed significantly to the growth, reaching a total volume of 9.9 million units, a 1.1% YoY increase. In contrast, LCV sales, though remaining a substantial part of the market, were slightly down, by 0.6% YoY, at 1.3 million units.

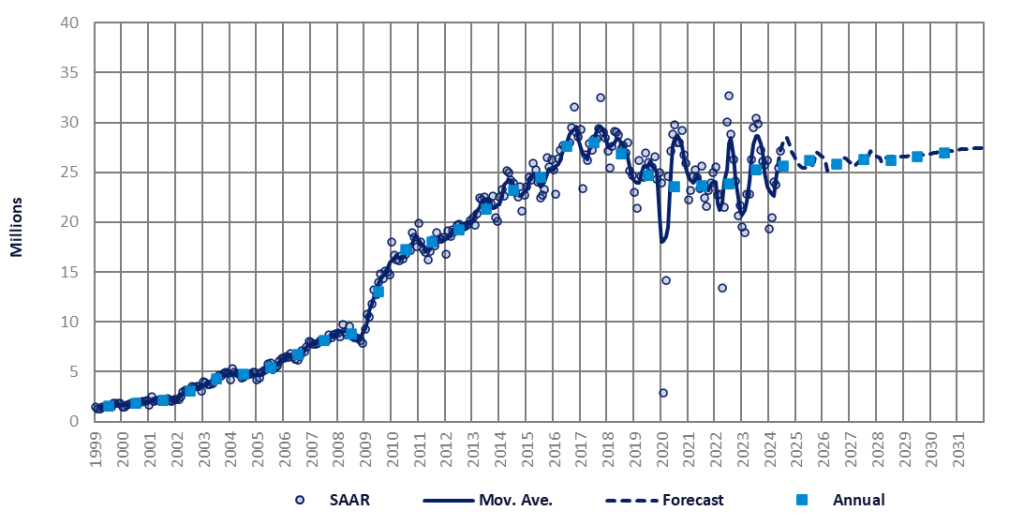

Despite the overall YoY decline, the market’s selling rate in June surged to 27.2 million units/year, a 6.8% increase from May, indicating an acceleration in market momentum. For H1 2024, the selling rate averaged 23.4 million units/year, with sales being flat (+0.9%) compared to the same period last year. The forecast for the year remains optimistic, with sales expected to reach 25.6 million units, a 1.6% increase and the highest level since 2018, suggesting a steady recovery and growth potential for the Chinese LV market.

In June, uncertainty in the external economic environment increased significantly, and domestic consumption demand was still insufficient to offset this. However, as the national “old for new” policy gradually took effect, the corresponding measures were introduced and followed up in various places, and the price war affecting new vehicles in the auto market cooled down temporarily, buying enthusiasm among wait-and-see groups was partially stimulated, and the national market maintained a relatively good level of development.

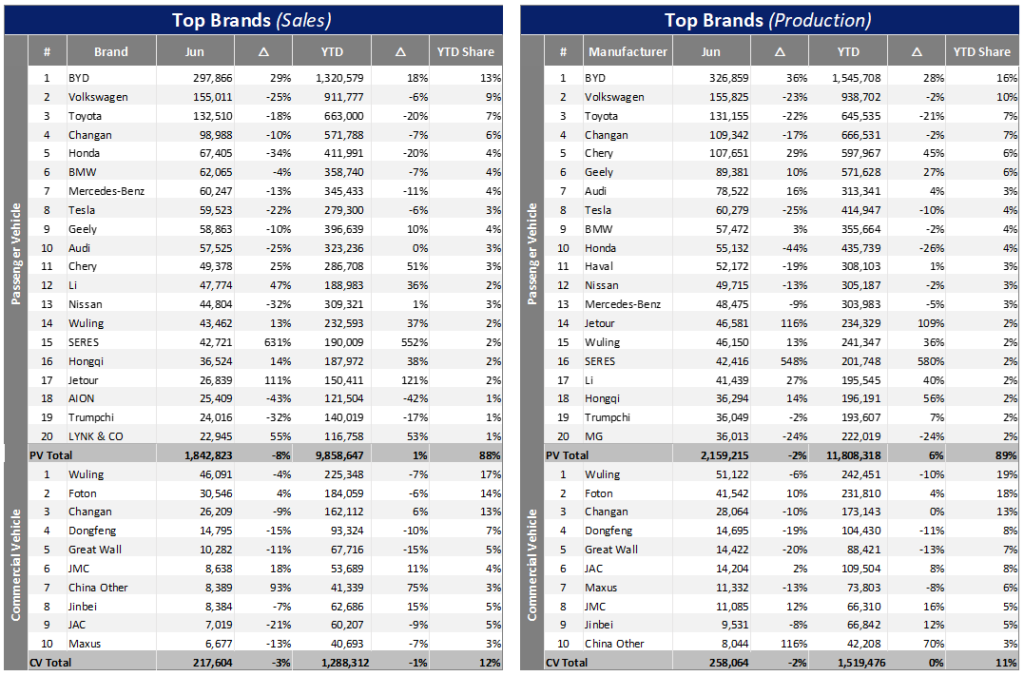

LV production in June was recorded at 2.4 million units, reflecting a modest YoY decrease of 1.9%, yet showing a more positive MoM increase of 5.3%. Cumulative output for the year to date has reached an impressive 13.3 million units, demonstrating commendable growth of 5.1% YoY. Within this achievement, PV production remained stable in June at 2.2 million units with a slight YoY growth of 1.9%. Notably, Chinese OEMs exhibited a significant increase of 12.5% YoY, highlighting domestic brands’ growing competitiveness and market share. In contrast, there was a substantial decrease of 21.6% YoY for JV brands, suggesting that these brands may be facing challenges in the current market dynamics. Conversely, the LCV segment reported a more dynamic performance, with June volumes reaching 258k units, reflecting a modest YoY decrease of 1.9%.

Production figures for the first half of 2024 in the automotive sector have shown significant YoY growth, outpacing sales. This robust performance is primarily attributed to the consistent rise in the share of New Energy Vehicles (NEVs) and a remarkable surge in exports. In June alone, China’s PV exports reached 406k units, marking a substantial YoY increase of 38.5%. Exports now constitute 19% of the total PV production, highlighting their substantial contribution to the overall output growth. The dominance in export volumes is still observed among Chinese OEMs, with Chery, SAIC, and Geely leading the pack, collectively accounting for 48% of the total export volume. Cumulatively, from January to June, China PV exports were 2.36 million units, reflecting a YoY increase of 34.8%, sustaining a rapid growth trajectory. The strong performance of Chinese automobiles in the international market has positioned exports as a vital pillar supporting the domestic automobile industry.

In the realm of NEVs, China’s sector has witnessed extraordinary expansion, with June output leaping to 945k units. This represents a significant YoY surge of 27%, coupled with a consistent MoM advance of 7%. Such vigorous manufacturing activity has propelled the NEV market penetration rate to a remarkable 46.9%, signifying a notable shift in consumer preference towards greener alternatives and a strategic reorientation by domestic manufacturers to embrace sustainable mobility. The aggregate volume for the first half of 2024 rocketed to 4.6 million units, illustrating impressive YoY growth of 34.8%. This accelerated growth in the NEV market is outpacing expectations and is demonstrating a clear catalytic effect on the entire automotive market.

The price war that started at the beginning of the year cooled down in June. Recently, as various car companies tired of exchanging price for volume, the three first-tier premium brands “BBA” (Mercedes-Benz, BMW, and Audi) chose to withdraw from the price war. It can be seen from the data that in H1 2024, although major premium brands actively participated in the price war, cumulative sales still fell by 4% compared with the same period last year. Therefore, since the price reduction did not boost sales, it is more important to retain brand value as much as possible. Perhaps more and more car companies will realise that price reductions may not lead to increased sales. They can gain a firm foothold in the Chinese market by continuously improving product strength and keeping up with the transformation to new energy vehicles. Therefore, it is clear that the continued sharp price cuts in H1 2024 disrupted the normal price trend of the market. It will take some time for transaction prices to recover. Coupled with the super-strong promotional efforts in Q2, which will have a hangover effect on car buyers in H2 2024, the strategy of exchanging price for volume may continue to weaken in July & August.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.