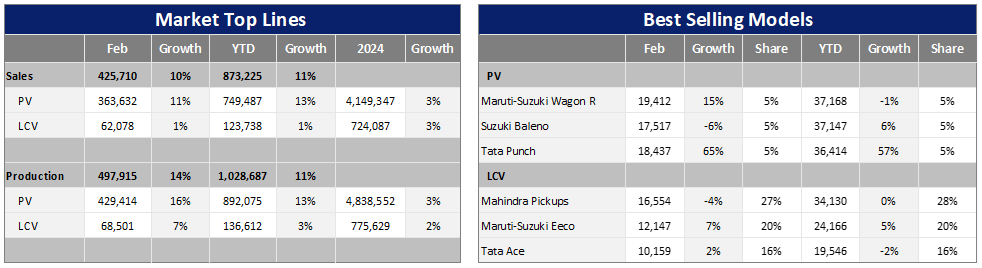

India’s Light Vehicles (LV) market has demonstrated resilience and growth, with sales reaching 426k units in February, a 10% increase year-on-year (YoY).

However, this figure represented a 5% decline month-on-month (MoM), as OEMs had replenished their inventory in January following a destocking exercise at the end of 2023.

Wholesales of Passenger Vehicles (PVs) stood at 364k units (-6% MoM, +11% YoY). Meanwhile, sales of Light Commercial Vehicles (LCVs) with GVW up to 6T were 62k units, showing a 1% increase both MoM and YoY.

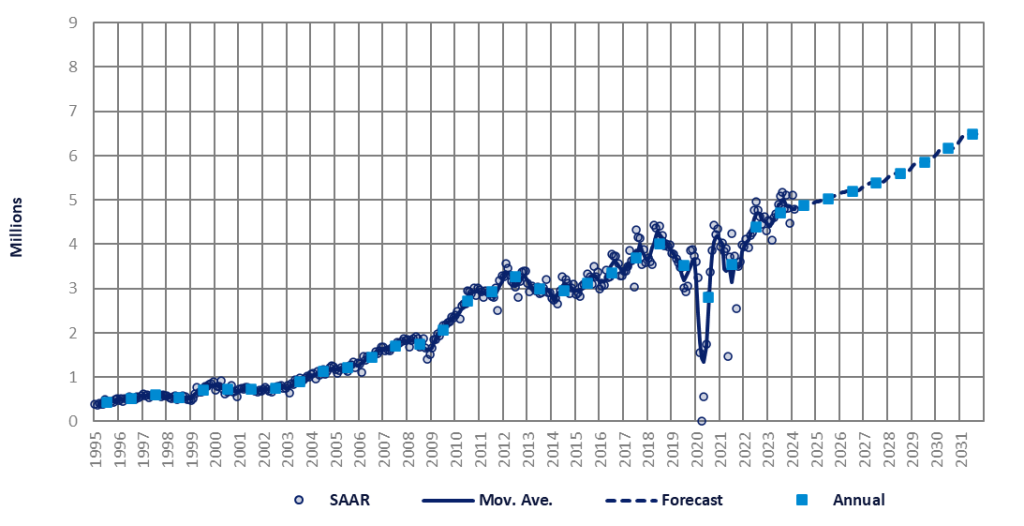

Subsequently, the selling rate reached a robust 4.8 million units/year in February after soaring to a near-record high of 5.1 million units/year in January.

As observed in previous months, SUVs remained the key driver of the market. To date, numerous updates to SUV models, including the refreshed versions of the popular Hyundai Creta and Kia Sonet (both are Sub-Compact SUVs) have sustained this momentum in sales. Discounts and incentives also helped OEMs move weak-selling models, such as Mini Cars and older vehicles (including SUVs).

Retail sales of PVs and LCVs similarly shrank to 379k units in February versus 443k units in January, according to data from the Federation of Automobile Dealers Associations.

Total LV sales in the first two months of the current year increased by 11% YoY to 873k units. This figure comprised 749k PVs (+13% YoY) and 124k LCVs (+1% YoY). Consequently, the year-to-date (YTD) average selling rate stood at about 5 million units/year.

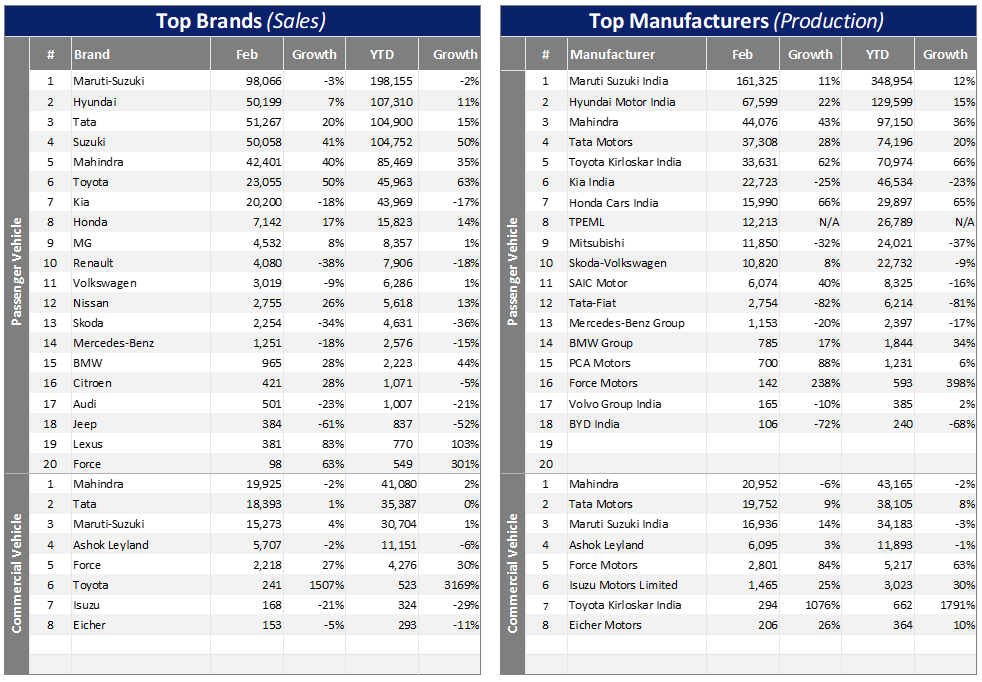

Preliminary data for March suggest that Tata Motors, Hyundai, and Toyota improved their wholesales over the previous month. In contrast, Maruti Suzuki, Mahindra, and Honda saw their volumes decline from their February totals.

LV sales in March were influenced by both positive and negative factors.

As the fiscal year drew to a close, OEMs and dealers offered attractive promotions and incentives to clear inventory. In addition, automakers continued to improve the overall supply of vehicles. Seasonal factors, such as weddings, may have also bolstered demand.

On the negative side, some buyers may have adopted a cautious stance ahead of the upcoming general elections. The popular variants of PVs also remain in short supply, which somewhat impeded sales growth.

Since LV sales in February were in line with our expectations, our forecast remains unchanged. Sales are projected to gain by 3% YoY to a record high of 4.9 million units this year.

The fiscal boost ahead of the upcoming elections (in April and May) is expected to continue through H1 2024 and help support job and income growth – and thus vehicle sales as well. The rural market is also showing strong signals of robust demand.

There is, however, a possibility that consumers and businesses will hold off on purchases, taking a wait-and-see approach ahead of the general election.

Moreover, the Reserve Bank of India (RBI, the central bank) could delay interest rate cuts to later this year, as domestic demand remains strong and headline inflation, while it is falling, remains above the bank’s target of 5%. This could affect purchasing decisions.

Plus, the LV market faces downside risks from prolonged monetary tightening, abnormal weather conditions affecting rural income, and an uncertain economic outlook with rising oil prices, given India’s status as a major oil importer.

Nonetheless, the risk to our 2024 forecast is currently on the upside, as SUV sales are booming and show no signs of a slowdown.