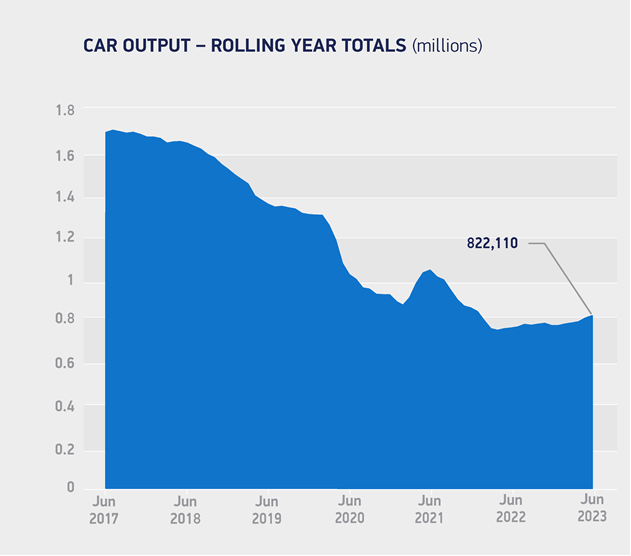

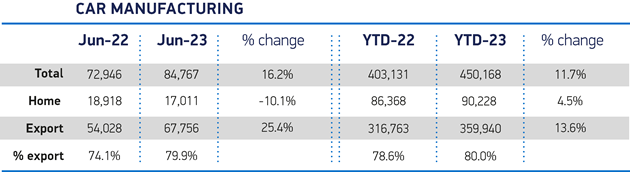

UK car production rose 11.7% in the first half of the year to 450,168 units with June – up 16.2% – the fifth consecutive month of growth, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT).

The performance represented the best first half since 2021 as manufacturers were increasingly able to manage global supply chain challenges – notably the shortage of semiconductors – that had constrained production since the pandemic. The news comes a week after the announcement of the development of a massive new gigafactory for the UK, helping anchor EV production for one of Britain’s biggest car makers.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

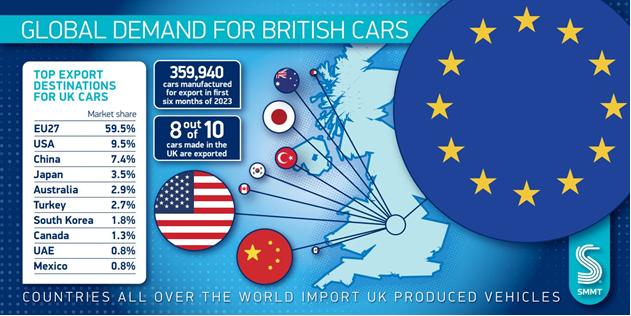

Since January, UK factories have produced an additional 47,037 units, the uplift having been driven by exports which have surged 13.6% to 359,940 units, representing eight-in-ten cars made here.

Volumes for the UK market are up too, rising 4.5% to 90,228 units. However, year-to-date output remains some 32.5% below 2019 levels, a reflection of structural changes in the sector but also pointing to the opportunity for UK car makers to recover if a globally competitive business investment environment can be assured, the SMMT said.

The capacity of UK car makers to turn out the latest, greenest models has also increased, with production of hybrid electric (HEV), plug-in hybrid (PHEV) and battery electric vehicles (BEVs) up 71.6% from January to June to a record total of 170,231 units. This represents more than a third (37.8%) of all cars produced so far this year.

The European Union (EU) remains the UK’s largest export market accounting for 59.5% of all British car shipments, up 11.2% to 214,017 units year to date. The SMMT noted that the EU is also the largest source of imported vehicles, “so safeguarding this important bilateral trading relationship is essential for both sides, hence the need for a quick and positive outcome to discussions on forthcoming changes to the rules of origin requirements for electrified vehicles and components”.

Mike Hawes, SMMT Chief Executive, said: “UK car manufacturing is growing again, with production – especially of electrified models – increasing and major investment announcements making headlines. This is testament to the resilience of the sector and its undoubted strengths – a skilled and productive workforce, world-class R&D, and efficient, productive plants. But we must build on this momentum, sustain growth and attract further investments with a strategy that focuses on competitiveness and which strengthens the UK’s unique automotive offering.”

Richard Peberdy, UK Head of Automotive for KPMG, sounded a note of caution regarding the UK’s economic situation.

“Increased car production volumes are clearing the backlog of car orders that built up over recent years of reduced supply. But higher inflation and interest rates are pressuring business investment, at a time when key decarbonisation decisions are being taken, including new product and technology development or greening and on-shoring of supply chains.

“Decisions taken now will shape the next decade of delivery for car manufacturers.

“Increasingly, the automotive sector is looking at economic conditions globally and making moves now that they feel will serve them best in the medium to longer term. Rules of origin changes in 2024 are one such consideration – and manufacturers on both sides of the Channel are hoping for an agreeable resolution that accounts for the battery manufacturing industry in Europe still being in its infancy.”