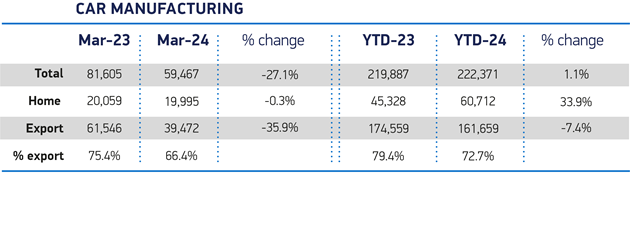

UK car production declined in March, down 27.1% year on year to 59,467 units, according to figures published by the Society of Motor Manufacturers and Traders (SMMT).

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

It was the first fall since August last year, but the SMMT said the decline was in line with expectations for a variable year, as manufacturers adjust factories to produce the next generation of cars, notably electric, winding down volumes of existing models in the process. An early 2024 Easter bank holiday also played a part, with fewer working days this March than the year before.

Volumes for the UK market declined marginally, down just 0.3% to 19,995 units, while production for export fell 35.9% to 39,472 units. Continuing recent trends, the European Union received by far the bulk of exports (57.9%) followed by the US (11.4%), China (5.9%), Australia (4.0%) and Japan (1.8%). Shipments to the top five export markets, apart from the US, all fell.

Electrified vehicle (battery electric, plug-in hybrid and hybrid) volumes again represented more than a third of all production (38.4%) with manufacturers producing a combined 22,865 units, although this was down 29.7% on the year before, reflecting model changeovers. Nissan ended production of its current Leaf model at Sunderland in March, in preparation for new models there.

Overall, UK car production remained up 1.1% in the first quarter, at 222,371 units, with a 33.9% rise in output for the UK offsetting a 7.4% decline in exports. Despite this fall, by far the majority – 72.7% – of all cars made in Britain in Q1 were for export.

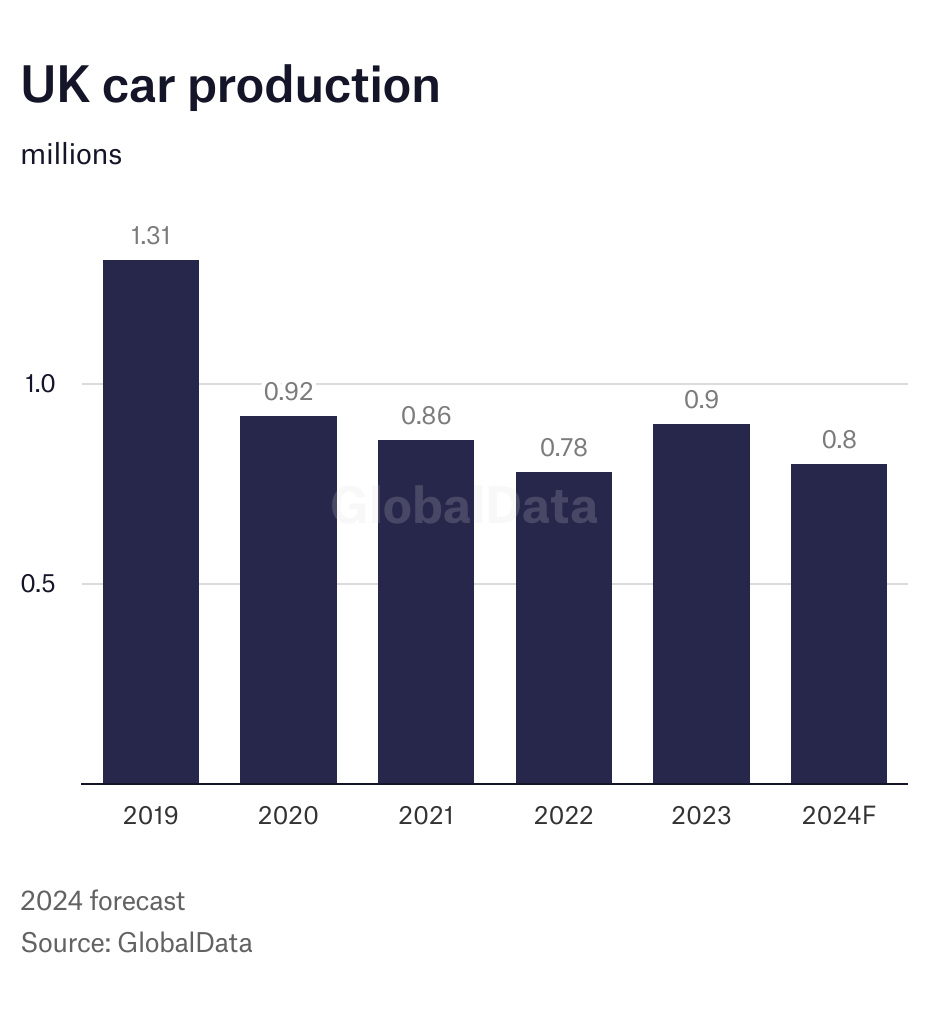

Justin Cox, an analyst at GlobalData, points out that UK car production is still way under where it was pre-pandemic. He said: “Our forecast for this year sees UK car output at around 0.8 million units. It was much higher before the pandemic, but we see it settling in the medium term at around a million units a year.”

Mike Hawes, SMMT Chief Executive, said: “This fall is not unexpected given the wholesale changes taking place within UK car factories as existing models are run out and more plants transition to electric vehicle production.

“We can expect further volatility throughout 2024 as manufacturers lay the foundations for a successful zero emission future. Recent investment announcements have boosted confidence and enhanced the UK’s reputation but there needs to be an unrelenting commitment to competitiveness. Free and fair trade deals must be secured, energy costs reduced and the workforce upskilled if we are to attract further investment to improve productivity and decarbonise automotive manufacturing and its supply chain.”