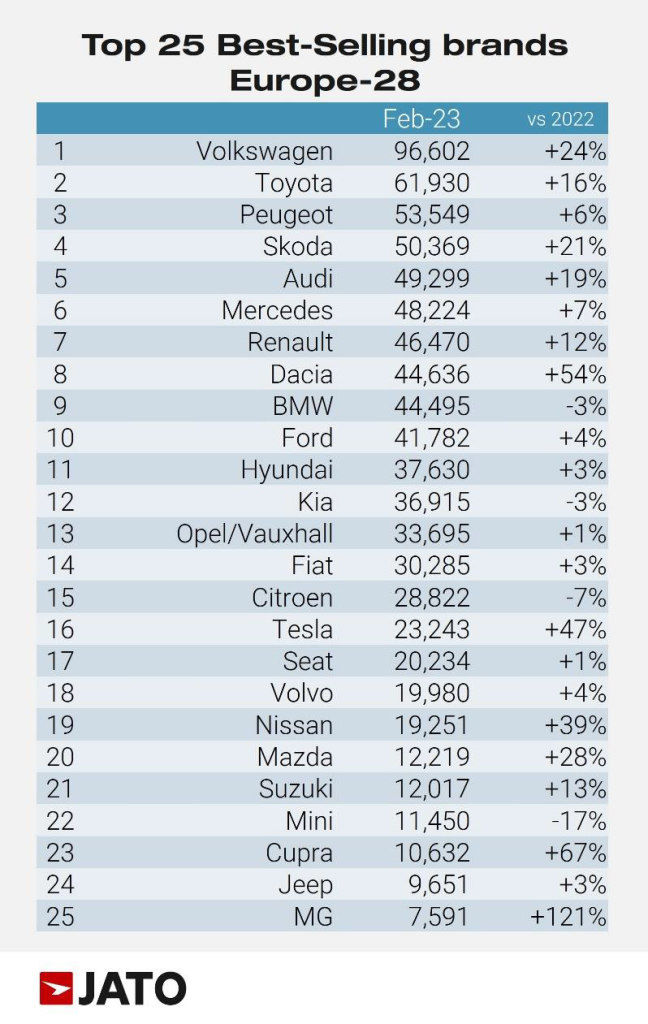

In February, the number of new passenger car registrations in 28 European markets – including the UK – rose 12% year on year to 900,000 units.

Year to date, the tally was up 11% to 1.81m.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Felipe Munoz, global analyst at JATO Dynamics, said: “While big structural problems persist, results from 2023 so far indicate that consumers are responding positively to more competitive offers in the market.

“However, rising interest rates – due to hit the market in coming months – may make consumer access to loans more difficult, potentially impacting purchasing decisions.”

Italy, Spain, the UK and Belgium saw strong, double-digit growth rates in February. The only countries that experienced a decline were Sweden, Norway, Finland and Cyprus.

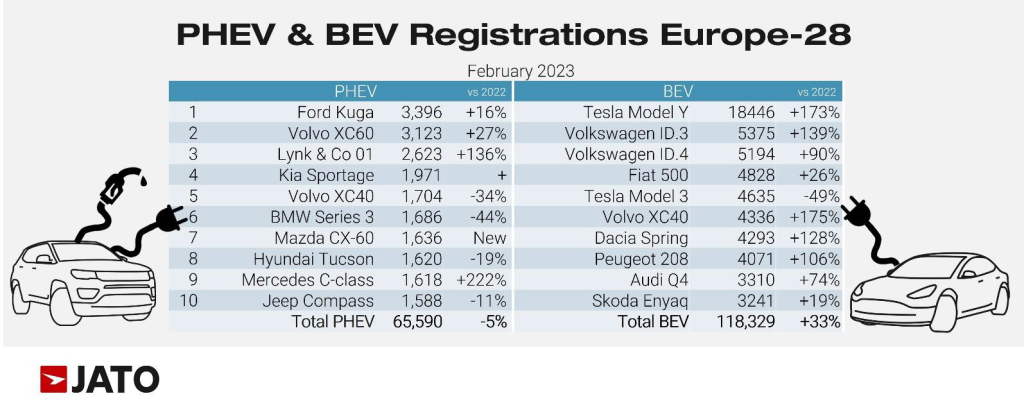

BEVs drive growth

Increasing demand for pure electric cars aided the overall positive results last month as 118,329 were registered, up 33% year on year.

Munoz noted: “Norway is no longer contributing to the growth of BEVs in Europe, despite being an industry leader for many years.”

The Scandinavian country was only the fifth largest BEV market last month, outshone by substantial growth in Germany, France, the UK, and the Netherlands, the four largest BEV markets in February.

The accelerated adoption of BEVs across the region came as a result of competitive deals and offers in the market, alongside declining consumer concern about battery range and charging anxiety.

BEV market share grew across 25 markets. Finland led the charge with an increase of almost 18 points between February 2022 and February 2023. Double-digit market share was recorded for BEVs in 14 countries: Ireland, France, Belgium, Luxembourg, Austria, Portugal, Norway, Sweden, Netherlands, Denmark, Finland, the UK, Germany, and Switzerland.

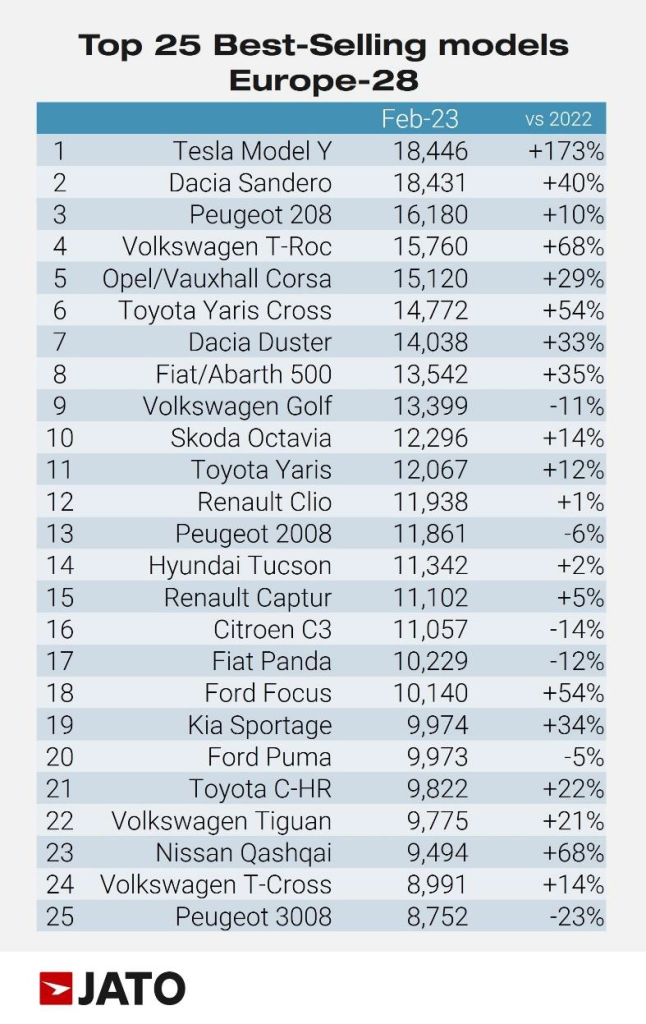

Tesla Model Y leads again

This growth trend for BEVs can also be seen in the overall ranking. The Tesla Model Y was the top selling vehicle in Europe in February 2023 despite February usually seeing fewer registrations for Tesla.

Munoz said: “If this trend continues, by the end of this year the Model Y could easily secure a place in the European top 10 best selling cars ranking.”

The Model Y was in the top five models for Austria, Denmark, Finland, Germany, Luxembourg, Netherlands, Norway, and Portugal. It was also the 10th most registered passenger car in the YTD ranking.

However, the rise in its popularity has resulted in less volume for the Model 3 which recorded a fall of 49% in contrast to February 2022 registrations.

Global BEV sales bounced back in February with China price war

Chinese OEMs lost traction

Despite the recent popularity of Chinese produced cars, results by assembly origin revealed that sales did not grow as substantially in comparison to other regions. In February, only 2.7% of new cars registered in Europe were made in China, a minimal decline from 2.9% in February 2022.

Munoz: “The entrance of Chinese vehicles into Europe is not taking place as quickly as many expected. There is clearly more work to be done on the models, production and marketing plans before these brands can successfully expand into the region.”