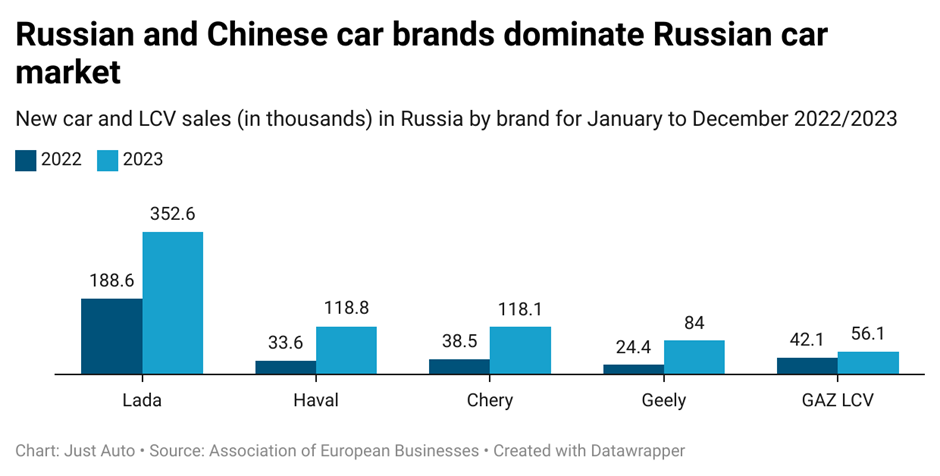

As Western vehicle makers exited the Russian car market in 2022 following economic sanctions caused by war in Ukraine, the Chinese saw an opportunity to accelerate their Russia trade and operations. Full-year data for 2023 Russia market by brand shows how Chinese automakers have moved in and filled the gap. Not only that, but parallel import mechanisms may well mean that some Western brands’ cars and parts are still finding their way into Russia (eg Citroen car kits reportedly being shipped from China’s Dongfeng for assembly at a Kaluga plant).

Chinese brands ranked top in new market sales in Russia in 2023

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

I would guess that Stellantis has little control of the parts and kits shipped to its partner in China once they land there. If some of these paid for items are then being forwarded on to Russia though, it’s a bit, well, awkward.

Citroëns assembled from imported kits at Stellantis Russia plant – report

The politics of the energy transition

As Stellantis gears up for higher electric vehicle (EV) production in Europe, it is also facing some friction from politicians who are sensitive to where it will put future EV investment. In particular, the company – embracing a large portfolio of volume car brands that include Fiat, Peugeot, Citroen, Chrysler and Opel/Vauxhall – has attracted the attention of Italian politicians concerned about prospects for future vehicle production in Italy.

Governments in Europe are going to become increasingly concerned over where EV capacity will be built, as Chinese OEMs’ ambitions fuel tensions. Stellantis is emerging as a case study.

Chinese OEMs’ offensive fuels Stellantis tensions in Europe – analyst

An ex-Top Gear TV presenter (thanks Quentin Willson) writes: What the UK Government must do to increase EV uptake

China's EV tech lead

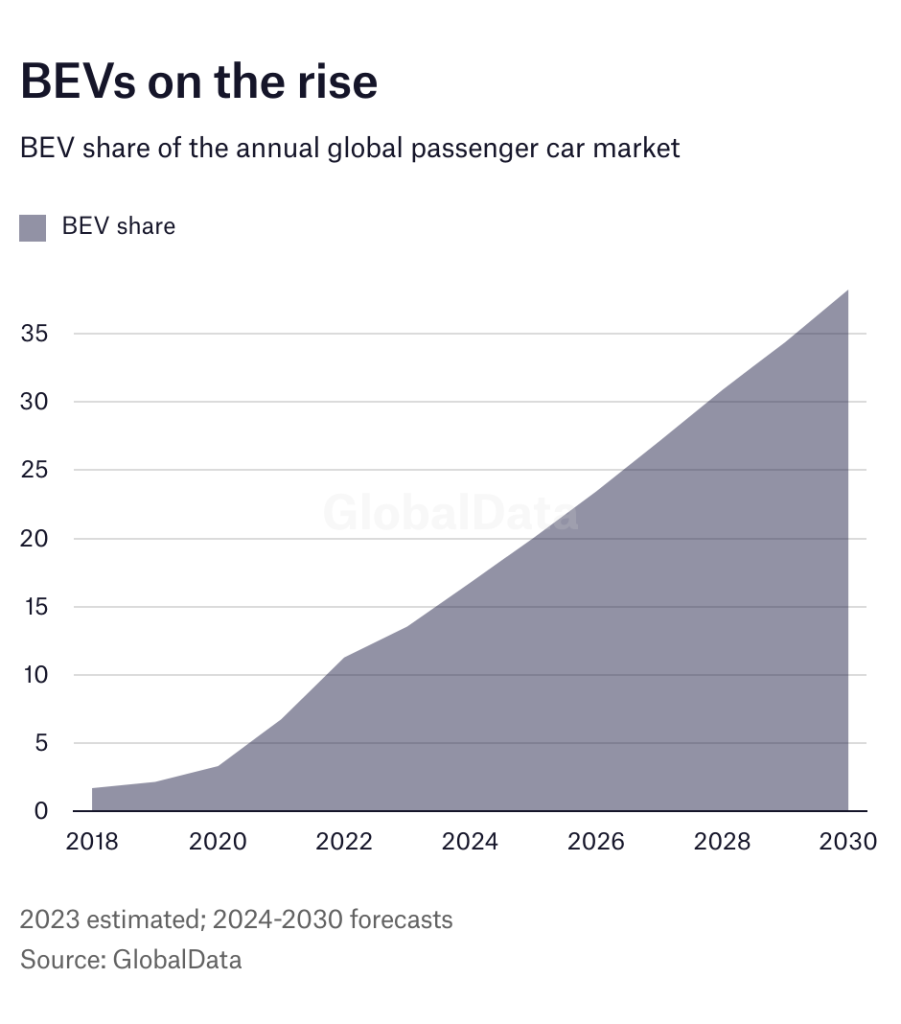

China is set to consolidate its position as the dominant country in the automotive industry as a result of developing cutting-edge battery technology for use in electric vehicles (EVs).

The country is already the leader in EV production, with GlobalData’s Global Light Vehicle Hybrid and EV database indicating an EV and hybrid sales volume of 11.42 million for 2023, nearly three and a half times more that of the next nearest country, the US with 3.35 million.

China is already a dominant force in the EV industry, and its work on solid-state batteries will strengthen its position.

How China’s EV battery tech is cementing it as the auto industry leader

Immigration boost for car sales in Canada?

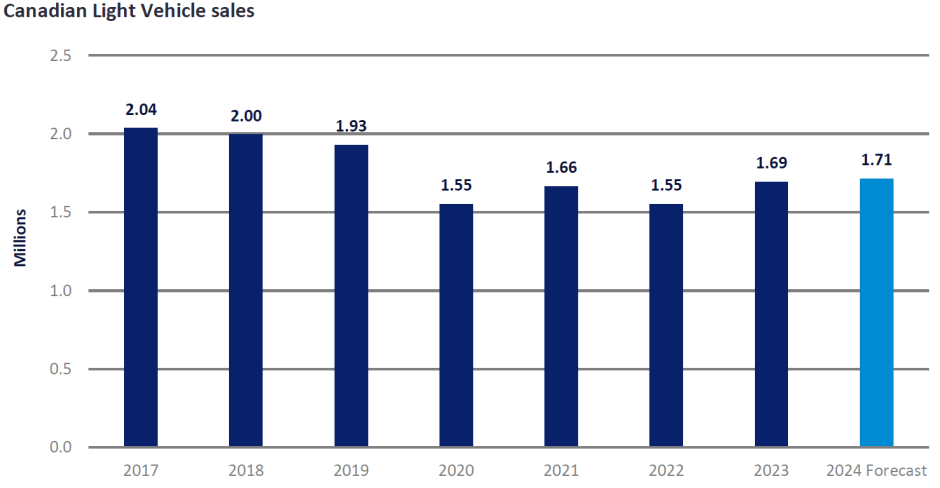

Canadian Light Vehicle (LV) sales in 2023 were considered muted although they achieved 9.2% year-on-year growth. Total sales were 1.7 million units but this was after significant decreases in 2020 and 2022, and well below the 1.9 million to 2.0 million units sold in 2017-2018. This is, unfortunately, one of the catches of a mature market. While total sales are generally predictable, long-term growth is usually quite modest.

Some commentators are saying that immigration might be one way to increase LV sales. An intriguing thought and apparently at odds with the political discourse south of the 48th parallel.

Can immigration kickstart Canada’s stumbling light vehicle market?