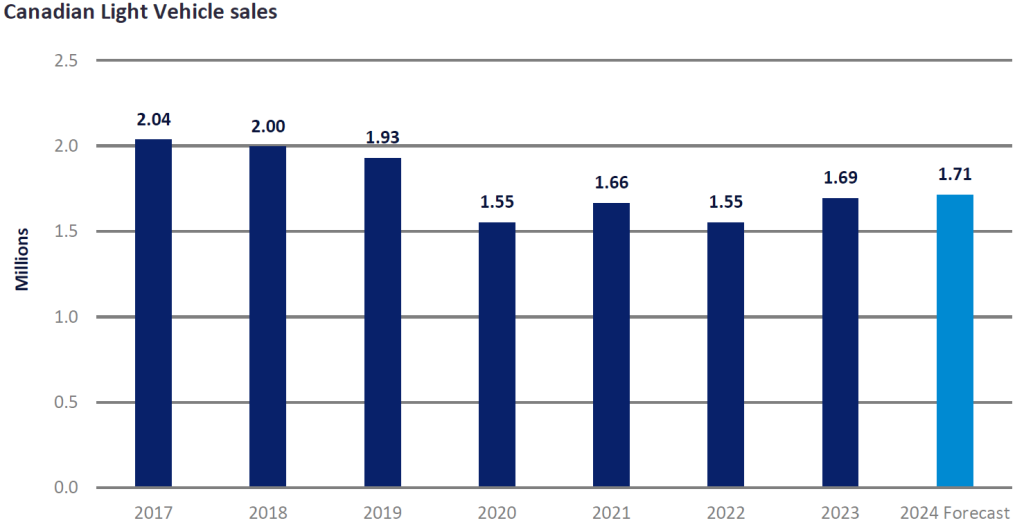

Canadian Light Vehicle (LV) sales in 2023 were considered muted although they achieved 9.2% year-on-year growth. Total sales were 1.7 million units but this was after significant decreases in 2020 and 2022, and well below the 1.9 million to 2.0 million units sold in 2017-2018. This is, unfortunately, one of the catches of a mature market. While total sales are generally predictable, long-term growth is usually quite modest. Some commentators are saying that immigration might be one way to increase LV sales.

Unlike many of its economic peers, Canada has continued to encourage immigration. At the end of 2023, the government announced it would leave in place an immigration target for 2024 which would see total immigration at 485,000 people that year and the announced targets for 2025-2026 would be 500,000 people in each of those years. This contrasts with the neighbouring US which has not made any significant changes to its immigration policy, though many are putting pressure on the government to limit immigration further. Even without any actual policy changes, the expectation from those looking to move is that they would be more likely to consider Canada, which appears more welcoming (than the US).

Of more importance to most people, however, would be housing, which unfortunately just like other countries, has experienced increasing costs. In general, this means that a personal vehicle would not be one of the first purchases most immigrants would consider. Moreover, the popular destinations within Canada for new inhabitants are large metropolitan areas, such as Toronto and Vancouver, which are also known to have practical and convenient public transit systems.

Canada also already has one of the highest car densities in the world. In 2022 it was 761 vehicles per 1,000 people. Vehicle density includes all vehicles on the road, not just simply new vehicles, meaning there is not always a direct one-to-one ratio between an increase in new vehicle sales and an increase in vehicle density. One instance where this occurs is when the scrappage rate decreases, meaning fewer cars are completely removed from service, and people drive their cars for longer. This looks likely to occur in the coming years and we do see the vehicle density inch up a bit; however, the ratio of new car sales to adult population has continued to decline from the peak of new vehicle sales in 2017. This could indicate that although there will be new incoming adults buying vehicles, these are likely to be used vehicles which otherwise would have been scrapped.

This means while the total population may increase and the total number of vehicles on the road may increase, all these vehicles will not be new, hence total new vehicle sales will not increase. This is also why, despite these increases, our sales forecast to the end of the decade declines year-on-year and never quite reaches the previous record set in 2018.

On the other hand, all these assumptions could alter if there is a change in government policy, especially given that federal elections (and a possible new government) must take place by October 2025. Nonetheless, our baseline forecast assumes immigration is likely to increase, but this event alone is unlikely to spur record LV sales.

Kimberly Krafft, Analyst, Americas Vehicle Forecasts, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center