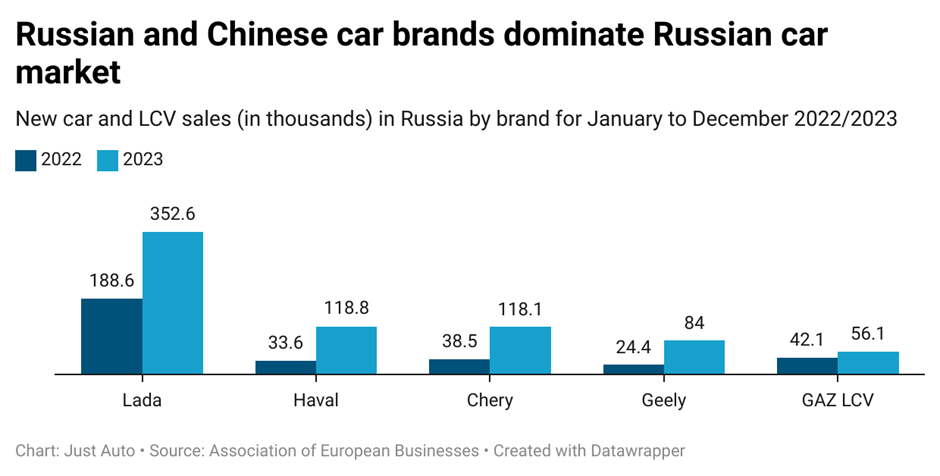

Data from the Association of European Business (AEB) shows that Chinese brands took top spots in Russia market new car sales in the period January to December 2023.

It comes as China has stepped in to fill the gaps left by the exit of Western automakers after Russia was imposed with economic sanctions following its invasion of Ukraine in 2022.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

‘No limits’ partnership

China is an important trade partner for Russia, with both countries announcing their ‘no limits’ partnership two years ago.

Recently it was reported that China and Russia had produced new Citroën models at Stellantis’ idled Kaluga plant.

Russian news site TASS reported that engine production at Haval’s plant in Uzlovaya industrial park in the Tula region, was slated to begin in early 2024.

Plant construction began in 2021.

In September 2020, the Industry and Trade Ministry concluded a special investment contract Haval Motor Manufacturing Rus. The company’s investment in local production in Russia will amount to 42.4 billion rubles ($454 million)

Russian and Chinese brands dominate 2023 new car sales

The year 2023 ended with a 57.8% car sales market increase in Russia – to 1.13 million units – following depressed sales in 2022, when the market was disrupted by Western firms’ exit and the confidence knock to the economy that followed Western sanctions.

Figures collected by the AEB, the main representative body of foreign investors in Russia, show brands such as Haval, owned by Great Wall Motor, Chery and Geely have seen a huge boost in sales, compared to the same period in 2022.

From July 2023, AEB’s data has been supplemented by sales data provided by PPC JSC (Passport Industrial Consulting).

Russia’s push for domestic brands

Lada, manufactured by state-owned AvtoVAZ, remained the top-selling brand in 2023.

In August of that year, President Vladimir Putin called for Russian legislation to be adjusted so that government agencies and officials could use only domestic cars.

This was supported by the State Duma of Russia, which in a statement said: “The domestic automobile industry needs help and support from the state. Based on it, Russian companies will be able to quickly launch and organise the production of various domestic car brands.”

Last December, Putin acknowledged that car prices had risen by around 40%, which he attributed to low production levels and the increased import costs domestic automakers faced.

In the same month AvtoVAZ confirmed its production targets for 2024, with firm president Mazxim Sokolov citing plans to produce over 500,000 for the year.

AvtoVaz’s inclusion in in the US sanctions lists forced it to adjust plans to produce 400,000 cars in 2023, Russian news agency Interfax reported.

Mr Sokolov said: “As soon as it became obvious that we were included in the SDN List, it became clear that passage through some of our supply chains would be difficult.