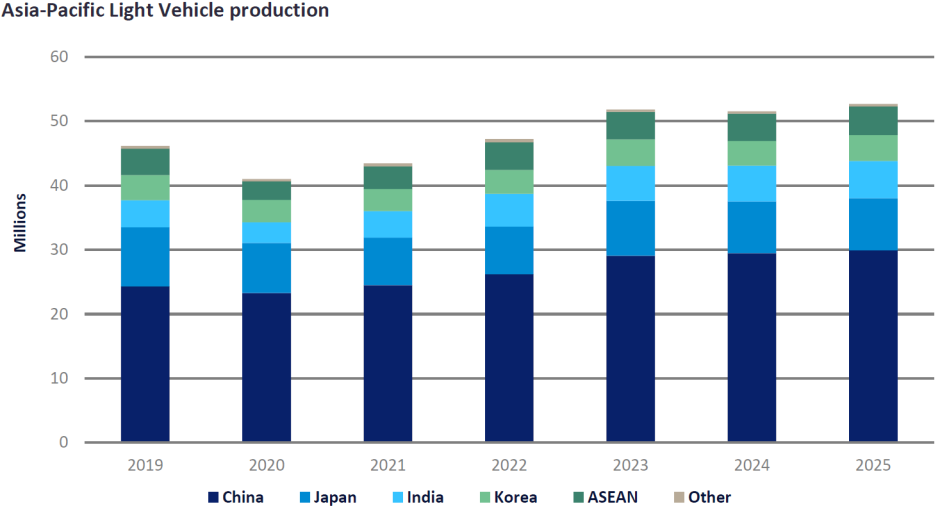

Asia-Pacific’s Light Vehicle (LV) production ended 2023 on a high note. The region’s production expanded nearly 10% year-on-year (YoY) to a record-high level of 51.8 million units thanks to the robust pace of production in China and Japan, and to a lesser extent, Korea and India. Strong exports were a key driver for growth in the mainland and China became the world’s largest vehicle exporter last year.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

All in all, the Asia-Pacific region’s light vehicle production trend ended 2023 on a high note, but this year will be a different story.

MORE: Asia-Pacific light vehicle production forecast to slow

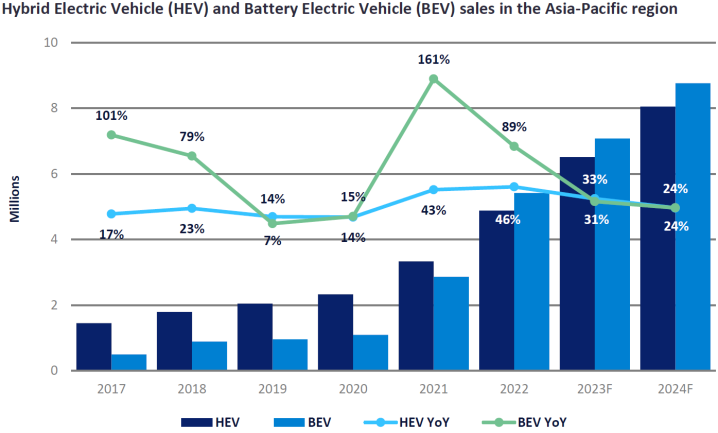

Still on Asia-Pac, the BEV sales trend unexpectedly experienced a slowdown in 2023 in key markets such as China and South Korea.

This slowdown in 2023 can be attributed to several factors. One of the key issues was that of dwindling subsidies in the key BEV market, which resulted in higher transaction prices for BEVs. In addition, the expansion of the charging infrastructure, especially rapid charging stations, was not able to keep up with BEV growth, resulting in increased range anxiety and inconvenience. Despite a doubling of sales volume in the past few years, BEV sales in the Asia-Pacific (AP) region are thought to have approached seven million units in 2023, only a ~31% YoY increase from 2022.

MORE: An unexpected event in 2023: BEV slowdown and the revival of hybrids in Asia-Pacific

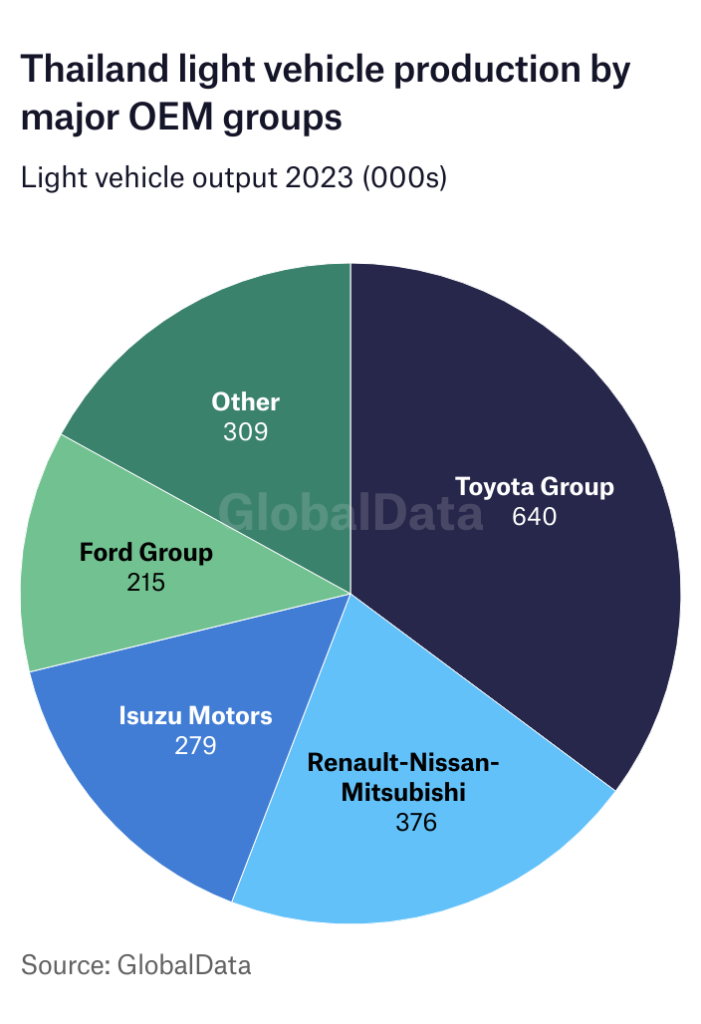

Thailand is emerging as a strong growth pole for BEV investment in SE Asia. This week, BMW said it is planning a second battery assembly factory in Thailand to meet growing demand for battery electric vehicles (BEVs) there.

Who are currently the main players in Thailand’s c.1.8m pa light vehicle industry? Think pickups and think Toyota, Mitsubishi and Isuzu. But get ready for more BEV cars from BYD, Changan and Great Wall. Plenty going on and expect more FDI in batteries, too.

MORE: BMW to build 2nd Thai battery plant

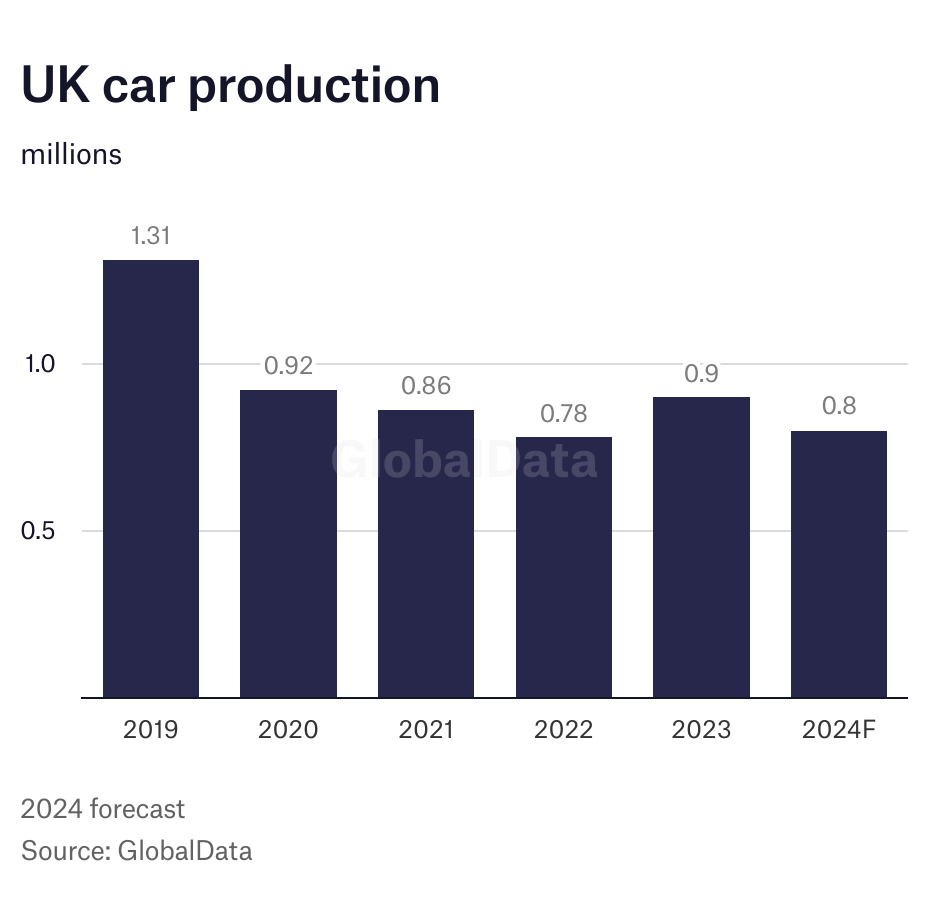

It was a pretty good week for the UK’s automotive industry. Besides the crucial announcement and confirmation of a major Tata battery gigafactory in the country’s southwest, the January car output numbers (and commercial vehicles, too) were healthily up. Given where the UK’s auto industry currently is (as the below chart illustrates), the good news has been understandably welcomed here.

MORE: UK car production up 21% in January

MORE: UK CV output still on the up