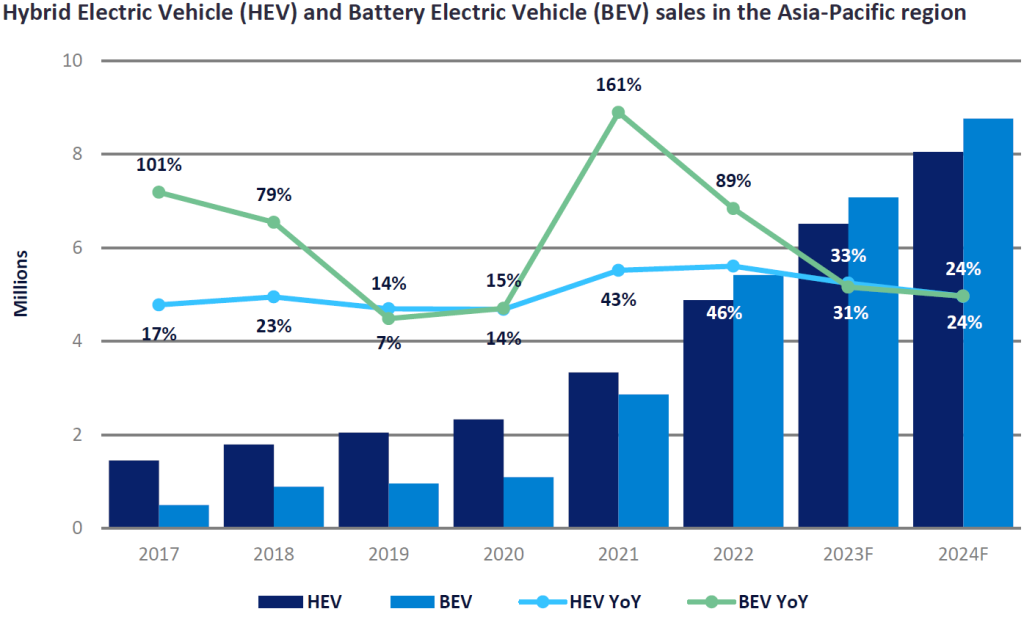

Since the start of this decade, Battery Electric Vehicles (BEVs) have been under the spotlight, being seen as the key xEV technology. With a boost from key government incentives and subsidies, tightened emission policies, and carbon-neutral targets, BEV sales have achieved rapid growth and surpassed other xEV types in 2022. However, the BEV sales trend unexpectedly experienced a slowdown in 2023 in key markets such as China and South Korea.

This slowdown in 2023 can be attributed to several factors. One of the key issues was that of dwindling subsidies in the key BEV market, which resulted in higher transaction prices for BEVs. In addition, the expansion of the charging infrastructure, especially rapid charging stations, was not able to keep up with BEV growth, resulting in increased range anxiety and inconvenience. Despite a doubling of sales volume in the past few years, BEV sales in the Asia-Pacific (AP) region are thought to have approached seven million units in 2023, only a ~31% YoY increase from 2022.

With BEVs facing a slowdown and a less optimistic outlook and the price of fuel trending upwards, much focus has shifted back to Hybrid Electric Vehicles (HEVs) as a suitable technology for an energy-efficient and environmentally friendly choice for consumers. Many OEMs have begun producing more HEV models in order to be in line with government emissions/carbon neutral policies. HEVs also demonstrate several key advantages compared to BEV at the moment, not least affordability, and no range anxiety. Therefore, HEVs have been able to retain robust growth across the AP region:

- China: In response to the strict Dual Credit policy, OEMs in China are actively pushing toward electrification to gain the necessary credits. Although HEVs (apart from PHEVs) do not generate New Energy Vehicle (NEV) credits, local brands like Haval and Geely have developed HEVs in order to earn valuable Corporate Average Fuel Consumption (CAFC) credits.

- Korea: Stricter emission norms are driving consumers away from diesel vehicles and towards hybrids, especially in the mid-to-large-size and SUV segments. Sales of HEV versions of key models such as Hyundai’s Grandeur and Santa Fe, plus Kia’s K8 and Sorento accounted for more than half of their total sales in 2023.

- India: Despite the GST tax rate for HEVs being in the same range as ICE and significantly higher than BEV, key OEMs such as Toyota and Suzuki have introduced more HEV models to their line-ups to earn “super credits” and reduce fleet-average CO2 emissions to meet their targets under the CAFE (Corporate Average Fuel Economy) norms, making them more affordable and competitive.

- Japan: As the undisputed leaders in hybrid technology, Japan’s key brands like Toyota and Mazda see hybrids as a crucial transition technology in the roadmap to BEVs, while other brands such as Honda are also moving toward BEV via this route. Japan will have the highest HEV sales share among the AP countries throughout this decade.

- ASEAN: With a strong influence from Japanese brands and incentive programs, HEVs remain the dominant xEV technology. ASEAN is expected to achieve the fastest HEV growth in this AP region due to the strong Japanese brand influence and less stringent emission standards than many other markets. Key brands such as Toyota and Honda continue to expand their HEV line-ups.

As a result, the HEV segment was able to maintain its steady growth in 2023, and sales are expected to have reached 6.5 million units with 33.5% YoY growth. HEVs are expected to continue to grow steadily in the short term as a much-needed transition technology. Then, as BEV technology develops further, charging infrastructure becomes more robust, and governments push for stricter emission regulations and more plug-in electrification, HEV growth will start to diminish in the second half of this decade. Nonetheless, HEV will remain a viable choice and a bridge toward the BEV era for some time to come.

Methin Changtor, Senior Manager, Asia-Pacific Powertrain Forecasts, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center