India’s vehicle market is expected to gain momentum this year and has very good long-term growth prospects, according to GlobalData unit LMC Automotive.

Amidst the doom and gloom of the current year, India is foreseen to be a major driver of growth in the Asia-Pacific region. The market has consistently outperformed our expectations in the first three months of the year, with total Light Vehicle (LV) sales at about 1.1 mn units. Due to a high base last year, this is a mere 1% growth year-on-year (YoY), but the total was 20% higher than in Q4 2021, thanks to an easing of the chip shortage.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

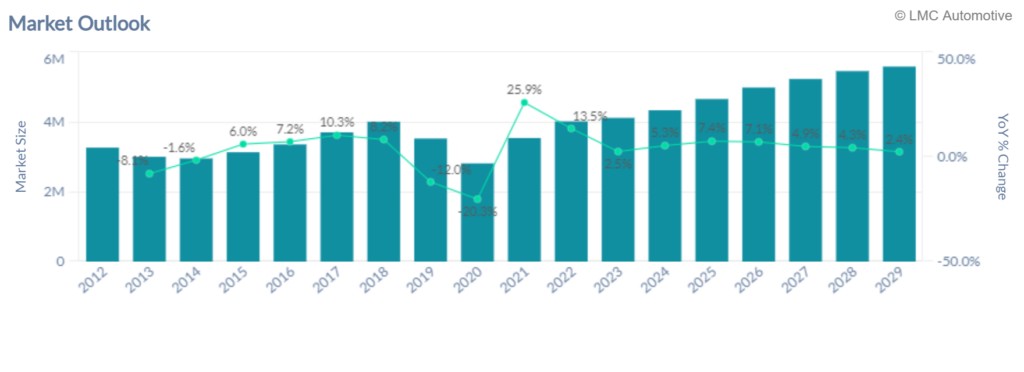

Demand remains robust, as illustrated by the long delivery times of up to 10 months. Not only has the COVID-19 pandemic subsided, but also a number of new model launches this year will attract consumers’ interest. Barring any escalation of the Russia-Ukraine war and the global supply disruptions, sales are expected to gain more momentum in H2 2022. Overall, we predict India’s LV sales will increase by 13.5% YoY to 4.0 mn units this year.

By comparison, sales in China are now predicted to slip by 0.5% to 25.4 mn units this year. The COVID-19 lockdowns in many cities have been extended and continue to disrupt economic activity. In addition to exacerbating tight supply, the lockdowns also hurt consumer confidence and spending power.

The evolution of LV sales in the other two key Asian markets – Japan and Korea – is also forecast to be weaker than in India. Sales in Japan have been hurt by the rise in Omicron cases in February, while the global supply-chain bottlenecks continue to hamper production and sales even though demand remains strong. In Korea too, demand remains robust, but sales are restricted by supply constraints because of the shortage of parts, including semiconductors.

Meanwhile, cumulative sales in the ASEAN region are predicted to grow by 11% YoY to 3.1 mn units in 2022. The forecasts for Indonesia, Thailand, Malaysia, the Philippines, and Vietnam have all been adjusted slightly upward in recent times, based on stronger-than-expected March sales in the region. However, because of the war in Ukraine, the lockdowns in China and the ongoing global supply disruptions, our forecasts remain cautious.

We expect India to be amongst the fastest-growing markets in the Asia-Pacific region in the long term, with LV sales calculated to expand at a CAGR of 5% over the next seven years. The only other major markets in the region to grow at roughly the same pace are Thailand, Vietnam, and the Philippines – but their respective annual volumes are significantly lower than those of India.

Ammar Master, Senior Manager, Asia Pacific Vehicle Forecasts, LMC Automotive