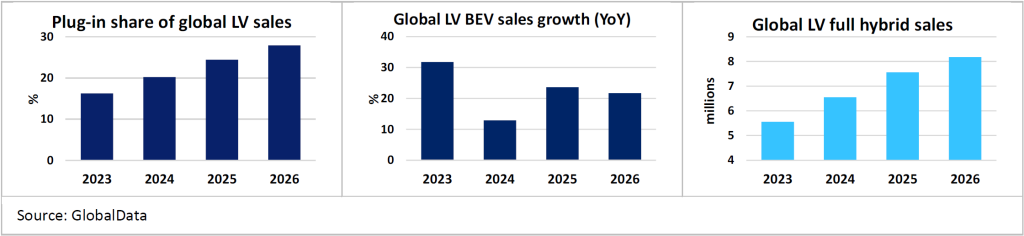

Despite the tariffs on automotive imports set to be imposed by US President Donald Trump, which will likely cut electric vehicle (EV) sales domestically, sales of them globally will rise to account for 25% of those of light vehicles (LVs) in 2025, according to a new report.

GlobalData’s Automotive Predictions 2025 report states: “While we expect President Trump’s likely actions aimed at reducing plug-in incentives and targets in the US to impact demand there, elsewhere we will see significant growth. Europe is expected, at least partially, to get back on track vis à vis plug-in sales while China, though growth is pivoting from battery electric vehicles (BEVs) to other plug-ins, will forge ahead this year.”

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

GlobalData forecasts that sales of plug-in EVs will rise by 4.4 million this year, increasing the proportion of light vehicle sales from 20% in 2024. China is expected to account for nearly half of the increase, at 2 million units, serving as the main driver of the increase. The report notes that demand will also be helped by the recovery of the battery-electric market in Europe and other markets where the vehicle type is gaining traction.

“More (and more affordable) products, pent-up demand, a new EU CO2 reduction target, some incentive improvement, and the replacement cycle will see Europe’s BEV market return to growth in 2025,” it states. “Just as in the 2020/21 period – the last time a new CO2 reduction target was implemented by the EU – new models that will help OEMs achieve targets and avoid fines were held back in 2024 and will be released in 2025.

“At the same time, we expect that prices of non-plug-in cars will remain high, just as they have since the disruptions of Covid-19 and the supplier parts shortages. This will reduce the BEV-ICE retail price parity gap and help steer people towards plug-in vehicles but, of course, there will be a headwind to topline car sales across the region – GlobalData anticipates low growth in overall demand totals.”

Trump tariff impacts on EV sales

Among the actions outlined in the report that GlobalData expects Trump to take in relation to EVs are the easing of emissions standards, freezing of investment in the charging infrastructure, removal of the personal leasing loophole for tax credit qualification, rescinding of California’s CAA waiver and ending or reducing of the Inflation Reduction Act’s $7,500 tax credit for EV purchases.

“The impact on the rate of EV sales in the US is dependent on how many of these areas are affected, and to what extent,” it says. “Initial analysis indicates that a moderate set of changes could reduce the current 2030 baseline BEV forecast by 14%, while a wholesale attack on growth-oriented measures could reduce the 2030 BEV share outcome from 30% to 18%.”

Trump has said this week, subsequent to the release of GlobalData’s report, that his proposed new tariffs on automotive imports will be “in the neighbourhood of 25%”, and it is thought they will apply to all foreign cars. They are intended in part to redress what Trump believes is an unfavourable balance of tariffs in the industry away from the US’ favour. Even prior to the ballpark figure being announced, the report stated that the tariffs expected would likely to reshape the industry.

“These measures aim to encourage domestic production but will also lead to increased vehicle prices, as manufacturers pass higher costs on to consumers,” it explains. “Automakers that rely on foreign manufacturing will face higher production costs. In addition to the tariffs, EVs sourced from the EU will face additional pricing challenges, as the US Inflation Reduction Act might exclude them from incentives, further reducing their competitiveness in the market.”

In addition, GlobalData expects the tariffs to disrupt supply chains as a result of the cross-border nature of automotive manufacturing and for the increased costs predicted to result in further job cuts within the industry.

“Tariffs will also lead to job losses in Mexico and Germany, where auto exports to the US play a significant economic role,” the report says. “Retaliatory tariffs from affected nations could further escalate the situation, impacting US exports and reducing global automotive trade efficiency. The financial constraints may compel companies to downsize operations and lead to job losses.”