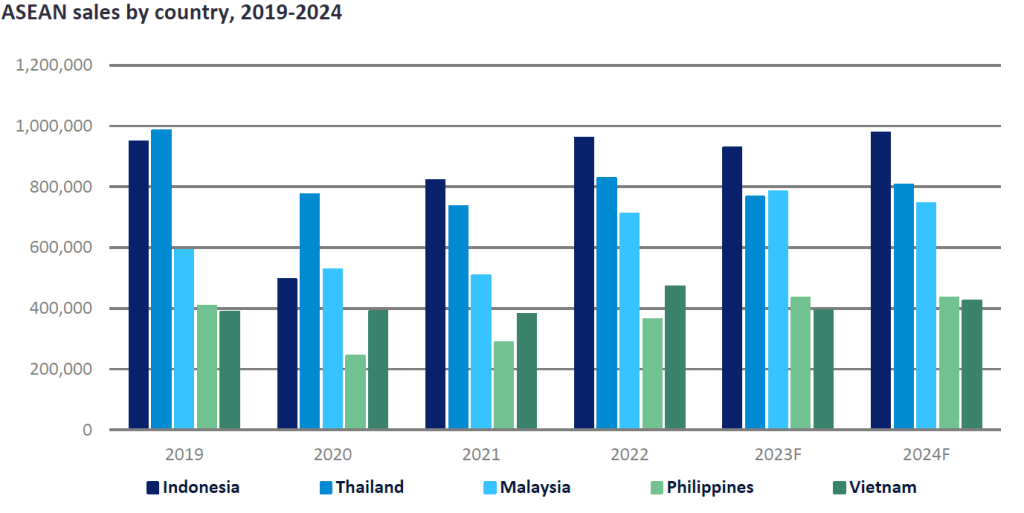

For more than a decade, Thailand and Indonesia have taken turns to be the largest and second-largest Light Vehicle (LV) markets in the ASEAN region. However, 2023 will be a challenging year for Thailand to maintain its position within the top two markets in the region.

For the first nine months of this year, Indonesia held on to the top spot with cumulative sales standing at 699k units. Thailand remained in second place with sales of 571k units. Malaysia came in at third place with sales reaching 568k units.

However, when looking at the current year-on-year (YoY) growth rate, one can see that sales in Thailand plunged by 7.2% YoY in the first nine months of 2023, while sales in Malaysia grew by 11.9% over the same period. At the end of the year, we expect that Malaysia will have overtaken Thailand as the second-largest LV market in the region.

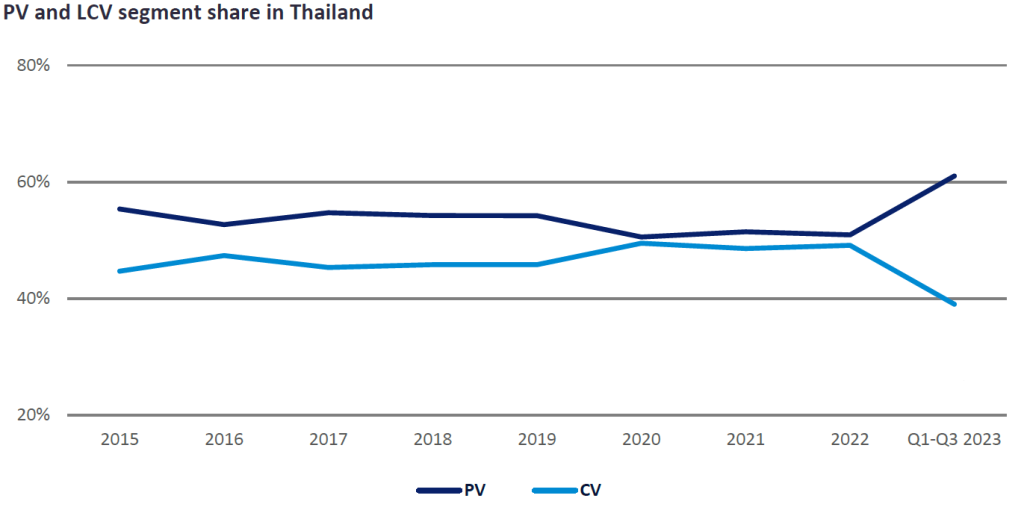

Since October 2022, Thailand’s LV market has been contracting and has not yet returned to positive growth. While the YTD decline to September for total LVs was a fairly modest 7.2%, it was 27.0% for the Light Commercial Vehicle (LCV) segment as demand for 1-ton Pickups ran out of steam. The Passenger Vehicle (PV) market has remained strong with a 12.2% YoY rise from January to September 2023, but this was insufficient to offset the significant decline seen in the LCV segment. It is worth noting that in 2022, the LCV segment accounted for 49% of total LV sales in Thailand while PVs accounted for 51% and the 1-ton Pickup truck was the biggest seller within Thailand’s LCV market, accounting for around 96% of total LCV sales in the country.

The key reasons for the ongoing decline in Pickup truck sales are:

See Also:

1. An uncertain economic outlook and lingering political unpredictability after the May general election, plus businesses holding back investment, including purchases of new commercial vehicles.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData2. During the pandemic, LCVs increased their market share against PVs, as demand for 1-ton Pickup trucks surged, due to growing e-commerce and the logistics business sector. However, demand for LCVs has since subsided.

3. Higher interest rates and tightened auto financing conditions have impacted sales of both PVs and LCVs. However, the impact on LCVs has been larger than on PVs, as many buyers of Pickup trucks are self-employed and/or in an informal business sector, and therefore, are facing difficulty obtaining approval for financing.

On the other hand, in the year to September Malaysian LV sales rose by 11.9% YoY boosted by the temporary sales tax exemption on the purchase of passenger vehicles (100% on locally assembled vehicles and 50% on imported vehicles) which ended in March 2023. A recovery in auto component bottlenecks and a number of new model launches also helped bolster sales.

Note that the sales tax exemption was initially intended to be valid from 15 June until 31 December 2020. However, its withdrawal was extended three times due to global supply shortages, the latest amendment being that it applied to any vehicle ordered before 1 July 2022 with registration needing to be completed by March 2023. As a result, Q1 2023 sales rocketed by 22.4% YoY as carmakers tried to deliver the vehicles before the 31 March 2023 deadline. However, after the expiration of the tax exemption program, the market has remained strong, with sales posting a 7.3% YoY increase during the period between April and September 2023, supported by aggressive promotional campaigns offered by carmakers intended to offset the exemption loss, at least partially.

One reason behind the recent sharp rise in the selling rate in Malaysia was a catch-up in production at Perodua, Malaysia’s best-selling automaker. The company decided to fully absorb the sales tax for all orders that it was unable to fulfil by March 2023. And according to our market intelligence, Perodua still has a huge order backlog and increased supply from its plants is pushing up sales overall in the market. It is worth noting that Perodua’s sales accounted for 40% of total LV sales in Malaysia in 2022.

Due to the current market conditions, 2023 full-year LV sales in Thailand are expected to decline by 7.4% YoY to 766k units while LV sales in Malaysia are projected to increase by 10.3% to 784k units. As a result, at the end of 2023, Malaysia is set to become the second-largest market in the region after Indonesia, with Thailand in third place.

Nonetheless, this ranking is expected to remain in place only in 2023. In 2024, the Thai LV market is projected to recover and grow by 5.3% to 807k (still significantly lower than the 986k units in 2019 and the one million units seen in 2018). By contrast, Malaysian LV sales next year are forecast to suffer a slowdown to 746k units.

Tanitta Tumrasvin, Senior Analyst, ASEAN, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center