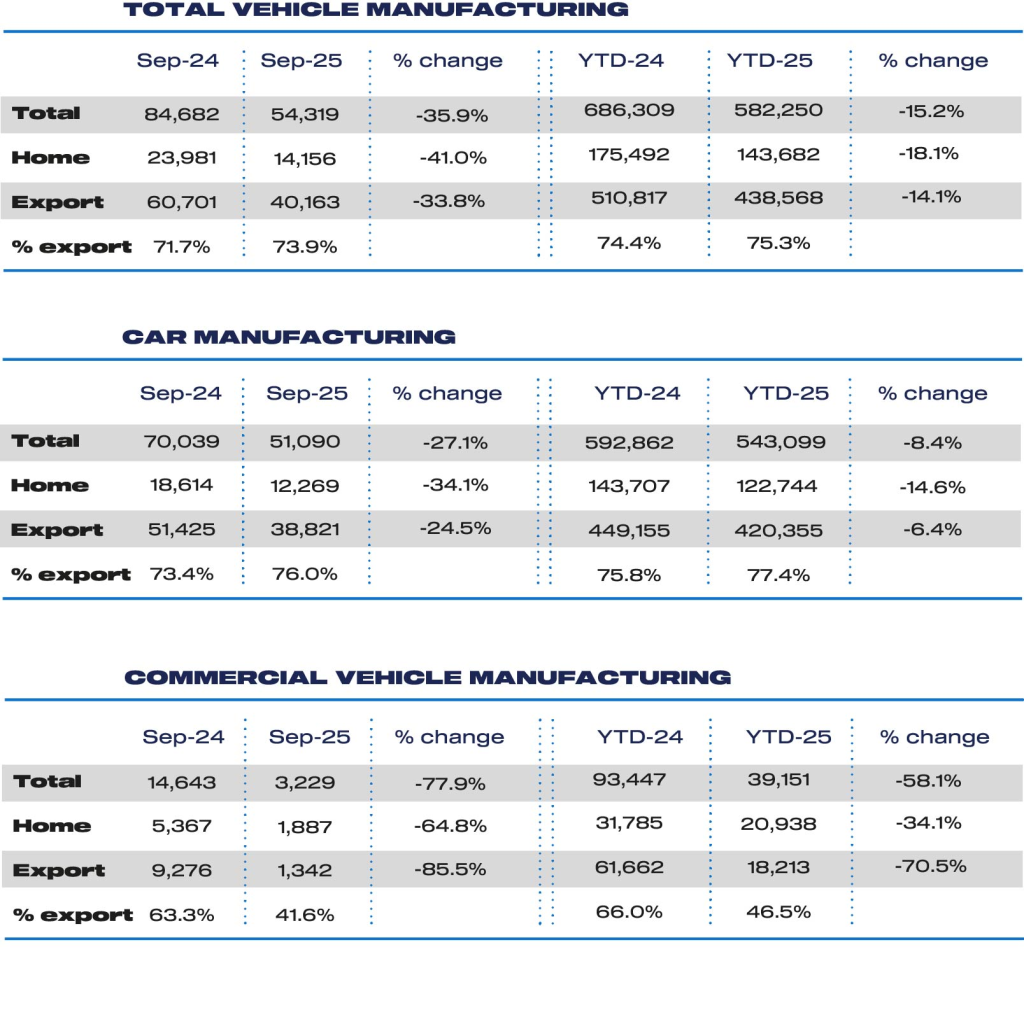

UK car production fell in October, down 23.8%, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT).

The SMMT noted that the drop came as Britain’s biggest automotive employer – Jaguar Land Rover (JLR) began its phased restart of operations after a cyber incident forced a pause in production in the month of September.

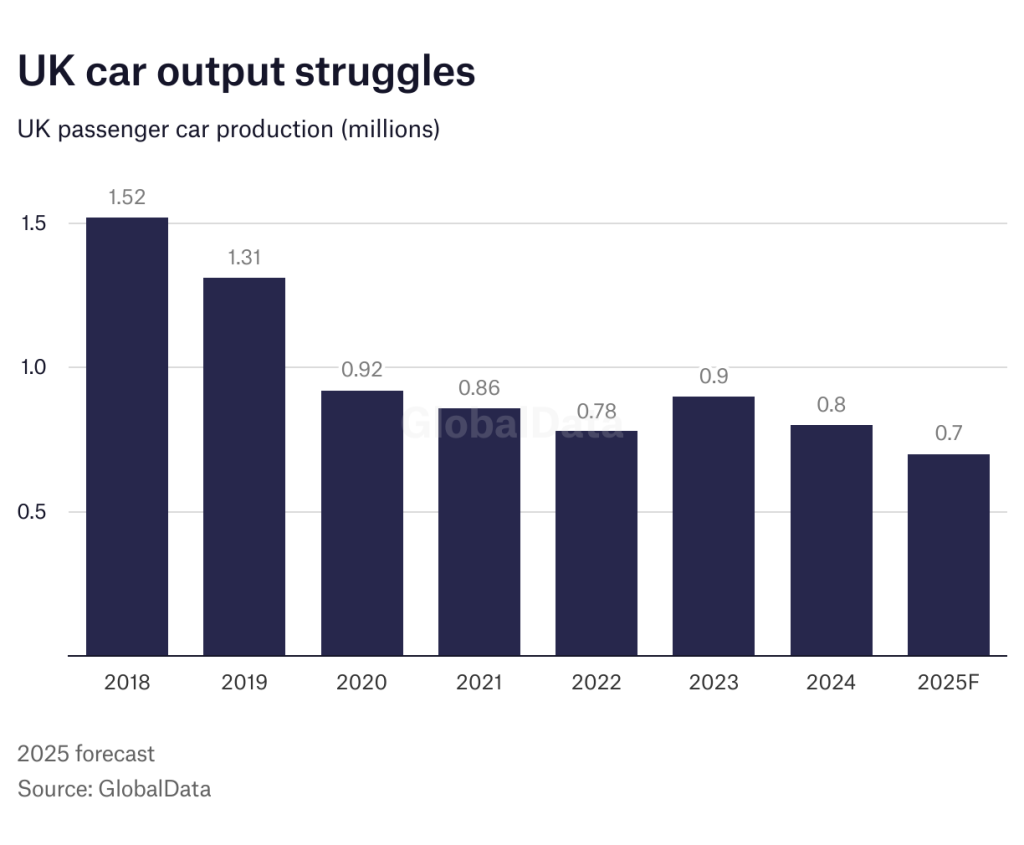

According to GlobalData, UK passenger car output this year is forecast at around 700,000 units and has declined from an annual 1.5 million units as recently as 2018. The SMMT has said it wants the UK government to create the conditions needed to restore the sector to a 1.3 million vehicle manufacturing hub by 2035.

Almost half the cars (46.2%) made in the month were either battery electric, plug-in hybrid or hybrid, with volumes up 10.4% to 27,287 units. Overall car production for the UK market fell by 10.6% to 13,785 units, while output for export declined -27.1%. 45,225 cars were produced for global markets – representing more than three quarters of total output – with the EU, US, Türkiye, China and Japan the top five export markets. Shipments to the EU, US and Japan all fell, while those to Türkiye and China rose.

The news comes two days after the UK’s Budget Statement in which the Chancellor announced a number of welcome competitiveness-boosting measures, including a further £1.5 billion in automotive transformation funding, and the deferral of regulation to end critical employee car ownership schemes into the next parliament – a move the industry had warned could lead to annual losses of £1 billion and put up to 5,000 jobs at stake. It also comes after the government published a consultation on its proposed British Industrial Competitiveness Scheme (BICS) which should bring down sky-high energy costs for manufacturers.

In terms of market measures – which help make the UK an attractive place for manufacturing investment – the SMMT said there was welcome news of a £1.3 billion top up to the Electric Car Grant and changes to the VED expensive car supplement, reducing the number of EVs that will be subject to the higher tax.

However, the SMMT also criticised the introduction of a new pay-per-mile EV tax (eVED) which it said would undermine the impact of those supportive EV measures, reducing demand for the very vehicles manufacturers are compelled to sell.

Mike Hawes, SMMT Chief Executive, said: “Another difficult month for UK vehicle production as the impact of the earlier cyber-attack continued to be felt. Growth is on the horizon, however, and Government has recognised the automotive industry as a pillar of national strategic importance, backing it with an industrial strategy and additional £1.5 billion to drive manufacturing competitiveness.

"Investment competitiveness also depends on a healthy domestic market, however, notably for EVs, and introducing a new electric Vehicle Excise Duty is the wrong measure at the wrong time. This new tax will undermine demand, so government must work with industry to reduce the cost of compliance and protect the UK’s investment appeal.”