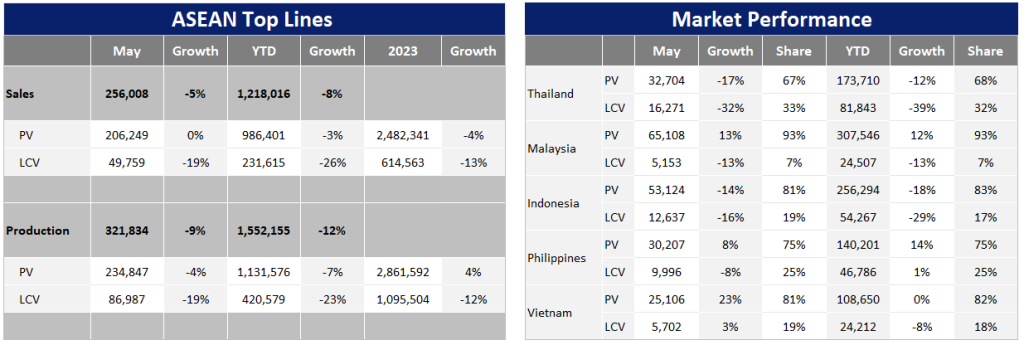

In May, ASEAN Light Vehicle (LV) sales dropped by 5% YoY, marking the 10th consecutive month of declines. Recent data reveals that this downturn continued in June, with Thailand, Indonesia, and Malaysia experiencing slumps of -26% YoY, -12% YoY, and -4% YoY, respectively, during the month.

Since these countries have together accounted for 73% of ASEAN LV sales this year, the overall ASEAN market is estimated to have dropped by 9.4% in June and 8.6% YoY in H1 2024.

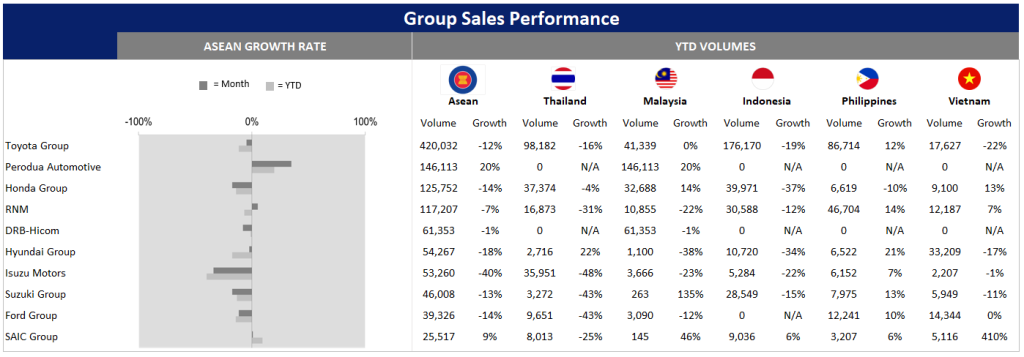

For Thailand, LV sales in the first half of the year are likely to have fallen by 24% YoY, with weaker performances for both Passenger Vehicles (PVs) and Light Commercial Vehicles (LCVs), which declined by 13% YoY and 39% YoY, respectively. According to the auto industry representative, this slowdown was a result of the tightening of auto loan approvals and requirements. However, in June, the Bank of Thailand informed automakers that the requirements had not changed, but that the high rejection rate was due to the poor quality of loan applicants and high household debt. In addition, slowing demand for Battery Electric Vehicles (BEVs) also hindered PV sales during the period. Thailand’s 2024 sales outlook has been revised downward to 635k units in this report. This is due to: sales continuing to underperform our expectations; the Bank of Thailand not being expected to start cutting interest rates until Q4 2024, given the baht’s weakness; the credit conditions being unlikely to improve quickly, given the high level of household debt (nearly 90% of GDP); and the country being expected to experience its worst drought in history this year, which will likely impact agricultural output.

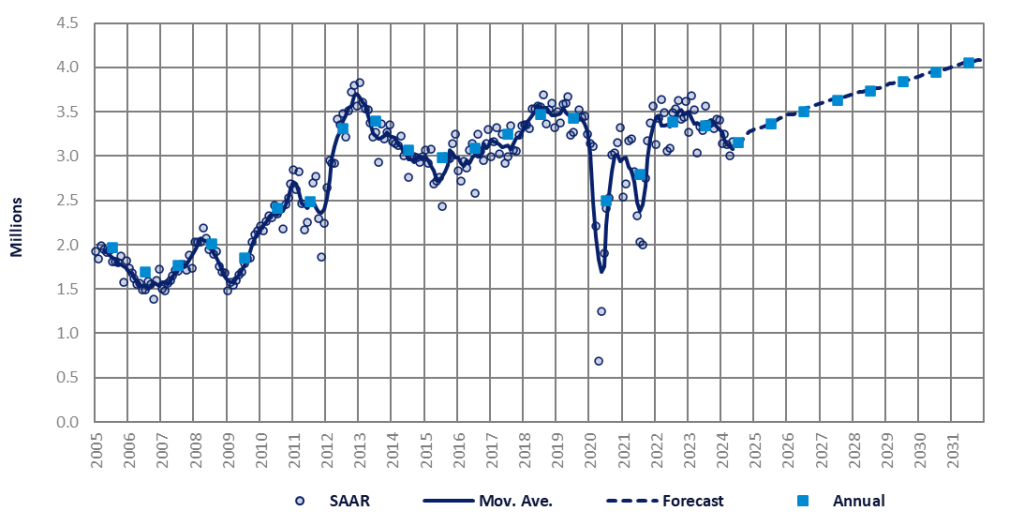

Indonesian LV sales have been declining since July 2023, resulting in a negative sales performance of 3% YoY for 2023 overall and a decline of 20% YoY from January to June 2024. This poor result is due to strict credit conditions, high auto financing rates, and a weak rupiah. While headline inflation remains within the central bank’s target range of 1.5-3.5%, the bank made a surprise rate hike in April, raising the policy interest rate to 6.25% – the highest since 2016. Additionally, lower commodity prices affected the economy, income, and LCV demand. As such, Indonesia’s sales outlook has been lowered through the long term, with 2024 sales projected at 837k units. Subsequently, the market is expected to gradually increase to reach the 1.0 million unit level in 2027 instead of 2026 as anticipated in our previous report. This adjustment was the result of there being no signs of recovery in LV demand, as well as the tightening of auto loan approvals, and the uncertainty of economic policy from the new government. However, GAIKINDO has called for the government to introduce tax cuts to boost LV sales, similar to the policy that was in place during the pandemic. If the government accepts GAIKINDO’s request, Indonesia’s sales forecast will be increased promptly.

The Malaysia Automotive Association (MAA) report showed that sales in the country rose by 11% YoY and 18% MoM in May. However, government registration data and a press release from Proton hinted that June sales fell by 4% YoY and 17% MoM. This was due to Proton suspending production for one week for maintenance and Perodua’s sales performance decelerating from a 20% YoY increase in January-May to only a 5% YoY increase in June. On a MoM basis, Perodua’s June sales plunged by 29%, reflecting the fulfillment of a large backlog of orders. Despite Malaysia’s sales being estimated to have increased by 8% YoY in H1 2024, the year-end sales outlook has been marginally lowered by 1% compared to our previous report and is now projected at 785k units. This downward revision is based on Perodua’s sales target and performance. Perodua reported outstanding sales growth early this year, but a press conference in May revealed its 2024 sales target of 330k units, which matches its 2023 result. This indicates a negative sales outlook in H2 2024 due to the fulfillment of a large backlog of orders and the pull-ahead effect of a temporary tax cut on PVs.

In the Philippines, LV demand remains strong and grew by 11% YoY in January-May, marking the 27th consecutive month of growth thanks to pent-up demand following the pandemic, robust remittance inflows from overseas Filipino workers, alleviation of supply constraints, and the market entry of Chinese automakers offering competitively priced vehicles. Based on advanced data, LV sales in the country continued to increase by 8% YoY in June, which was stronger than expected. The persistent uptick led to an increase in the Philippines’ 2024 sales forecast to 458k units, marking the fourth consecutive year of growth.

In Vietnam, LV sales in May jumped by 19% YoY, but YTD sales dropped by 2% YoY. The strong May result was supported by aggressive sales campaigns. As the month’s sales were in line with expectations, Vietnam’s 2024 total was marginally adjusted and projected at 384k units. Another key development in this report is that the re-introduction of registration fees is expected to be implemented from August 2024 to January 2025.

In conclusion, ASEAN 2024 LV sales have been lowered from 3.17 million units to 3.10 million units, due to downward revisions for Thailand, Indonesia, and Malaysia.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.