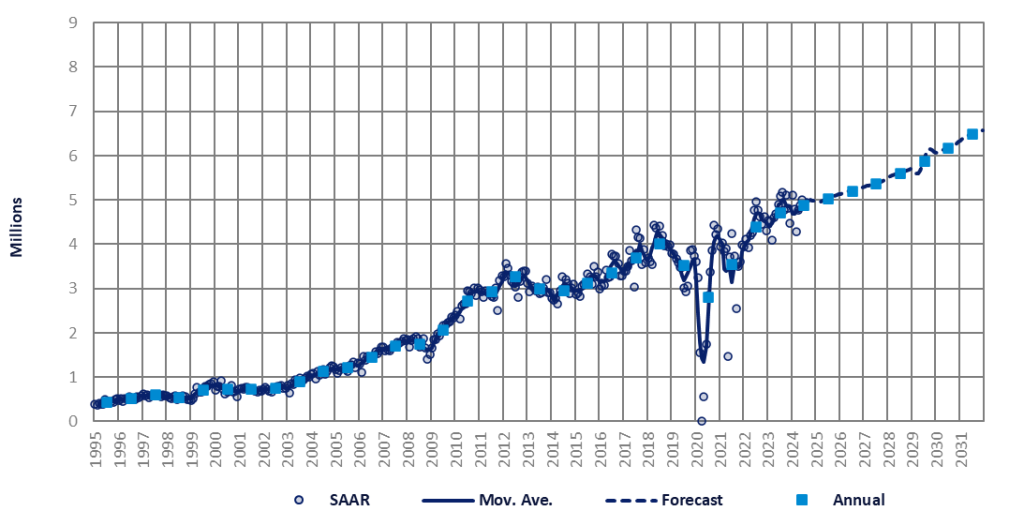

The Indian market continues to exhibit resilience. In June, the selling rate reached 5 million units/year, a 3% increase from a robust May performance.

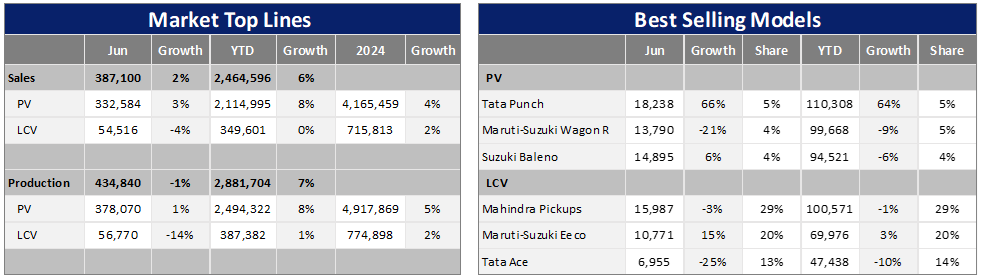

Light Vehicle (LV) wholesales in June totaled over 387k units, representing a 2% month-on-month (MoM) decline. However, this marks a 2% rise year-on-year (YoY), despite a high comparative figure in 2023.

Passenger Vehicle (PV) sales comprised 333k units (-3% MoM, +3% YoY), while Light Commercial Vehicles (LCVs) with gross vehicle weight of up to 6T accounted for more than 54k units (+1% MoM, -4% YoY).

The modest reduction in volumes for June resulted from uncertainties surrounding the general elections, as consumers and businesses exercised caution and postponed purchases. Concurrently, automakers curtailed deliveries of underperforming and outdated models to reduce elevated stock levels at dealerships.

Heatwaves across India during the month also significantly diminished showroom visits, with the Federation of Automobile Dealers Associations (FADA) reporting a 15% drop in customer walk-ins.

As a result, retail sales of PVs and LCVs fell to 322k units in June, compared to 349k units in May and 382k units in April, according to FADA data. More concerning is the PV inventory at dealerships, which reached an unprecedented 62-67 days in June – more than double the typical levels.

Total LV wholesales from January to June rose by 6% YoY to approximately 2.5 million units. This figure includes 2.1 million PVs, up by 8% YoY, and 350k LCVs, which showed no growth. Consequently, the selling rate averaged 4.8 million units/year in H1 2024.

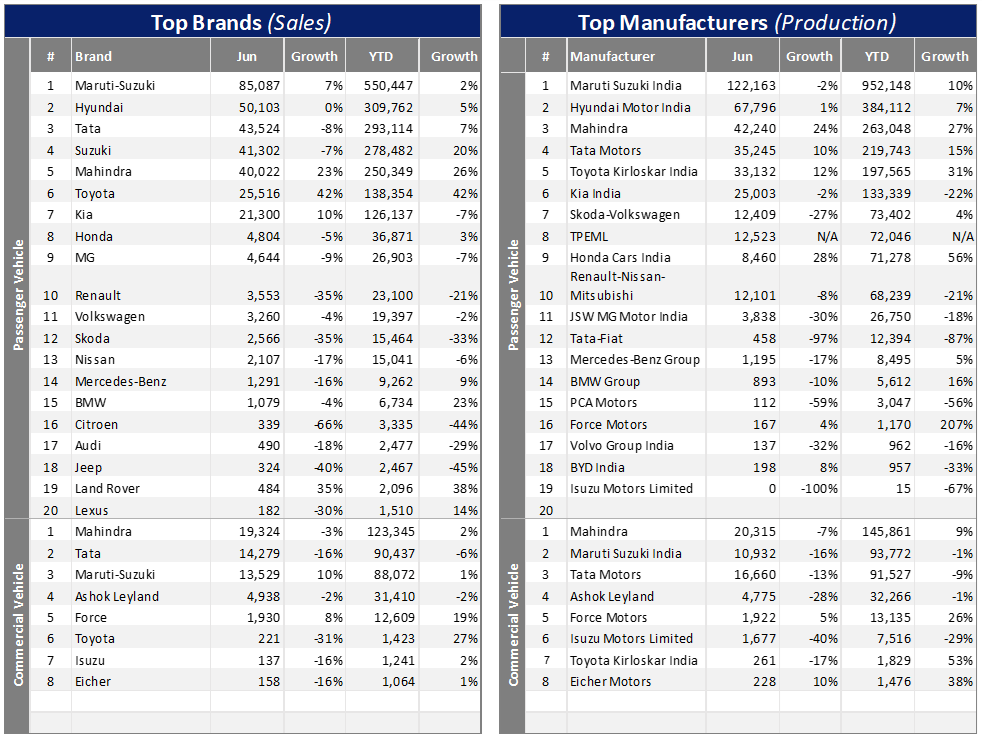

It is estimated that the market retains a significant backlog of orders, ranging between 400k-500k units, predominantly consisting of PVs from Maruti Suzuki and Mahindra. Although pending orders have decreased, they equate to roughly 1.5 months of PV sales.

In response, carmakers and dealers are offering substantial incentives, including discounts and consumer schemes, even for popular SUVs such as the Maruti Suzuki Brezza and Grand Vitara, the Mahindra XUV700, and the Tata Safari and Harrier.

Preliminary July data from some major OEMs suggests little change in PV wholesales versus the previous month. Suzuki Group’s volumes have declined by 1% MoM, while Hyundai’s sales have dropped by 2%. Conversely, Tata and Mahindra have improved their wholesales by 3% and 4%, respectively.

As noted in our last report, sales are expected to rebound following the conclusion of the general elections. The introduction of new models and generations will likely stimulate buyer interest in new vehicles.

On the downside, extreme weather conditions, such as heatwaves and floods, could affect not only rural demand but the overall economy. A record-low rupee, persistent inflation, and high interest rates are also concerns. Inflation remains above the Reserve Bank of India’s (RBI) 4% target and could rise further due to the heatwaves, tempering expectations of an imminent RBI rate cut.

Our forecasts have been maintained, with only minor adjustments. As such, LV sales are projected to reach a new record of 4.9 million units this year, representing an increase of 4% YoY. Looking forward, sales are anticipated to accelerate to 6.5 million units by 2031.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.