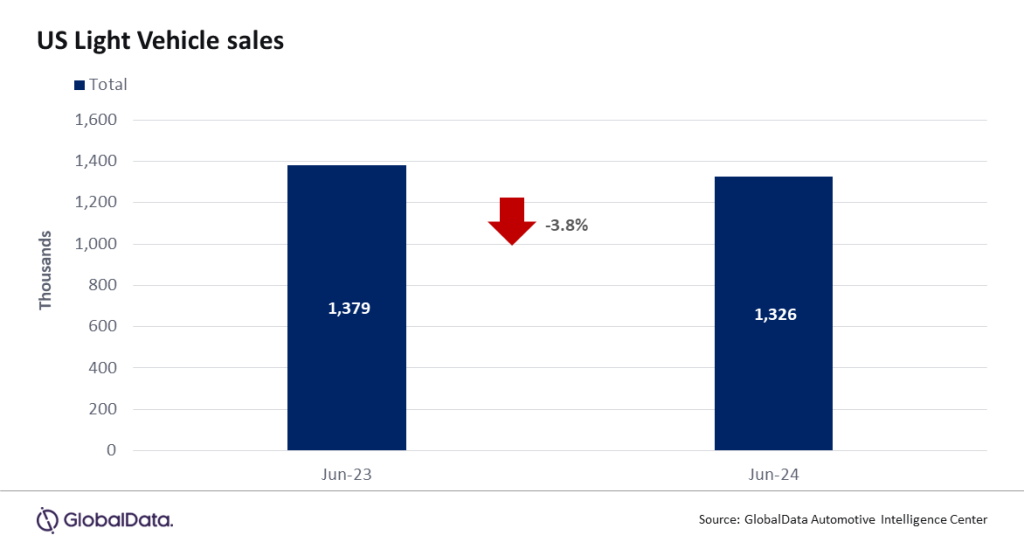

According to preliminary estimates, Light Vehicle (LV) sales fell by 3.8% year-on-year (YoY) in June, to 1.33 million units. The CDK cyberattack has caused significant disruption across the industry, and therefore some brands could potentially see larger revisions than would normally be the case. Still, sales in June are unlikely to change for many of the largest OEMs, while there is a possibility that volumes in July will see a boost instead.

US LV sales totaled 1.33 million units in June, according to GlobalData. The annualized selling rate was 15.3 million units/year in June, down from 16.0 million units/year in May. The daily selling rate was estimated at 51k units/day in June, compared to 55.4k units/day in May. Given the obvious challenges that the industry faced in June, we should not read too much into either the annualised or daily selling rates this month.

NB: It is not possible to provide retail/fleet splits this month due to the CDK cyberattack.

General Motors (GM) once again led the market in June, and opened up a gap of almost 34k units over second-placed Toyota Group, which was impacted by stop-sale orders on some models. Ford Group was the third-largest OEM with 160k units. At a brand level, Toyota continued to lead on 165k units despite the recalls, with second-placed Ford seemingly affected by the cyberattack, as its volumes were a modest 153k units. Chevrolet was the next closest challenger behind Ford, on 144k units. For the first time since March, the Toyota RAV4 returned to the top of the model sales rankings, on 41.7k units, as Toyota reported that the cyberattack had little impact on its sales activity. This relegated the Ford F-150 to the runner-up position, with 37.6k units. In terms of segments, Compact Non-Premium SUVs continued to see an easing in market share in June, accounting for 20.2% of total sales, although this was still 5.1 pp ahead of the next largest segment, Midsize Non-Premium SUVs. Meanwhile, the Large Pickup segment enjoyed its highest market share since January 2023, at 14.1%.

David Oakley, Manager, Americas Sales Forecasts, GlobalData, said: “Although the industry has become accustomed to dealing with adversity in recent years, the CDK cyberattack was another curve ball that disrupted activity on a number of levels during June. Many dealers that use CDK’s software found it difficult to conduct normal business operations, although reports suggest that workarounds were found in many cases. The sales data also supports this idea of resilience, as volumes were certainly not as low as might have been the case, especially given that the attack occurred on June 19th and affected the busiest weeks of the month, as well as a quarter end. Still, there was undoubtedly a negative impact for some OEMs, as we would have expected sales to grow modestly YoY had the cyberattack not happened. Some buyers may have chosen to defer their purchase until the issue was resolved, but with the restoration of systems expected imminently, we anticipate that most of the lost sales will be recovered in July”.

US inventory likely ended June at just above 2.7 million units, on par with the level seen last month, but an increase of nearly 42% from June 2023. Days’ supply is expected to be at 50 days, which is the same as last month. With recovery from the cyberattack expected to be robust in July, inventory will contract more than typical during the month’s summer production shutdown for some of the domestic manufacturers. Production levels are expected to resume some inventory rebuilding in August and will be managed to demand through the remainder of 2024.

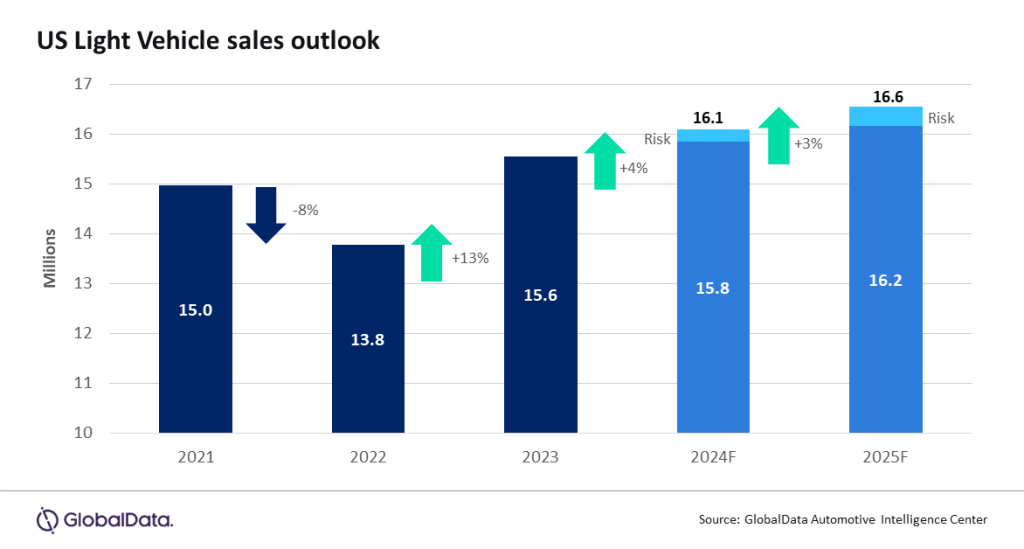

The monthly pattern may have been distorted in June, and now through August, but the forecast for 2024 remains at 16.1 million units, a 4% increase from 2023. If July and August see measurable recovery, the forecast could still push to 16.2 million units. Fleet sales are still projected to increase to account for 18.9% of LV sales this year, nearly back to pre-pandemic levels. The outlook for LV sales in 2025 remains stable at 16.6 million units, an increase of 3% YoY.

Jeff Schuster, Vice President Research and Analysis, Automotive, said: “The forecast for LV sales has been stable for several months now, with the risk bias holding to the upside as affordability continues to improve somewhat, and the mix of lower-priced vehicles and trim levels help to bring in displaced consumers. While the upcoming US election is not expected to have a significant impact on topline volume, economic and regulatory policy could certainly impact Electric Vehicle (EV) growth and sourcing trends.”

Global outlook: The global LV selling rate in May stood at 87.4 million units/year, a modest improvement from 86.2 million units/year in April. Sales volumes in May increased by just 0.7% to 7.2 million units, which was weaker than expectations going into the month. Lower demand in China accounted for much of the weak global gain. The country experienced a contraction of 3.3% in May, which was noticeably stronger than the 0.4% decline projected; however, the selling rate still improved from April. Japan (-4.5%) and Korea (-7.3%) also contributed to the muted performance in May. A slight pullback in expected demand has trimmed the outlook for 2024 by 200k units to 88.9 million units, a 2.5% increase from 2023. China’s trade-in subsidy does not appear to be providing the boost to demand that the government intended. However, globally, risks remain balanced, and the auto market is stable.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.