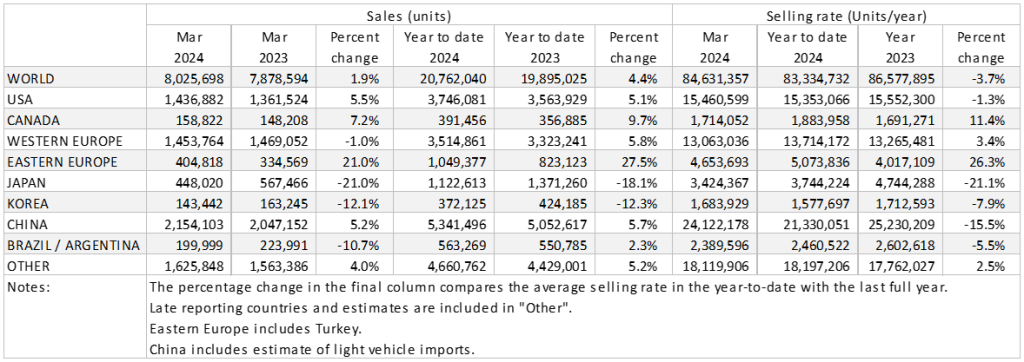

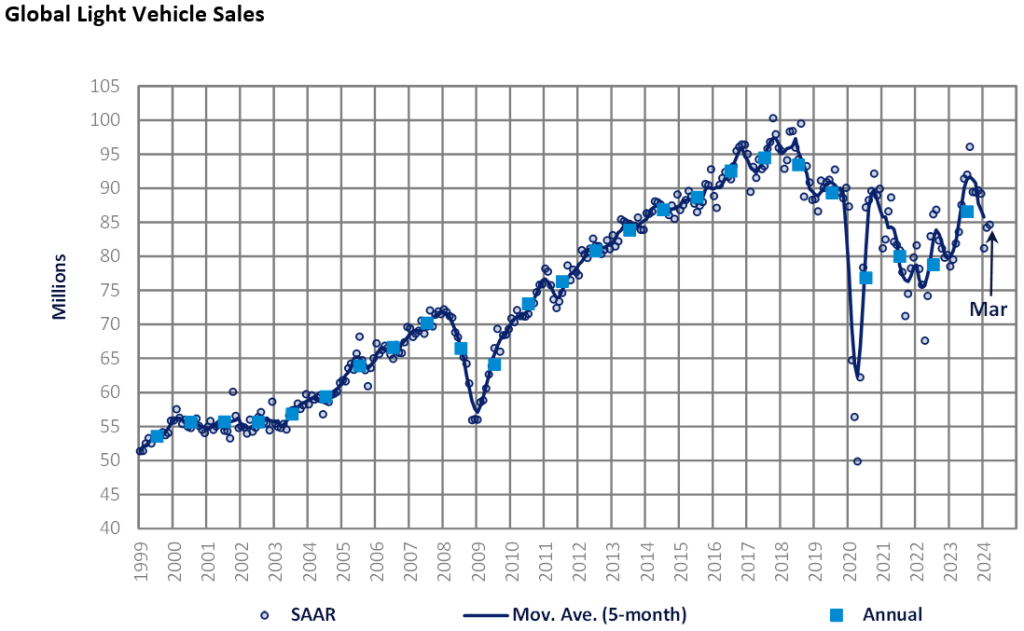

The Global Light Vehicle (LV) selling rate stood at 85 million units/year in March, broadly in line with the previous month. 8.0 million vehicles were sold last month, a 2% improvement year-on-year (YoY), with year-to-date (YTD) sales up over 4%.

It was a mixed picture at a regional level in terms of selling rate evolution. In the US, the selling rate was a little lower month-on-month (MoM), though it remains solid, supported by continued easing of prices and the increasing of incentives. China’s selling rate accelerated from a weak February, while Europe saw a moderate decline in selling rates.

Reminder: from this year, we are excluding exports from the China sales total, where we had previously been including them. We have backdated this adjustment to 2018.

North America

The US Light Vehicle market increased in March 2024 by 5.5% YoY, with sales growing to 1.44 million units. The selling rate slightly slowed in March to 15.5 million units/year, down from the 15.8 million units/year reported in February, according to preliminary results. Growth has been supported by the fact that transaction prices continue to slow, dropping to US$44,209 in March, a decrease of US$341 on a month-over-month basis. On the other hand, incentives continued to grow, with March marking the fifth consecutive month of incentives exceeding US$2,000, at US$2,836.

In March, Canadian Light Vehicle sales reached almost 159k units, expanding by 7.2% YoY. While sales continue to grow YoY amid uncertain economic conditions, the selling rate saw a decline in March, to 1.71 million units/year, down from 1.93 million units/year in February. As for Mexico, sales grew slightly by 5.5% YoY in March, to 125k units. The Mexican market continues to be buoyant, with the selling rate coming in at 1.46 million units/year in March, in line with its performance in the first two months of the year, but pacing well ahead of the year-ago rate.

Europe

The Western Europe LV selling rate fell MoM to 13 million units/year in March, with raw sales down 1% YoY. March’s selling rate remains 20% below pre-pandemic March 2019’s result. Despite a weaker result last month, YTD sales totaled 3.5 million units, an improvement of 5.8% on the same period in 2023. While the economic backdrop remains challenging, the market is still expected to grow for the 2024 full year, supported by some easing of vehicle prices.

The Eastern Europe LV selling rate fell MoM to 4.7 million units/year in March, although raw sales increased by 21% YoY. The market finished Q1 strongly, with total sales of over 1 million units (+28% YoY). This result was supported by continued strong performance in Turkey, and robust recovery in Ukraine and Russia.

China

Preliminary data indicates that China’s domestic automotive market accelerated in March after a slow start to the New Year. The March selling rate was 24.1 million units/year, an almost 18% increase from a weak February. That, however, brought the Q1 2024 average rate to only 21.3 million units/year, a significant slowdown, compared to the Q4 2023 average of 26 million units/year. In YoY terms, domestic Passenger Vehicle sales (i.e. wholesales, excluding exports) increased by 5.4% in March and 6.2% in Q1, but growth are exaggerated by depressed year-ago sales. In stark contrast, Passenger Vehicle exports expanded by 34% YoY in Q1, signaling that China’s automotive industry continued to rely on exports to offset a slack in the domestic market.

It appears that many consumers are taking a wait-and-see approach amid the intensifying price war. The official consumer confidence index hit a record low in February, suggesting that consumers are tightening spending, too. The central government has instructed local governments to introduce policy and financial support for trading-in consumer goods, including vehicles. Shanghai has already started a cash subsidy program for trade-ins, and other local governments are expected to follow suit. There is a chance that the government will launch more stimulus measures.

Other Asia

In Japan, sales continued to plunge, impacted by the production suspension at Toyota and Daihatsu (the leading manufacturer of Mini Vehicles, which account for almost 40% of Japan’s total Light Vehicle sales) as a result of the scandals at each of the automakers. The March selling rate was only 3.42 million units/year, down 3% from a weak February. In YoY terms, sales declined by 21% in March and 18% in Q1, due partially to a high base. However, with the two automakers resuming normal production, supply is expected to catch up soon. Demand remains solid, as consumers are becoming more optimistic, thanks to substantial pay hikes at many corporations in April and record-high stock prices.

After a weak start to the New Year, the Korean market picked up some pace in March, partially because Hyundai resumed production at its Asan plant, which had been temporarily shut down for retooling. The March selling rate was 1.68 million units/year, up 6% from a weak February. That, however, brought the Q1 average rate to only 1.58 million units/year. In YoY terms, sales declined by 12% in March and Q1 overall – but note, the declines are somewhat exaggerated by a high base, as sales a year ago were strong due to the temporary tax cut on PVs (which expired in June 2023). Compared to sluggish sales of locally produced models, imports did well in March, boosted by a strong surge in Tesla’s deliveries.

South America

Brazilian Light Vehicle sales declined by 5.6% YoY in March, dropping to 176k units. The selling rate also staggered in March, to 2.12 million units/year, down from the 2.37 million units/year reported in February. Although results were slightly disappointing, the selling rate may have been negatively impacted by distortions to sales activity around the Easter holidays. Inventory levels increased in March to 222k units, up from 218k units in February. Days’ supply increased by 1 day on a MoM basis, to 36 days.

In Argentina, Light Vehicle sales landed at 24.0k units, dropping by a staggering 36.1% YoY. The country is facing lingering economic headwinds, in addition to adjusting to policies proposed by the new presidential administration. Although the import restrictions were lifted in December, it is still too early to judge the impact from the policy change. The selling rate slowed dramatically in March, to 270k units/year, down from 329k units/year in February.