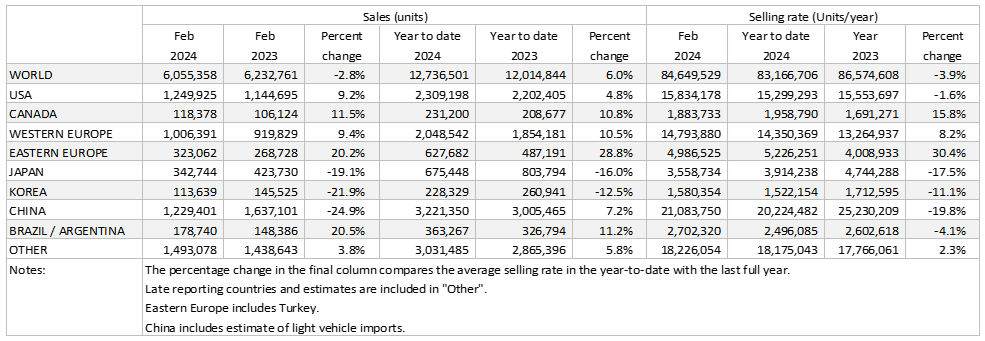

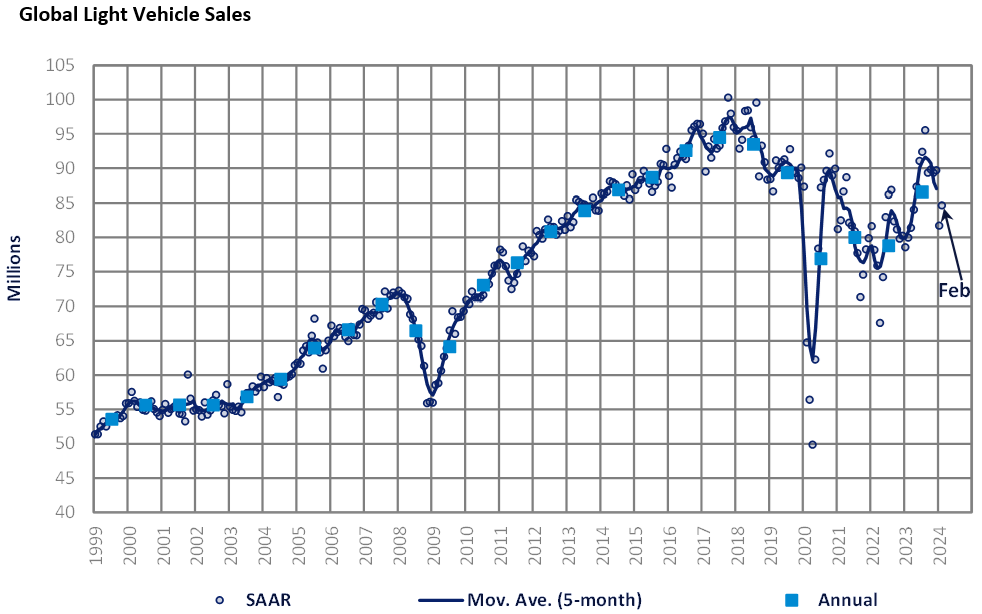

The Global Light Vehicle (LV) selling rate rose to 85 million units/year in February, up from 82 million units/year in January, though still weak compared to the second half of last year. Over 6 million vehicles were sold last month, though the YoY result was down 2.8% YoY primarily because of a contraction in China.

Many key markets saw moderate selling rate growth in February. In Europe, it was a mixed picture as Western Europe’s selling rate grew while Eastern Europe’s rate slowed. China’s selling rate improved moderately from January, though it remains somewhat weaker than at the end of 2023. In the US, prices continued to ease, and incentives ratcheted up, supporting market expansion.

Reminder: from last month’s report onward, we are excluding exports from the China sales total, where we had previously been including them. We have backdated this adjustment to 2018.

North America

The US Light Vehicle market increased in February 2024 by 9.2% YoY, with sales reaching 1.25 million units. The selling rate recovered from the slow start in January as the rate increased to 15.8 million units/year in February, up from the 14.8 million units/year reported in January. Transaction prices could be showing signs of slowing down, as prices continued to drop in February, as prices dropped by US$324 on a month-over-month basis to US$44,551 in February. Whereas, on the other hand incentives continued to grow, with February marking the fourth consecutive month of incentives exceeding US$2,000, at US$2,630.

In February, Canadian Light Vehicles sales reached 118.4k units, as sales grew by 11.5% YoY. The selling rate slowed in February to 1.88 million units/year, down from 2.03 million units/year in January. As the country struggles with headwinds associated with the recession, it is possible that sales may falter in the coming months. As for Mexico, sales grew by 12.0% YoY in February, to 112.8k units. As sales continue their strong run of growth in Mexico, the selling rate also increased in February to 1.5 million units/year, up from the 1.4 million units/year recorded in January.

Europe

The Western Europe LV selling rate grew month-over-month to 14.8 million units/year in February, representing a 9.4% improvement in raw sales, YoY. However, the LV selling rate is still almost 15% behind its pre-pandemic February 2019 volume. With supply restrictions passing, the focus has turned to the strength of the economy, and, in this regard, the situation remains challenging. However, some easing of prices is expected this year.

The Eastern Europe LV selling rate stood at 5.0 million units/year in February, lower than an upwardly revised January figure, although raw sales were up 20.2% YoY. This strong YoY result was boosted by recovery in Ukraine and Russia, as well as continued strong performance in Turkey.

China

According to advance data, domestic sales (i.e., wholesales, excluding exports) in China improved only slightly in February after a weak start to the New Year. The February selling rate was 21 million units/year, only a 9% increase from a depressed January. The year-to-date selling rate averaged 20.2 million units/year, far below last year’s total Light Vehicle sales of 25.2 million units. In YoY terms, sales declined by 25%, due to the timing of the Lunar New Year holiday (which was in February this year, while it was in January last year).

As demand remains weak, the “price war” has only intensified. Led by Tesla, OEMs are rushing to offer discounts and incentives for both NEV and ICE models. Prices of ICEs are falling rapidly, eroding automakers’ earnings. And the never-ending price war may be causing consumers to take a wait-and-see approach. A spate of negative news in the economy, such as a slow job market, falling asset prices, and the property crisis, are depressing consumer confidence as well.

In Japan, sales remained very weak, with the February selling rate falling to only 3.6 million units/year, down nearly 17% from January. The main cause was the production suspension at Daihatsu (a leading Mini Vehicle maker) due to the scandals over its safety test – and at Toyota, as a result of some certification issues with its affiliate, Toyota Industry. Moreover, some supply disruptions were reported at other OEMs as well, after the major earthquake in Ishikawa Prefecture on New Year’s Day. However, with the two automakers starting to normalize production, sales are expected to rebound as soon as supply catches up.

The Korean market continued to disappoint. In February, the selling rate was only 1.58 million units/year and sales plunged by 22% YoY. Behind weak sales were Hyundai’s temporary plant shutdown at its Asan plant for retooling and the Lunar New Year holiday – and most importantly, the cooling of consumer sentiment amidst high financing costs and an uncertain economic outlook. Not only domestic models, but also sales of imported models declined sharply, due partially to shipping delays caused by rising tensions in the Red Sea.

South America

Brazilian Light Vehicle sales grew by 29.7% YoY in February, expanding to 155.3k units. The selling rate increased in February to 2.38 million units/year, from 2.04 million units in January. Inventory levels marginally increased in February to 217.6k units, up from 216.5k units in January, and days’ supply remained at the same level, at 38 days. Production managed to recover despite the shorter month and the Carnival holiday.

In Argentina, Light Vehicle sales landed at 23.5k units in February, facing a decline of 18.1% YoY. Whereas sales slowed on a month-over-month basis, the selling rate increased to 326.1k units/year in February, up from the 253.3k units/year reported in January.