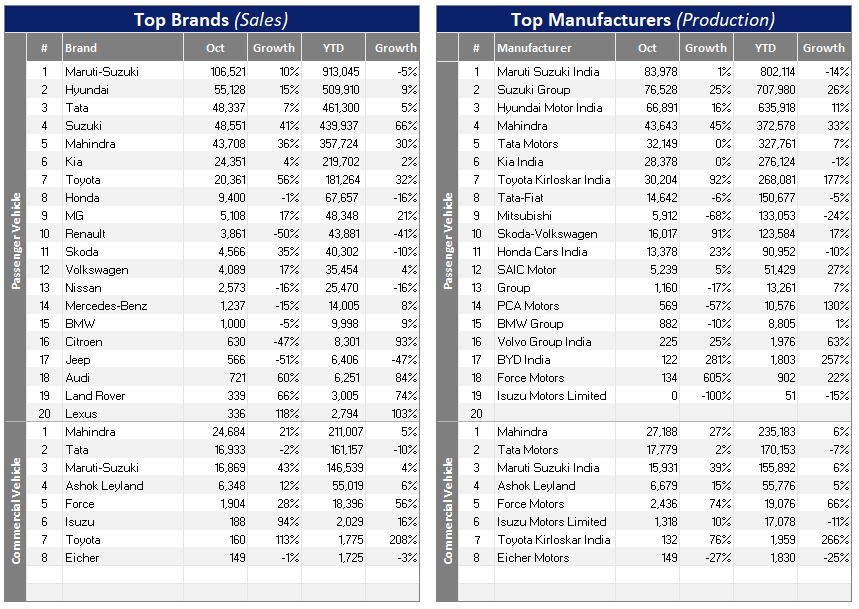

The Indian market continues to surprise on the upside, as total Light Vehicle (LV) wholesales in October reached an unparalleled 449k units.

Sales were up by 7% month-on-month (MoM) over the previous month’s peak and by 16% year-on-year (YoY).

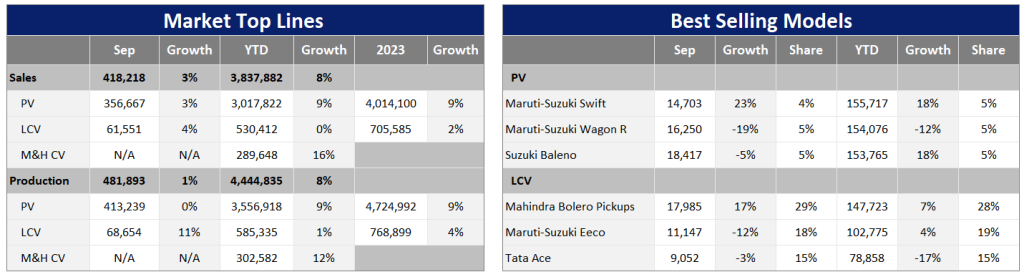

About 382k Passenger Vehicles (PVs) were dispatched in October, up by 7% MoM and 15% YoY. Demand for Light Commercial Vehicles (LCVs) with Gross Vehicle Weight (GVW) of up to 6 tonnes exceeded 67k units (+9% MoM, +18% YoY).

LV sales in the month started on a weak note due to the inauspicious Shraddh period until 14 October 2023 but picked up in the latter half of the month during the auspicious Navatri period (October 15 to 24).

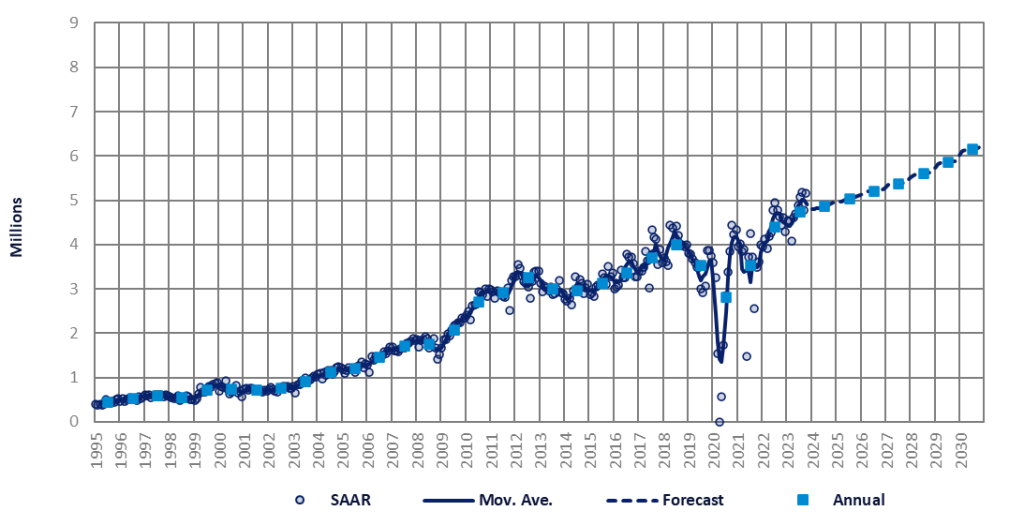

Consequently, the October selling rate reached 5.15 million units/year, which was virtually the same rate as the record high of 5.18 million units/year in August.

Inventory build-up for the festive season and increased output (thanks to improved supply of semiconductors) helped to boost wholesales results in October. Sizeable discounts and incentives from OEMs and dealers also sustained sales momentum in the month. It also appears that sales in rural areas started to recover after below-average monsoon rainfall had an impact on rural incomes.

As OEMs are fulfilling pending orders (mostly PVs), the number of backlogged orders has fallen from 700k to 750k units in summer to 500k to 600k units at present. That is, however, still high, as it is equivalent to 1.5 to 2 months of PV sales in the country.

Market leader Suzuki had an order backlog of about 215k units by the end of October, which was down from the peak of 400k units a few quarters ago. Other OEMs with high pending orders include Mahindra (286k units, as of 1 November) and Hyundai (115k units).

Retail sales of PVs and LCVs in October surged to 404k units versus 378k units in September, the Federation of Automobile Dealers Associations (FADA) reported.

During Navatri, retail sales of PVs increased by 7% YoY. Overall, it is estimated that OEMs dispatched 1 million vehicles during India’s 90-day festival period.

Cumulative LV wholesales between January and October neared 4 million units, which represented a growth of 8% YoY. This total comprised 3.4 million PVs (+9% YoY) and close to 600k LCVs (+2% YoY).

While deliveries from OEMs to dealerships continued to increase, the average inventory for PVs in India soared to another record high of 63-66 days at the end of October, as per the data from FADA. Of note, this inventory surpassed the previous month’s high of 60-65 days.

The peak of the festive season is over, and OEMs will likely start to cut back dealer inventories, which makes us cautious about the near-term sales outlook.

There are other concerns, too. Vehicle prices are estimated to have increased by 20-30% in the past two years (due to the implementation of the BS-VI emission standard, stricter safety regulations, and higher costs of materials and production). Financing costs remain high as well. In the overall economy, the general elections in April-May 2024 pose some uncertainty. Although Prime Minister Narendra Modi’s ruling party is widely expected to win, a new government normally pauses and reviews fiscal spending.

Even so, the slightly higher-than-expected October wholesales led to minor upward adjustments in the 2023 sales forecast. The rest of the forecast is unchanged. LV sales are expected to expand by 8% to an all-time high of 4.7 million units this year and by 3% to 4.9 million units in 2024. Sales in H1 2024 are expected to be boosted by government spending ahead of the general elections in April and May.