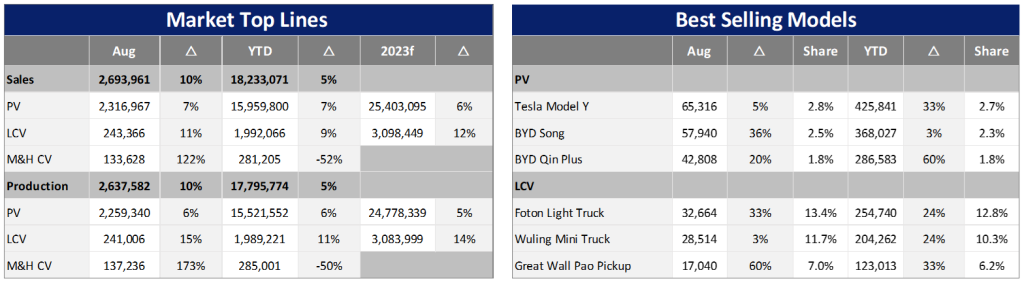

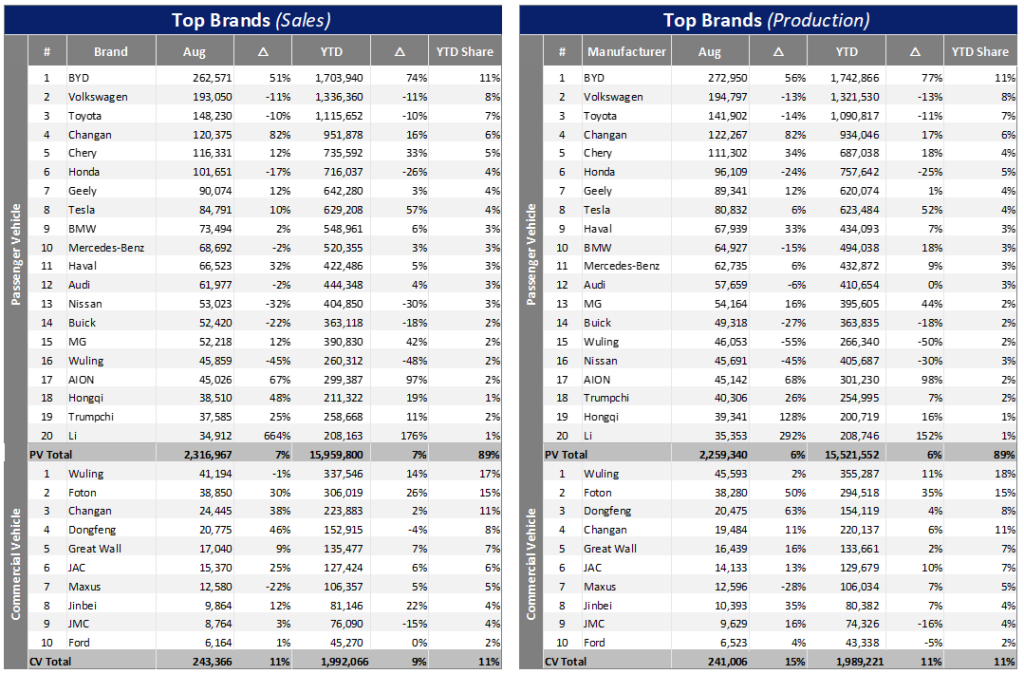

The Chinese market continued to surprise on the upside in August. Light Vehicle (LV) wholesales came to 2.56 million units with growth of 7% YoY. At a component level, total PV wholesale volume reached 2.32 million units with growth of 7% in the month. At the same time, the Light Commercial Vehicle (LCV ) sector recovered well, increasing by 11% year-on-year (YoY) to a total of 243k units. On a month-on-month (MoM) basis, PV sales increased by 8%, and LCV sales also increased by 5% in August.

Since the beginning of this year, cumulative LV wholesales have reached 17.95million units, an increase of 7%. On the production side, the total LV build in August was 2.50 million units, increasing by 7% YoY. At the vehicle type level, PV output (89% of total LV production) was 2.26 million units in August, which was 58k less than the wholesale volume. PV output in August was up by 6% YoY and increasing by 6% YTD.

LCV output was 241k units in August, up 15% YoY and increasing by 11% YTD. YTD (to August) LV production volume came to 17.51 million units, increasing by 7%. With the recent intensive introduction of a series of macro-control policies and measures, enterprises’ confidence in market development has been further enhanced, production demand has recovered synchronously, and major car companies are also constantly launching new products, which will help further release market demand. Hence, we believe that in the next few years, China’s automobile industry will achieve steady growth driven by the growth of exports and new energy vehicles (NEVs).

Recently, the Chinese government introduced a number of measures aimed at promoting automobile consumption and stabilising growth in the industry. Seven departments including the Ministry of Industry and Information Technology jointly issued the “Work Plan for the steady growth of the automobile industry (2023-2024)”, which proposed that in 2023, China’s automobile industry will maintain a stable and good development trend and strive to achieve annual car sales of 27 million, an increase of about 3%. In 2024, the operation of the automotive industry will remain within a reasonable range, and the quality and efficiency of industrial development will be further improved.

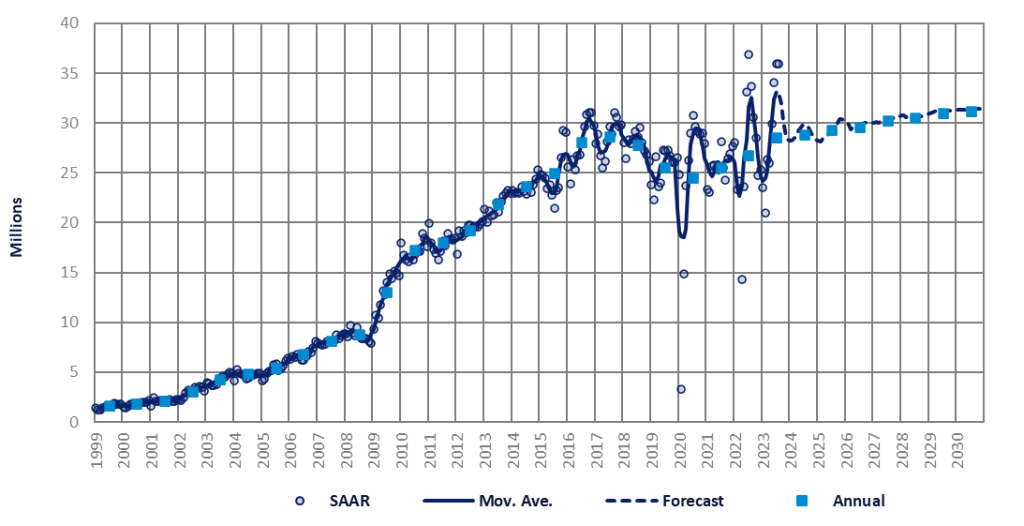

The August selling rate reached 35.9 million units/year, unchanged from July (which was a record high). The YTD selling rate averaged 29 million units/year, compared to last year’s total LV sales of 26.7 million units. In YoY terms, sales increased by 6.9% in August (despite a high year-ago base) and 7.1% YTD. The selling rate in the three months from June to August averaged an exceptionally strong 35 million units/year. Driving such an outstanding market performance are strong exports and robust domestic sales.

Driven by increased exports to Russia and by strong global demand for NEVs from China, exports of PVs expanded by 36% YoY in August (and 73% YTD). In contrast, domestic PV sales grew only 2.6% in August (0% YTD), but this was due to a high base caused by exceptionally strong sales after the COVID-19 outbreak containment from June to August last year, resulting in relatively modest YoY growth this year.

After a weak start to the year, domestic sales have been gradually improving. In the next few months, the effects of various policies continuing to emerge, coupled with the automotive market being about to enter the peak sales season and major OEMs continuously launching new products, will help to further release market demand. We remain optimistic about the performance of the market and expect it to continue to achieve positive growth.

The ongoing price war is adversely affecting OEM margins, but it does result in attracting more consumers. As competition among automakers intensifies, especially in the electric vehicle market, increasingly affordable and attractive models are available. The Chinese government’s extension of the temporary purchase tax exemption policy for new energy vehicles until the end of 2027 has also played a great role in promoting the growth of NEVs.

As such, we have raised the sales forecast by 745k units for 2023, by over 1 million units/year for 2024 and 2025, and by about 640k units for 2026. However, it should be noted that near-term downside risks exist, mainly from the liquidity crisis in the real estate sector (said to directly and indirectly account for 25% of GDP), declining exports, and high youth unemployment.

On the other hand, we have lowered our sales forecast for 2028 by 500k units, 2029 by 800k units, and 2030 and beyond by 1 million units per year, as the step decline of the temporary purchase tax reduction for NEVs in 2025 and 2027 will directly affect overall sales. The faster-than-expected ageing of the population is another factor in lowering the long-term forecast. The UN forecasts that by 2035, people aged 65 and over will account for 21% of China’s population, more than a percentage point higher than previous forecasts.

At present, the China automobile market is in a stage of rapid development. With the continuous progress of science and technology and the improvement of environmental protection requirements, the automobile industry is facing unprecedented challenges and opportunities. The positioning of the Chinese market for automobiles is changing from mechanical systems to durable consumer electronics, which may make the use cycle of automobiles greatly shorter, and given the huge population base, there is room for further improvement in China’s car ownership levels in the future.