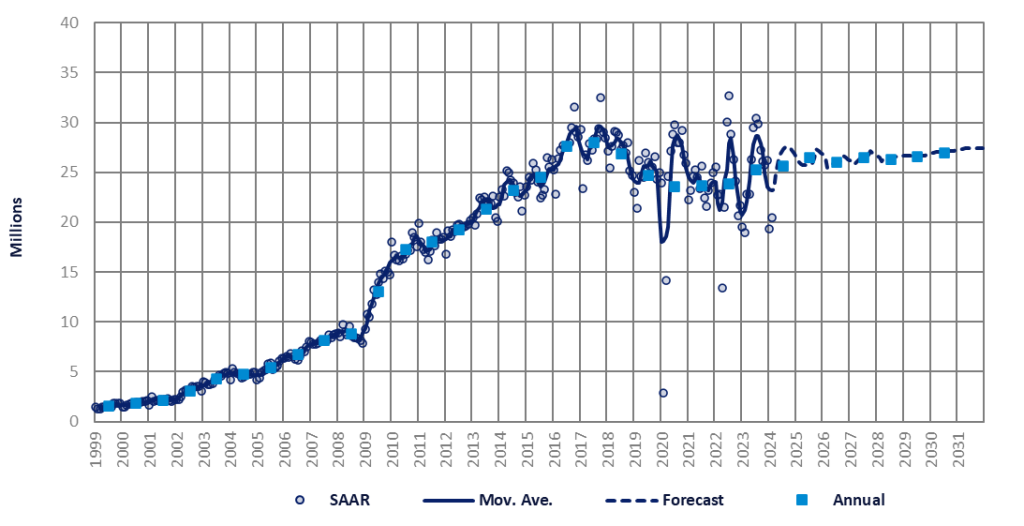

China’s auto market improved slightly in February. The selling rate in February was 20.5 million units/year, an increase of only 5.9% from the sluggish January. The year-to-date (YTD) average selling rate is 19.9 million units/year, well below last year’s total LV sales of 25.2 million units.

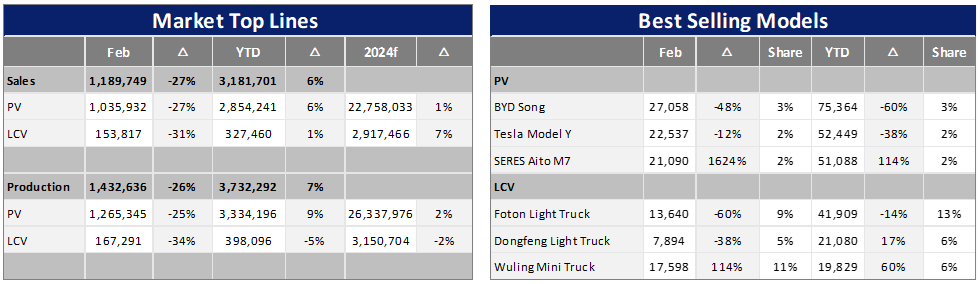

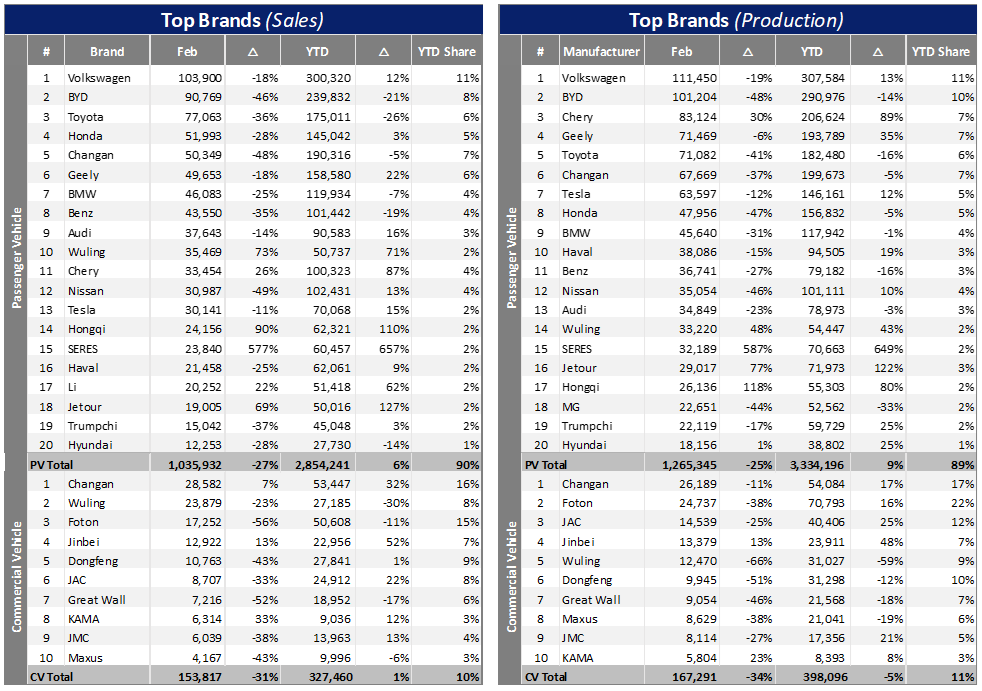

Total Light Vehicle (LV) domestic sales (i.e. wholesales excluding exports) reached 1.2 million units in the month, decreasing by 27.5% year-on-year (YoY) and dropping by 40.3% month-on-month (MoM).

At the vehicle type level, Passenger Vehicle (PV) sales for February decreased by 26.9% YoY to 1.0 million units. At the same time, commercial vehicles (CV) dropped to 153k units decreasing by 31.4% YoY in February. In terms of the MoM growth rate, PV decreased by 43.0%, and CV fell by 11.4% over the same time. Domestic sales (i.e. wholesale, excluding exports) improved slightly in February after a weak start to the year.

The important reason for the sharp MoM and YoY declines in February is that the Spring Festival holiday resulted in fewer sales days, and some car companies pulled forward sales from early 2024 into 2023 to hit annual sales targets. In addition, the price war after the Spring Festival heated up rapidly, forming a considerable wait-and-see trend, and this combined with the anticipated release of a new favourable policy in March, resulted in an adverse February sales trend.

In terms of production, total LV production in February was 1.4 million units, a decrease of 26.3% YoY and 37.7% MoM. The YTD volume in 2024 is 3.7 million units, with a slight growth of 7.1%. At a vehicle type level, PV production (accounting for 90% of total LV production) in February was 1.3 million units, a YoY increase of 25.1%. CV production in February was 167k units, a significant decrease of 34.3% YoY.

In February, Chinese PV exports reached 311k units, a YoY growth rate of 17% and accounted for 24% of total PV production. It is worth noting that the proportion of exports in total production has increased from an average of 15% last year to 24% in February. This shows that the impact of exports on overall production has increased further. With the scale advantage of China’s new energy vehicles and market expansion needs, more and more Chinese-made new energy brands are going abroad, and their recognition overseas continues to increase. Although there has been some resistance from Europe recently, in the long term, the new energy export market still looks good, and the future is bright. At present, the huge overseas market potential has prompted more and more Chinese car companies to seek to build factories overseas to further reduce costs. Even so, based on conservative estimates of current trends, China’s annual export volume of light vehicles will exceed five million units in the next 2-3 years.

After a small adjustment in January, a new round of the price war started immediately after the Spring Festival in February. On February 19, BYD took the lead in launching the slogan “Electricity is cheaper than oil” and simultaneously launched two cut-price models of plug-in hybrid cars, which have a pure electric range of 55 km, but a price of only CNY79.8k (US$11K). It is foreseeable that more and more car companies will join this fierce price war. Of course, this will also accelerate the elimination of some weak brands.

The State Council recently issued the “Action Plan for Promoting Large-Scale Equipment Renewal and Trade-in of Consumer Goods.” The plan aims to expand domestic demand and encourage local governments to introduce policies and financial support for the trade-in of consumer goods, including cars. Shanghai launched a trade-in cash subsidy program in January 2024 (valid until 31 December 2024). A subsidy of CNY2,800 (approximately US$390) is provided for replacing an old car with an ICE model, and a subsidy of CNY10k (approximately US$1,385) is provided for BEV models. Other local governments are expected to follow suit, but the subsidy amount and other details may vary based on the financial situation of each city or province. The subsidy program could help boost sales in the coming months.

For LCVs, too, replacement demand will be a key for growth this year. Late last year, the State Council issued the “Action Plan for Continuous Improvement of Air Quality,” which is expected to help scrap old CVs and replace them with NEVs. In particular, the government is aiming to eliminate old diesel CVs of the State III and State IV emission standards. The State III emission standard was introduced ten years ago (in 2014) and CVs are generally scrapped after 15 years. That means that replacement demand will continue to increase in the coming years. Currently, the ratio of NEVs in the domestic LCV market is estimated to be 9%, compared to one-third in the PV sector.

In the short term, although sales in February were weaker than expected, we decided not to make major changes to the 2024 sales forecast, only slightly lowering it by 98k units, because sales at the beginning of the year are always unstable. In addition, as just mentioned, the government has announced some policy measures to promote sales. Therefore, we expect sales to pick up in the coming months, and the growth rate of domestic sales this year is expected to remain around 1.7%.