The auto industry in the UK has criticised a new planned UK annual tax that will apply to electric vehicles and plug-in hybrids used on UK roads from 2028.

The new annual tax is designed to address falling petrol and diesel fuel tax revenues as electrified vehicles take a bigger share of the UK’s car market (pure petrol and diesel engine models are still planned by the government to end UK sales in 2030).

In the Autumn Budget yesterday (26 November) it was announced that there would be a 3 pence per mile charge for electric car drivers and 1.5 pence per mile for plug-in hybrid drivers. The new tax would apply from 2028, but the details on how it is measured and enforced have yet to be established. The new tax appears to be needed to fill the tax raising gap caused by rising electrification and lower petrol/diesel fuel duty revenues. In Britain, petrol and diesel fuel is subject to 52.95 pence duty – almost 40% of the typical pump price for a litre of petrol. By its nature, the existing fuel duty tax is levied according to the motorist’s mileage, but analysts note that the annual tax revenue raised – around GBP25bn - is way above what is spent on the UK’s roads.

The UK’s Society of Motor Manufacturers and Traders (SMMT) has said that singling out electric cars for a new pay per mile tax would ‘suppress demand, discouraging consumers and making ever-tougher sales targets even more costly and challenging to achieve’.

On an average car mileage of around 7,000 miles per annum, the new EV duty would amount to an annual charge of GBP210.

In its response to the Budget Statement, the SMMT said introducing a new electric-Vehicle Excise Duty is the ‘wrong measure at the wrong time’.

"Manufacturers have invested to bring more than 150 EV models to market. However, the pressure to deliver the world’s most ambitious zero emission vehicle sales targets – whilst maintaining industry viability – is intense. With even the OBR warning this new tax will undermine demand, government must work with industry to reduce the cost of compliance and protect the UK’s investment appeal.”

Mike Hawes, SMMT Chief Executive, said: "Manufacturers have invested to bring more than 150 EV models to market. However, the pressure to deliver the world’s most ambitious zero emission vehicle sales targets – whilst maintaining industry viability – is intense. With even the OBR warning this new tax will undermine demand, government must work with industry to reduce the cost of compliance and protect the UK’s investment appeal.”

Nevertheless, the SMMT also said the UK government has recognised the automotive industry as a pillar of national strategic importance, backing it with an industrial strategy and additional £1.5 billion to drive competitiveness and investment.

“Deferring the end of employee car ownership schemes into the next parliament, meanwhile, will be welcomed by workers across the sector,” Hawes noted.

He also said: "Changes to the VED expensive car supplement are welcome, as is the additional £1.3 billion funding for the Electric Car Grant and support for charging infrastructure.”

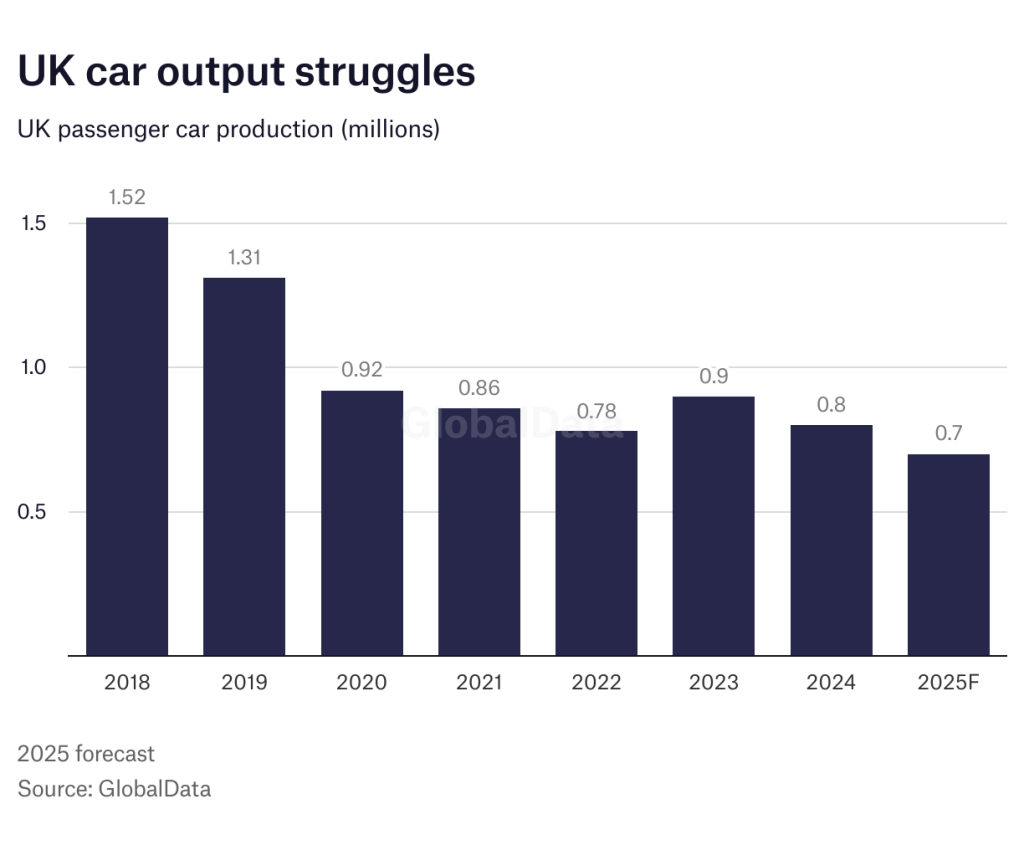

The SMMT has said it wants the UK government to create the conditions needed to restore the sector to a 1.3 million vehicle manufacturing hub by 2035.

According to GlobalData, UK passenger car output this year is forecast at around 700,000 units and has declined from an annual 1.5 million units as recently as 2018.