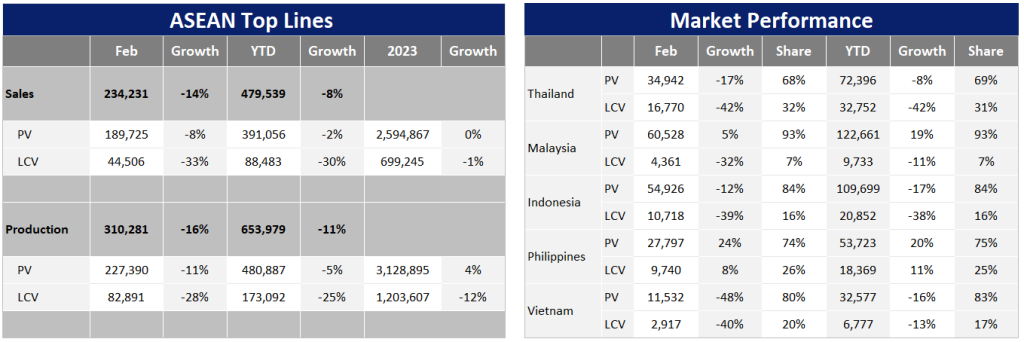

The ASEAN Light Vehicle (LV) market has witnessed a notable 8% year-on-year (YoY) decline in the first two months of 2024, with a marginal 2% fall in January and a significant 14% drop in February.

This downturn is largely due to poor sales performances in Vietnam, Thailand, and Indonesia, while Malaysia and the Philippines have shown mixed results.

Vietnam

In Vietnam, LV sales had surged by 29% YoY in January but nearly halved from the previous year in February. This fluctuation can be attributed to the Tet (Lunar New Year) festival, which typically impacts LV sales. In this case, the Tet festival occurred in January 2023 and February 2024. Consequently, Vietnam’s sales in January-February 2024 fell by 15% YoY.

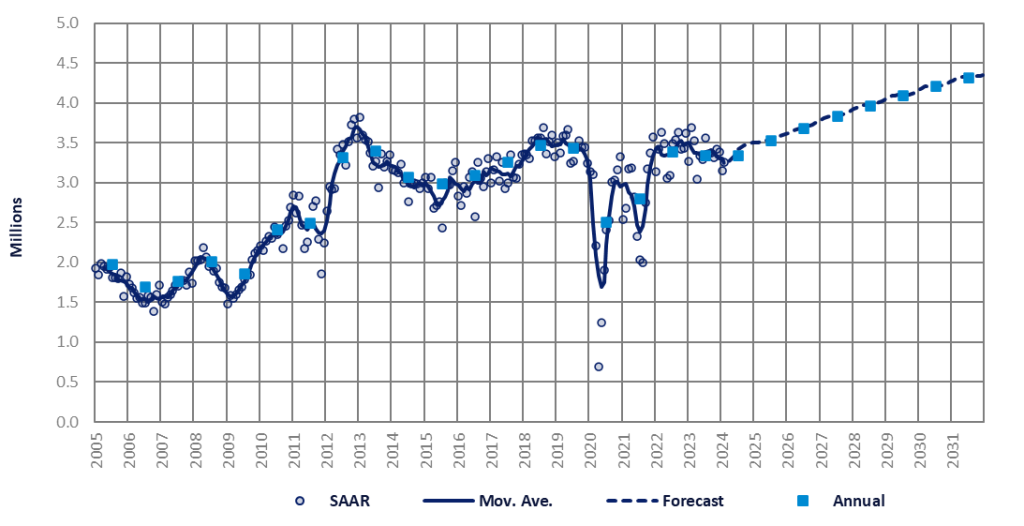

Looking ahead, we have lowered Vietnam’s 2024-2027 LV projections by an average of 2% per year compared to our previous report. This adjustment is based on weaker-than-expected February sales and concerns about the ongoing property crisis and an uncertain global economic outlook. We now forecast Vietnam’s 2024 LV sales at 396k units.

Thailand

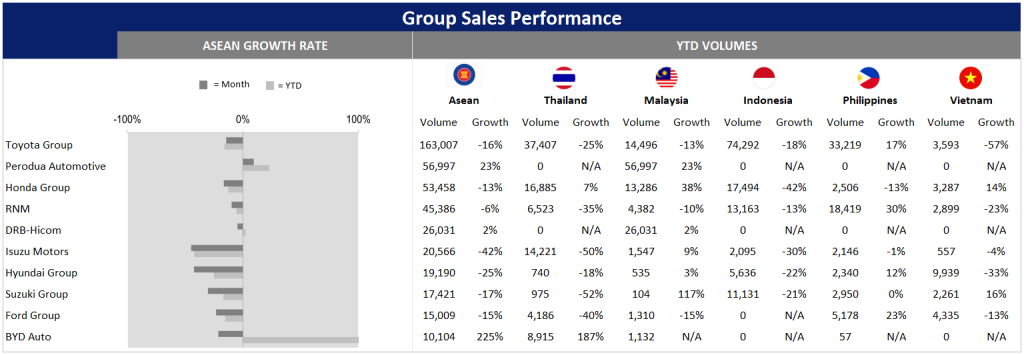

Thailand’s LV market saw a 27% YoY drop in February. This decline affected both the Passenger Vehicle (PV) segment, down by 17% YoY, and the Light Commercial Vehicle (LCV) segment, which experienced a decrease of 42% YoY. Notably, Thailand’s PV sales had risen by 12% YoY in 2023 and 2% YoY in January, driven by the government’s Battery Electric Vehicles (BEV) purchasing cash subsidy program. However, BEV sales began to weaken in February, with their share of total PV sales falling from 36% in January to only 10% in February, as the government slashed the BEV subsidy from THB 150,000 (starting from Q4 2022) to THB 100,000 in February.

Furthermore, preliminary data for March suggest that Thailand’s LV sales decreased by 29% YoY for the month. Consequently, sales are estimated to have contracted by 25% YoY in Q1 2024. The poor sales in Q1 2024, along with negative economic indicators such as high household debt, tightened vehicle loan approvals, and increasing cases of repossessed vehicles, have led us to lower our near-term outlook for Thailand. We now foresee sales declining by 3% YoY to 733k, with the risk still skewed to the downside.

Indonesia

In Indonesia, LV sales fell for the eight consecutive month in February, down by 18% YoY. The cumulative sales in the first two months of the year thus fell by 21% YoY. This lackluster sales performance can be attributed to consumers and businesses delaying purchases ahead of the presidential elections held on February 14. We anticipate that sales will continue to decline in March and April, as demand for LVs is expected to be impacted by the Ramadan and Eid al-Fitr periods.

Considering the weaker-than-expected February sales, we have made minor downward adjustments to our forecast. We now predict Indonesia’s LV sales to increase by only 2% YoY to 948k units in 2024, which is the same level as 2019 sales. However, the forecast presents a downside risk owing to the bleak economic outlook, which is influenced by the deceleration in China’s economy and escalating geopolitical tensions. Additionally, more stringent vehicle loan approvals by financial institutions are expected to dampen LV sales.

In contrast, LV sales Malaysia and the Philippines saw positive results in February. Following a hike of 35% YoY in January, Malaysia’s February sales improved by a mere 1% YoY. Additionally, LV sales in March are estimated to have declined by 13% YoY, according to a press release from Proton. This trend could indicate that the large volume of backlogged orders, which was the main growth driver in 2023, is nearly fulfilled.

Malaysia

Our outlook for Malaysia remains unchanged, with LV sales in 2024 forecasted to drop by 4% YoY to 765k units. This negative sales outlook is influenced by several factors, including the temporary tax cut that pulled demand ahead, the clearing of the large volume of backlogged orders in H1 2024, and the government’s plan to raise the high-value goods tax (HVGT) from May 1, 2024.

Philippines

In the Philippines, the LV market continued to grow, rising by 19% YoY in February. This pushed the year-to-date (YTD) sales to a 17% YoY increase, thanks to pent-up demand, the removal of supply constraints, and the entry of Chinese carmakers offering vehicles at affordable prices.

Despite the strong sales from January to February, we assume sales in the Philippines to increase slightly by 3% YoY to 451k units in 2024. Our outlook considers several negative indicators such as the lagged impact of high interest rates on consumer spending, weakened consumer confidence in Q4 2023 due to high borrowing rates and a weak Philippine peso, and the increasingly uncertain global economic outlook posing risks to the Philippines’ exports and remittance inflows.

As a result of the downward adjustments for Vietnam, Thailand, and Indonesia, the projected LV sales for ASEAN in 2024 have been lowered. We now foresee regional LV sales in 2024 to remain virtually flat at 3.29 million units, which is a 2% lower than our previous forecast.