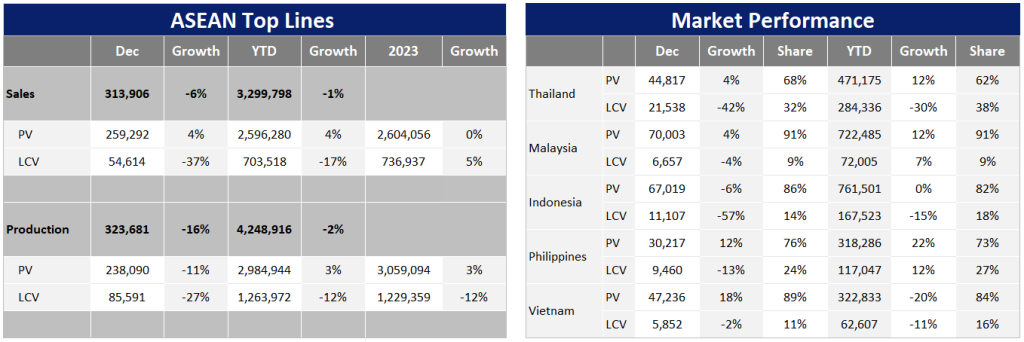

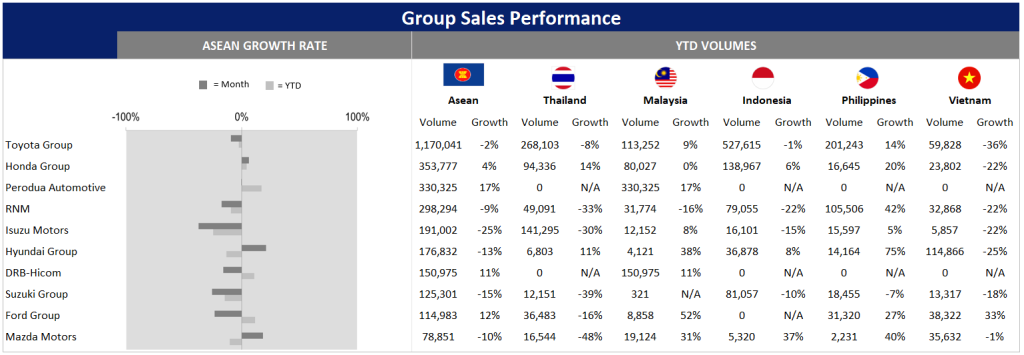

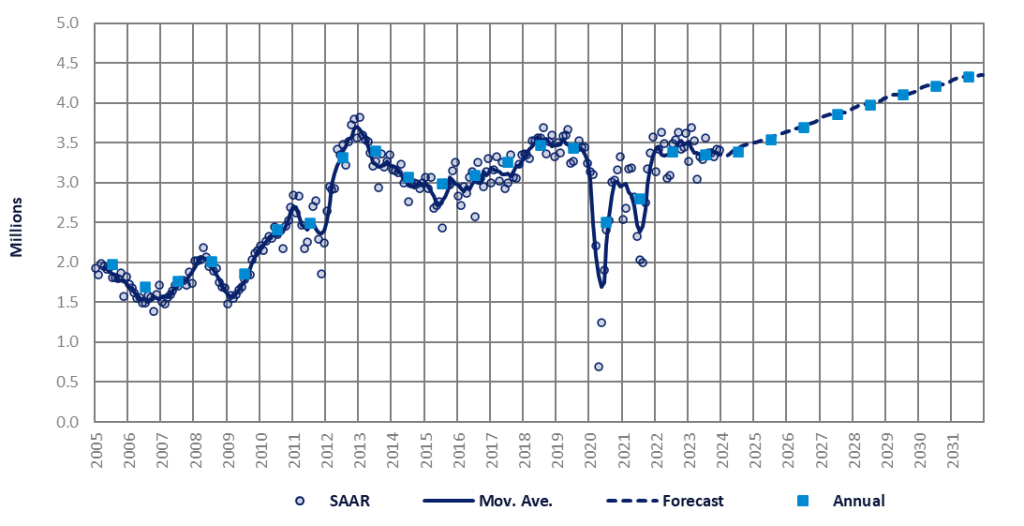

Even if ASEAN Light Vehicle (LV) sales started 2023 with positive sales growth in Q1 2023 (+3% YoY), the full-year sales number dropped 1% YoY in 2023 due to the negative sales results during the rest of the year; Q2 (-1% YoY), Q3 (-3% YoY) and Q4 (-3% YoY).

Malaysia

Looking at the details by country, Malaysia’s LV sales surged a strong 12% YoY to a record high of 794k units in 2023, driven by: 1) carmakers’ strategy to absorb the temporary tax cut measurement, which ended fully in March 2023; 2) the large backlog of orders; and 3) the recovery of the auto component shortage. Referring to Proton Holdings’ (Proton) press release, the company estimated January 2024 sales to be 66k units (+30% YoY). However, we still expected 2024 sales will decline to 750k units since 1) demand was pulled ahead by the temporary tax cut; 2) the large volume of backlogged orders should be cleared early in 2024; 3) the government plans to raise the high-value goods tax (HVGT) from 1 May 2024, which will have an impact on premium vehicle sales – although luxury brands currently account for only about 4% of total LV sales in Malaysia. Moreover, the government also plans to increase the service tax rate to 8% from the current 6% from 1 March 2024, which will increase labor charges for vehicle servicing.

Philippines

For the Philippines, LV sales fell to 243k units in 2020 at the height of the pandemic. Then, demand continued to recover strongly and returned to exceed the pre-pandemic level (407k units in 2019 vs 435k units in 2023). Looking closely, LV sales averaged only 332k units per year between 2020 and 2023. That suggests that pent-up demand has yet to be fully satisfied or some sales were permanently lost due to the pandemic. However, we have found that the growth rate began to decelerate from 25% YoY in H1 2023 to 15% YoY in H2 2023. As such, we expect 2024 sales to be virtually flat at 437k units due to the rise of negative indicators, such as: 1) The lagged impact of high interest rates is expected to hit consumer spending this year. The central bank has raised its policy rate to 6.5% (the highest since 2007) to contain inflation and the peso’s (PHP) fall. 2) Consumer confidence (including the sub-index of “Good time to buy motor vehicles”) weakened markedly in Q4 2023 in the face of high borrowing rates, the weak PHP, and the higher cost of living. 3) The global economic outlook is increasingly uncertain, presenting a risk to the Philippines’ exports and remittance inflows.

In contrast, the 2023 sales of Indonesia, Thailand and Vietnam registered in negative territory. Indonesia LV sales dropped 3% YoY in 2023 as H2 2023 sales plunged 11% YoY, which was surplus to the growth achieved in H1 2023 (+6% YoY). The poor sales in H2 2023 was due to 1) the temporary tax cut in 2021-2022 pulling sales ahead; 2) the pent-up demand and backlogged orders (after the pandemic and the component shortages) were fulfilled; 3) high inflation, rising interest rates and the weak rupiah (IDR) undermined consumers’ purchasing power; 4) the economy was slowing, dragged down by marked deceleration of goods exports; and finally, 5) political uncertainty ahead of the presidential election on 14 February 2024 appeared to give pause to businesses’ investment plans, including the purchases of LCVs. Based on the most recent information, Indonesia LV sales plunged 26% YoY in January 2024 as the slowing economy hurt demand and consumers applied a wait-and-see approach ahead of the election result in February 2024. Due to the timing of information, our forecast (960k units in 2024) does not reflect this background.

Thailand

Thailand 2023 LV sales plunged 9% YoY to 756k units. Looking at each segment, the demand for Passenger Vehicle (PV) sales remained robust throughout 2023, rising 12% YoY from 2022 to 471k units. Light Commercial Vehicle (LCV) sales in 2023 declined 30% YoY to 284k units due to the lack of demand for Pickup trucks. Our preliminary data shows that the Thai market fell 16% YoY in January 2024. However, BEV sales jumped from 9k units in December 2023 to 14k units in January 2024, as consumers rushed to buy BEVs before the end of government’s BEV subsidies under the EV 3.0 package on 31 January 2024. We note that subsidies for the purchase of electric cars under the EV 3.5 scheme took effect in 2024 but the latter scheme offers fewer benefits than the EV 3.0 measures. For 2024 outlook, Thailand LV sales were expected to increase slightly to 785k units, but with downside risk from the kingdom’s high household debt and tightened auto loan terms.

Vietnam

Vietnam LV sales dropped 18% YoY to 385k in 2023 due to the opaque economic situation and the pull affect from the registration fee cut on locally produced models (June to December 2020 and November to May 2022). However, the government re-introduced this policy, which ran from July to December 2023, and as such it was able to partially help the industry. LV sales results improved from a 30% YoY decline in H1 2023 to a 6% YoY decline in H2 2023. We project Vietnam LV sales to increase 6% YoY to 409k units in 2024 since the central bank (State Bank of Vietnam) has already started to cut its policy rate and the economy is poised to accelerate along with a rebound in the export and tourism sectors.

In summary, ASEAN 2024 LV sales were forecasted to marginally increase 1% YoY to 3.34 million units, with a lower sales outlook for the Malaysia market.