GlobalData’s AI report unpacks the market, key trends and how it serves as a force of creative destruction. As artificial intelligence (AI) grows increasinlgy ubiquitous, there’s no question that it is disrupting a myriad of industries. According to forecasts from GlobalData, the total AI market will be worth $1trn by 2030, with it having grown at a compound annual rate of 39% from $103bn in 2023. GlobalData’s recently published AI report unpacks how the technology is affecting businesses and what challenges the industry must navigate. Of the AI market in 2024, Josep Bori, research director for thematic intelligence at GlobalData and author of the report, told Verdict: “From an adoption perspective, we think the early excitement will taper off and companies will focus on the return on investment of using AI technologies, with particular consideration of risks around rapidly evolving AI regulation, the carbon footprint of the large AI models, as well the explainability of the outputs.”

El cheapo EVs

In an exclusive guest opinion piece for Just Auto, Albert Trullàs, Product Engineering Director of eMobility at Spanish automotive components firm Ficosa, considered the industry’s race for lower priced electric cars. "lectrification of mobility is one of the cornerstones in the fight against climate change. The transition to electric vehicles (EVs) represents an unprecedented opportunity to decrease dependence on fossil fuels and reduce greenhouse gas emissions. However, the democratisation of EVs faces a significant obstacle: the price. According to market research company JATO Dynamics, the average price of an electric vehicle in Europe is around €60,000. This figure, still far from that of combustion vehicles, undoubtedly hampers the mass adoption of these vehicles. For this reason, the automotive industry in the old continent has been immersed in its particular race, especially since the pandemic, to offer the market a 100% electric vehicle that is profitable to produce, offers good autonomy, and has a more accessible selling price. There is a certain consensus that the price point of €25,000 is considered the ‘sweet spot’ for achieving the democratization of electric mobility. The goal seems clear. However, the arrival of this “popular” electric vehicle, manufactured in Europe, with a price of less than €25,000, does not appear to be as rapid as expected. What is causing this situation? What is holding back the industry? What are the challenges (and opportunities) that European manufacturers face in achieving this milestone?

Future GMC, Chevy

GMC has Hummer and Chevrolet has (a few) cars but otherwise these brands share almost everything including most future models. Once boasting an array of models approaching the level of Toyota, Chevrolet has over the years become ever smaller and now consists mainly of light trucks. The Corvette is one of a few exceptions to that rule, while another car, the Malibu, will soon be discontinued. Which means that next year, the ’vette will be the sole Chevy car available in the US and Canada.

In data: India

According to figures released by GlobalData, the Indian vehicle market continued to perform strongly, with the May selling rate inching up by 2% from the previous month, to 4.9 million units/year. Total Light Vehicle (LV) wholesales in May stood at 397k units, which was up by 3% month-on-month (MoM) and by 4% year-on-year (YoY), despite high sales in 2023. Passenger Vehicles (PVs) accounted for 342k units (+4% MoM, +5% YoY), while Light Commercial Vehicles (LCVs) with gross vehicle weight (GVW) of up to 6T comprised 55k units (-5% MoM, -2% YoY). Some consumers and businesses remained cautious and postponed vehicle purchases during the six-week general elections that ended in early June. In addition, showroom traffic slowed due to the extreme heatwaves experienced across the country. On the other hand, demand for SUVs, including growth in rural areas, continued to drive sales and helped to offset lower demand for small and entry-level cars. In May, retail sales of PVs and LCVs slumped to 349k units compared to 382k units in April and 372k units in March, according to data from the Federation of Automobile Dealers Associations (FADA).

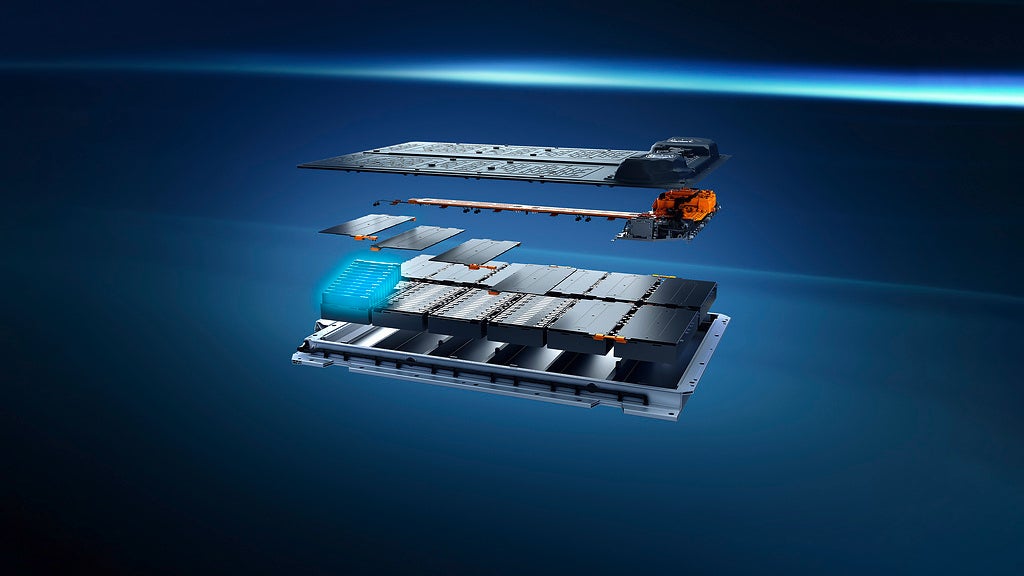

Spanish batteries

Japan based electric vehicle (EV) battery manufacturer AESC Group has begun construction of a new, full scale battery plant in Navalmoral de la Mata in Spain’s Caceres province. AESC, majority-owned by China’s Envision Energy, said it would invest US$1.1bn in the first phase of construction of the plant which was scheduled to be become operational in 2026 with a production capacity of 30GWh of EV batteries per year. It was expected to be Europe’s first mass production facility for lithium iron phosphate (LFP) batteries, a lower cost alternative to the lithium ion batteries widely used today. The groundbreaking ceremony was attended by AESC’s newly appointed CEO for the US and Europe Knudt Flor, Spanish prime minister Pedro Sanchez and the mayor of Navalmoral de la Mata Enrique Hueso. AESC said the new factory would provide competitively priced, high quality, long cruising range batteries, without disclosing which vehicle manufacturers it would supply. The company had long term deals with automakers including Renault, Nissan, Daimler and Honda.

Tesla delays robotaxi

Telsa is delaying the launch of its robotaxi to October, news agencies reported this week. CEO Elon Musk initially set the date in August, which has now been pushed back as the design team was told to rework some elements of the car, Bloomberg said, citing people familiar with the decision. News of the delay was communicated internally, reports said. Earlier this year Tesla ostensibly cancelled its small car Model 2 project, a new entry level car. Instead it said it would continue developing robotaxis on the small vehicle platform, according to Reuters.

Takata again

BMW was recalling 394,000 vehicles in the United States due to faulty airbag inflators which could potentially cause serious or fatal injuries, the National Highway Traffic Safety Administration said on Wednesday. An air bag inflator could explode, sending potentially deadly sharp metal fragments flying and striking the driver or others in the vehicle, NHTSA told Reuters. According to BMW, the issue covers Takata air bag inflators that had been previously recalled but the vehicles could have had a replacement steering wheel installed with a defective air bag. Owners would take vehicles to dealers for inspections, and if a steering wheel with a recalled airbag is found it will be replaced. BMW said it was unaware of any crashes or injuries tied to the new recall.

Russia payment problem

US sanctions have affected payments between Russia and China over vehicle sales, according to Alexei Podshchekoldin, the head of the Association of Russian Automobile Dealers. Imports of Chinese cars into Russia have been impacted, with the issue posing a more serious problem for smaller vehicle importers, who have seen payments bounce, Reuters reported. The two countries have had to resort to “complex steps” to try to avoid payment delays, including using small regional Chinese banks.

BlueOval on track

BlueOval Battery Park Michigan remains on track to begin production of lithium iron phosphate (LFP) batteries in 2026 for Ford’s future electric vehicles, the automaker said. Ford received a revised incentive offer from the Michigan Economic Development Corporation’s Michigan Strategic Fund for BlueOval Battery Park Michigan in Marshall, Michigan, to match the reduced scope of the project announced last November. The agency also revised its incentive offer for another job-creation and investment initiative spanning several Ford facilities in Michigan.

Toyota Ionna

Toyota said it would participate in the North American electric vehicle (EV) charging partnership Ionna, joining seven other automakers as an investor and founding partner of the company. Ionna aims to build a network of at least 30,000 DC fast charging stations compatible with both NACS and CCS charge ports in Canada and the US by 2030, with the first to be installed in the second half of 2024. The charging network, which would be backed also by BMW, GM, Honda, Hyundai, Kia, Mercedes-Benz and Stellantis, was expected to lift the prospects for EV sales in the two countries.

Porsche China plunge

Porsche first half 2024 sales fell 7% year on year to 155,945 vehicles but plunged by a third in China. China sales were off 33% to 29,551 vehicles with the automaker explaining: “The main reasons for this still are the ongoing tense economic situation in the Chinese market and the focus on value oriented sales.” Porsche also said it was currently updating five of its six model series which could “temporarily lead to gaps in the range in individual markets and model series”.

EV plant threat

VW Group has warned that capacity under-utilisation means that it is considering the future of its EV-producing Audi Brussels plant. In a statement, VW said that due to the development of sale of the “Audi Q8 e-tron model family in certain markets”, it has decided to support an information and consultation process at the Brussels site as required by Belgian law. In this process, the statement added that the Board of Management of Audi Brussels S.A./N.V. is working together with the responsible social partners to develop solutions for the site. However, it said that at the end of this process, ‘the site may among other things be closed down.’

Honda closing Thai plant

Honda Motor said it would stop producing vehicles at its Ayutthaya plant in Thailand in 2025 and planned to consolidate output at its newest factory in Prachinburi province to capacity utilisation and efficiency. That followed similar decisions by other Japanese automakers this year, including Suzuki and Subaru, to cease vehicle production in the country while Kia Corporation earlier this year also decided to shelve plans to build a new plant. Japanese automakers are coming under increasing pressure from Chinese automakers in this south east Asia market, particularly from BYD which launched commercial production at a new 150,000 unit/year plant in Rayong province last week.

Have a nice weekend

Graeme Roberts, Deputy Editor, Just Auto