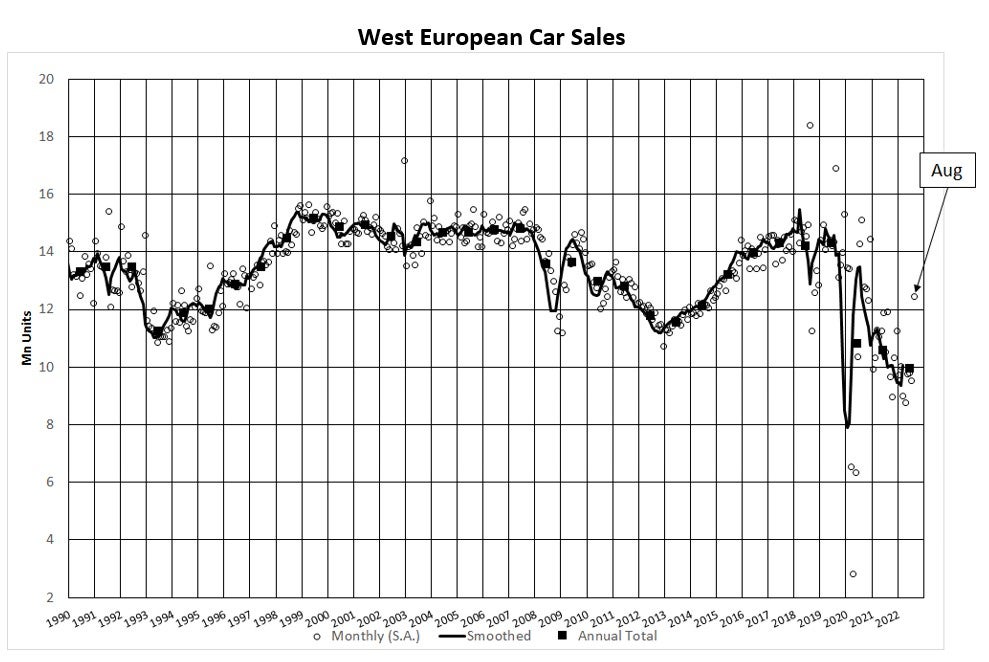

There were signs of some improvement to the car market in Western Europe in August as the underlying sales rate picked up according to data published by LMC Automotive, a GlobalData company.

The Western Europe selling rate improved to 12.4 mn units/year in August, from 9.5mn units/year in July. However, LMC said the uptick should not be over-emphasised as August is normally the weakest month for new vehicle registrations in the region.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The August uptick follows a 10% decline to Western Europe’s car market in July.

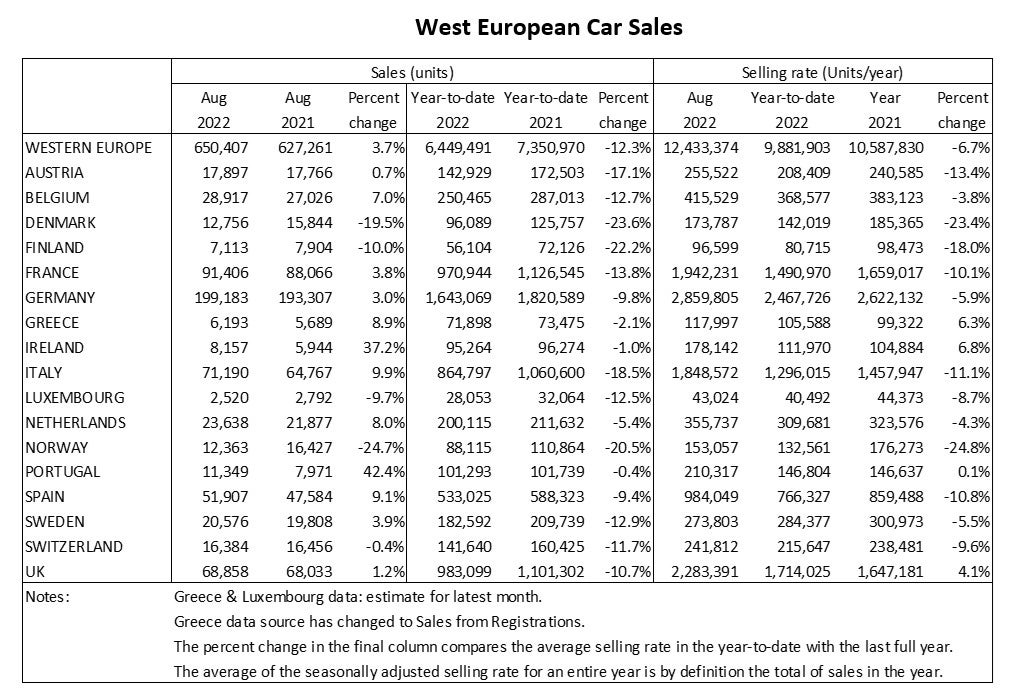

Overall, new car registrations for the month stood at 650k units, which despite being disappointing, is still a 3.7% improvement on the performance of August 2021. The year-to-date (YTD) selling rate of 9.9 mn units/year is down 6.7% from the overall 2021 result, which is consistent with a year fraught with ongoing supply-side issues.

In August, the German car market (passenger vehicle or PV) selling rate continued to climb, with the latest result of 2.9 mn units/year being higher than both June (2.3 mn units/year) and July (2.4 mn units/year). While this positive trend might be encouraging, the reality is that the industry and wider economic backdrop remains challenging, LMC stressed.

The UK selling rate of 2.3 mn units/year might look like a strong improvement over the 1.6mn units/year in July, but the PV market is still down 10.7% year-to-date (YTD) on what was an already weak base for comparison in 2021. In France, the PV selling rate picked up well in August, standing at 1.9 mn units/year compared with 1.4 mn units/year in July, though again this improvement is on a seasonally weak month with overall market volumes this year clearly struggling as production disruption pegs back registrations.

The Italian PV selling rate improved in August, climbing to 1.8 mn units/year from 1.4 mn units/year in July. However, the year-to-date (YTD) selling rate in Italy stands at 1.3 mn units/year and remains very weak by historical norms. As with the other major Western European countries, the Spanish PV selling rate picked up to 980k units/year which is a comfortable hike over the 760k units/year rate seen in July.

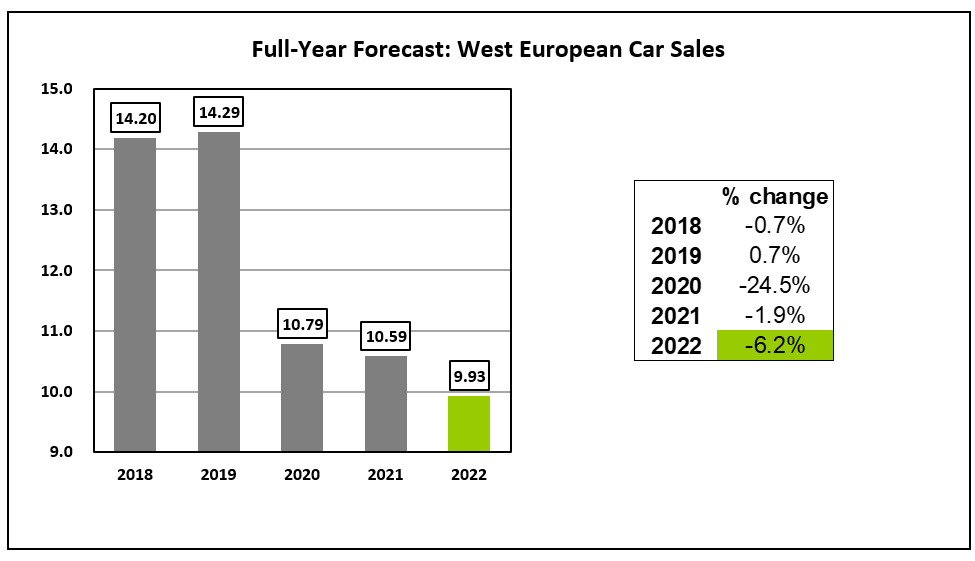

LMC’s full year forecast for West Europe’s car market in 2022 remains at 9.9 mn units which, being largely unchanged from July, signifies that the selling rate is expected to strengthen over the remaining months of the year.

However, analysts noted that market activity in the region is sure to be tempered by ongoing supply-side constraints. Meanwhile, demand-side factors remain a concern as living costs are stretched by the continuing rises in inflation and surging energy prices.

“It seems that just as the chips crisis supply-side constraints to sales start to ease, attention switches to demand-side concerns later this year and into next year,” said LMC analyst Jonathon Poskitt. “Challenging conditions for vehicle manufacturers and suppliers alike are set to be a part of the industrial landscape in automotive for a while yet. Besides the market squeeze caused by a looming economic downturn, they still face further supply-side pressures in the shape of rising costs for raw materials and energy.”