Volkswagen Group has reported first half operating profit of €3.5bn, down 8.2% on the same period last year.

It said a number of factors played a part in the decline, including higher personnel expenses compared with the same prior-year period due to collective agreement pay increases and provisions for termination agreements at Volkswagen AG. The company is currently in talks with IG Metall over pay, with the German labour union also opposing VW plans to reduce production capacity in Germany.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The company also said H1 costs were impacted by ramp-up costs for new models and supply chain constraints that could not be offset by volume growth.

Board member Thomas Schäfer said that despite all the cost-cutting measures already underway the company needs to reduce fixed costs still further in a ‘difficult market environment’.

Provisions for termination agreements at Volkswagen AG also affected earnings. “Without special items we would have achieved an operating margin of 6.0% for our Brand Group Core,” he said.

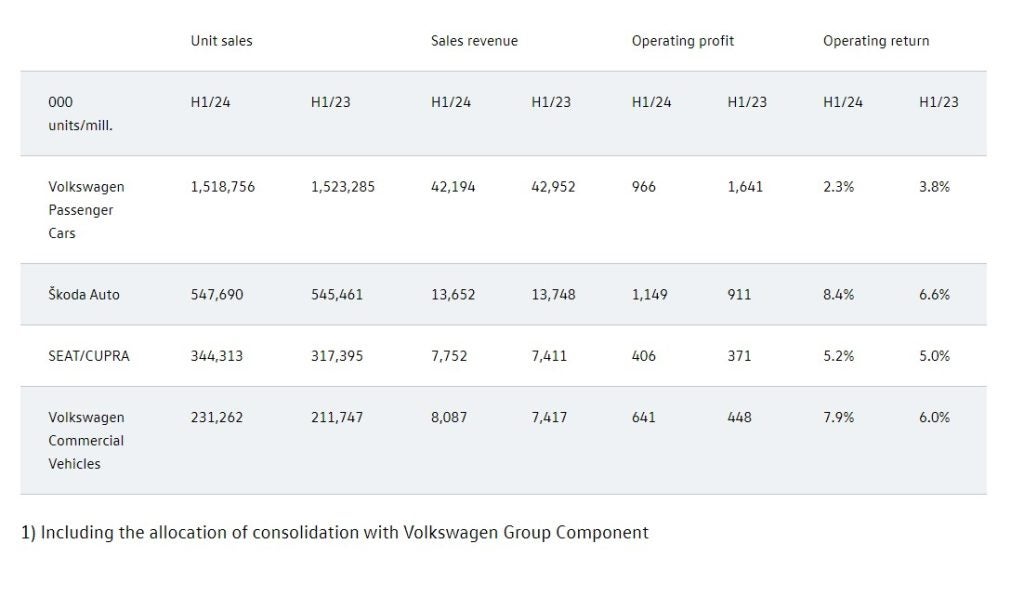

Unit sales in the first half of the year for core group brands (VW pass cars, Skoda Auto, SEAT/CUPRA and VW commercial vehicles) grew slightly to 2.49 million vehicles (2.45 million vehicles in H1 2023). Sales revenue was up just 0.4% to €69,051m.

VW passenger cars delivered 1.52m cars in the H1 period, down 0.3% on last year. SEAT/Cupra was up 8.5% to 344,313 units while Skoda Auto also managed a gain of 3.8% to 448,600 units. VW commercial vehicle sales were up 9% to 231,262 units.