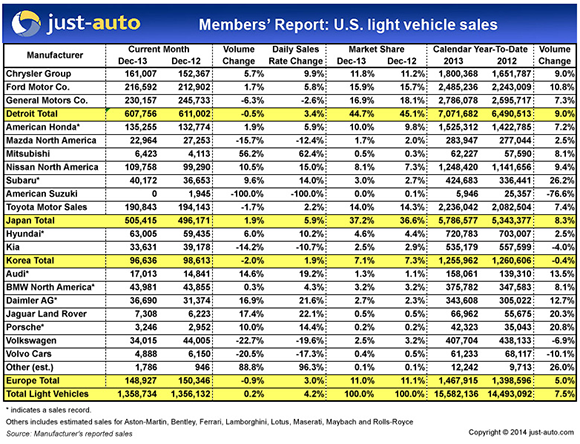

Winter storms, a strong November and one less selling day than in December 2012 combined to keep the lid on US light vehicle sales last month as year on year market growth was limited to 2,602 cars and trucks or barely 2%. The seasonally adjusted annualised sales rate (SAAR) came in at 15.4m: well below analyst expectations of 15.8-16m and just 160,000 deliveries ahead of 15.24m a year ago.

Total sales for the year were about 15.6m, in line with just-auto projections and 7.5% ahead of 2012’s total.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Ford was America’s favourite brand. The F-series pickup cruised to its 32nd year as America’s best selling vehicle and the Fusion finished the year as the top American badged car.

Despite generous incentives, all four General Motors brands came up short. Chevrolet took the biggest hit, down 8.1%, as slow pickup sales and discontinued models weighed on its results. The revamping of the Chevy Malibu seems to have worked; December sales rose 33.2%.

Chrysler notched a 45th month of year over year sales gains as the new Jeep Cherokee, Grand Cherokee and Ram pickup were able to offset weak car sales. Dodge Dart sales continue to be slow; Chrysler may have to do a mid cycle refresh.

While Detroit’s market share took a small hit in December, full year share was up 0.6 points to 45.4%.

The Japanese automakers also saw a year over year share increase of 0.3 points to 37.1%.

A 10.6% drop in Toyota car volume wiped out gains posted by Toyota brand trucks and Lexus models to leave the largest Japanese automaker in the red by -1.7%.

Honda set a new December sales record. The Accord was the best selling car in December but Toyota’s arch rival Camry was the best selling car for the year. Honda was nonetheless able to claim the best selling small car, best selling minivan and best-selling SUV/CUV titles.

Nissan posted a healthy increase in both December and full year sales as its car and truck lines produced double digit monthly advances.

The big news came from the second tier companies: Subaru set a new sales record and Mitsubishi reported its best December in seven years, finishing the year in the black thanks to the Outlander Sport and Mirage.

The Korean automakers lost the most share in December and in 2013 as continued weakness in Kia wiped out record results from Hyundai.

Shortfalls at Volkswagen and Volvo left the European automakers in the red for December. VW has fallen on hard times and needs new product.

Records were set by Audi, BMW, Mercedes Benz and Porsche. Land Rover set a new annual sales record as Jaguar Land Rover North America reported its best year since 2006.

Both BMW and Lexus outsold Mercedes in December but, thanks to the CLA, Mercedes was the top luxury brand in 2013.

The most significant growth was in the ultra premium segment where a huge December volume jump was driven almost entirely by a resurgent Maserati more than tripling its December 2012 sales. Bentley also finished the year with a hefty gain.

December’s results can be attributed to unusual weather or pull ahead sales in November but growth in 2013 was the slowest since 2009. This indicates that the forces driving the sales surge are dissipating. Pent-up demand has largely been satisfied and 2014 is likely to be more competitive, testing automakers’ determination to curtail expensive incentives, control production and avoid too easy credit.

It will take only modest growth to hit the 16m mark in 2014 but it may yet be a bit longer before the industry can return to the kind of numbers generated in the early years of the 21st century.