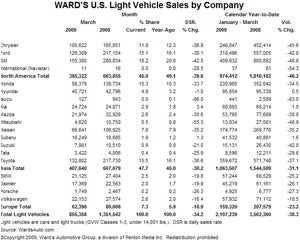

US total light vehicle sales (adjusted for selling days) may have been down 34.2% to 855,358, as calculated by WardsAuto.com, but that was nonetheless well up on February’s 687,356 and rather better than Edmunds.com’s (unadjusted) forecast of a 42.7% plunge to 774,000 units or JD Power’s 798,000 prediction.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

US business TV channels last night noted upticks in housing and consumer confidence and GM and Chrysler both said showroom traffic improved considerably in the last week, as the potential for bankruptcy at either rose.

Chrysler posted its highest sales total in six months, and GM’s sales were 23% higher than in February, according to the New York Times this morning. GM said it made more sales on Tuesday – after the Obama administration forced its chief executive to resign and set a 60-day deadline for the company to more aggressively restructure or go bankrupt – than on the last day of any month since September.

Ford said it increased retail market share in March to its highest level since December 2006, capping two consecutive quarters of gains and estimated its retail share performance from October 2008 through March 2009 was the strongest of any major manufacturer compared with the same period a year ago.

Combine that with the comment yesterday from European tier one supplier Faurecia’s CEO that automakers have stopped cutting sales and output forecasts, and maybe, just maybe, bottom has been reached, though Yann Delabriere cautioned the auto industry’s recovery nonetheless will be long and gradual. And, of course, it’s finally spring in the critical US market, which should bring some buyers out of hibernation as well.

The year on year sales falls at the Detroit three were notably lower in March versus February with GM down 42.5% to 155,380, Ford off 38.1% to 129,309 and Chrysler falling 36.9% to 100,622.

The key Japanese brands didn’t do much better. Toyota was down 36.6% to 132,802, Honda off 33.7% to 88,379, ‘Nee-saan’ fell 35.2% to 66,641, and ‘Mars-daa’ dipped 30.6% to 21,974.

Subaru inched up 1.3% to 16,249 and Mitsubishi plunged 55.3% to 4,620.

Hyundai, clearly benefiting from the free payment protection plan it pioneered – and copied this week by Ford and GM in the US and Honda here in the UK – was off just 1% to 40,721 while affiliate Kia posted a 3.4% uptick to 24,724 units.

Amongst the Europeans, Volkswagen had the smallest fall (16.4%) and highest unit sales (22,153) followed by BMW (-19.8%; 21,125), Daimler (-19.9%; 17,369) and Porsche (-26.3%; 1,749).

A thought: if the Chrysler-Fiat alliance goes ahead, will Chrysler claim the Fiat and Alfa sales as its own or will we welcome the Italians back into the European section of the Wards tables?

Overall, last month, domestic light vehicle sales fell 36.5% to 614,026 and import brands were off 27.4% to 241,332.

Total year to date sales were off 38.3% to 2,197,239 for the first quarter.

In the individual models tables, trucks still rule. Ford’s F-series (81,579) and Chevy’s Silverado (67,283) still managed to head off the top selling car, Toyota’s Camry (67,199). Chevy’s acclaimed Malibu was top US model in sixth place (35,600).

Graeme Roberts