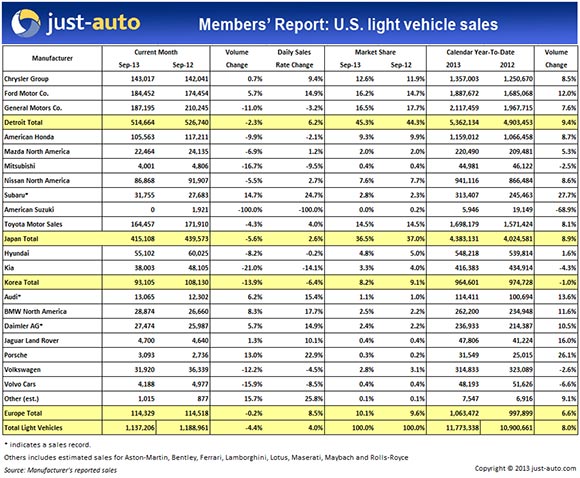

Thanks to a quirk in the reporting calendar, US light vehicle sales in September missed their year ago mark for the first time since May 2011.

Since the long Labour Day holiday was counted in August’s totals this year, September was left with two fewer selling days. Sales volume totaled a bit over 1.1m light vehicles, down 4.4% from September 2012, as the majority of automakers came up short. But, adjusted for daily sales rate, September came in with a 4.0% gain.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The seasonally adjusted annualised rate (SAAR) for September was 15.28m, the lowest tally since April. However, considering that August’s unusually robust 16.09m figure included sales that actually occurred in September, the meaning of last month’s SAAR wouldn’t seem to be a cause for concern.

Chrysler confounded the analysts by chalking up a 42nd month of improved sales, though the gain was just 0.7%; less than 1,000 units. Sales of the Ram pickup continue to be strong and the Dodge Durango and Dodge Dart both contributed substantial growth to the mix. Chrysler’s minivans were the sales leaders in September but Jeep stumbled due to the continued delay of the new Cherokee.

Strong car sales and another 60,000+ month for the F-Series pickup truck gave Ford a 5.7% boost, the largest among the Detroit automakers. Fusion sales jumped 62.4% keeping it the best selling American badged car. Ford SUV/crossover sales stumbled a bit last month with a 20.6% drop in sales of the Edge.

General Motors sales fell 11.0% on surprisingly weak pickup sales. GM said about 60% of the pickup volume in September were the new 2014 models. But Silverado sales fell 10.8% while the Sierra, the GMC clone, dropped about 1.5%. GM has announced it will be putting cash on the hood of the new trucks, citing stiff incentive competition from Ford and Ram. Car sales were also soft: the Cruze hit a 50.6% speed bump and deliveries of the Sonic and the redesigned Impala were also down.

Despite the tepid results, the Detroit automakers picked up an entire point of market share, courtesy of the Japanese and Korean brands, which gave up a combined 1.4% of the market.

With the exception of Subaru, which had another record month, every Asian marque was in the red in September. Losses ranged from Toyota’s 4.3% shortfall to Kia’s 21.0% plunge.

What share Detroit didn’t take was snapped up by the European premium brands. Mercedes padded its lead over BMW in the luxury segment and Audi passed Acura as it chalked up its 33rd consecutive month of record sales.

Volkswagen is continuing to struggle and management has promised fresh product. One wonders why the folks in Wolfsburg don’t just send over some of the vehicles they are already selling in Europe.

The August-September imbalance will probably correct itself in the fourth quarter, yielding an annual volume in the mid 15m range, but there are some cautionary signs for rapid growth beyond that.

Since 2009, year over year growth has been measured in double digits. From September 2009 to September 2010, sales grew 10.3%. In the same period a year later, that figure was 15.4% and last year, growth in the first three quarters was 14.5% as the economy appeared to gain traction.

This year, cumulative growth to the end of September is just 8% and an examination of each month since the end of January 2013 shows a similar picture. Some have already dismissed the September results as the fault of the Labour Day shift or concern about the current Washington follies but this trend appears to be deeper. It may be that the pent-up demand that has driven growth has been sated, but when significant new products like the GM pickups can’t jump-start sales, there may be other factors worthy of a closer look.