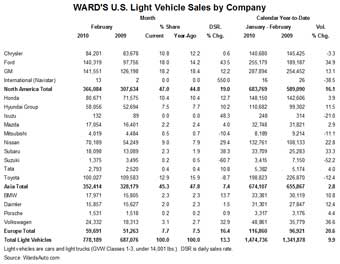

Ford was the big winner in the US light vehicle sales race in February, posting an adjusted-for-selling-days rise of 43.5% to 140,319 units, according to WardsAuto.com data. GM sales rose 12.2% to 141,551 and Chrysler inched up 0.6% to 84,201 units.

The comparison month was, of course, a post-credit-crunch February 2009 but black ink is black ink and reporting rises a pleasant change. Overall sales rose 13.3% to 778,719 last month.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Cue Ford sales analyst, George Pipas: “The market continues to be tough, but we’ve started the year with a 24% sales increase in January, and a 43% increase in February, it’s a very positive start in what continues to be a very challenging environment.

“We’re going to keep concentrating on building products that people want to buy and that they’ll value and if we do that, then the results will take care of themselves and it won’t always be the case that we are able to put these kind of numbers on the board, but I think it shows continuing progress on this plan that we’re on.

“We expected both an increase in retail sales and we achieved that, retail sales were up 28% this month versus a month ago. The fleet business was up a little over 70%, both in magnitude and direction that was generally consistent with our expectations for the month.”

Of the key import brands, Toyota, alone, posted an 8.7% drop to 100,027 in the midst of its recall woes but it should be noted that a some cars that might have been sold were stuck in dealer inventory or the factory supply pipeline awaiting gas pedal and/or floor mat modifications.

Honda volume rose 12.7% to 80,671 and Nissan was up 29.4% at 70,189. Hyundai-Kia group sales rose 10.2% to 58,056 and minnow Subaru remained on a roll with February volume up 38.3% to 18,098.

“A year ago the economy and our industry were at a low point marked with great uncertainty,” said John Mendel, sales chief for American Honda. “While we remain cautious, we’re happy to see customers actively seeking [our] products like the new Accord Crosstour.”

Dave Zuchowski, Hyundai Motor America’s sales chief said new products helped. “Our sales gains in February were driven by strong consumer response to new products like the Tucson, which was up 102%, and the new US-built Sonata, which was just launched this month and has already driven a 58% sales increase. For the Hyundai brand as a whole, consumer retail sales were up 21% while incentive spending was down more than 30%. We’re excited about the momentum we’re carrying into March.”

Zuchowski added that February was a strong month for both Hyundai and the industry, taking into account the adverse weather conditions [widespread snow storms as far south as ‘sunbelt’ Texas – ed] in much of the country.

Mitsubishi posted a 10.4% drop to 4,019 units but local president and CEO Shinichi Kurihara was upbeat: “While February’s severe weather affected showroom traffic in some of our key sales regions, we feel we have maintained a positive momentum.”

Sales for the past three months (December through February) increased more than 9% compared to the previous three month period (September through November).

“We intend to build upon this success to enjoy an improved sales increase next month,” Kurihara said.

Suzuki tanked a massive 60.7% to 1,375 units last month. There have been suggestions recently it might leave the US but has just launched the Kizashi, a well specified sedan competitor for the likes of the Chevrolet Malibu, Honda Accord and Hyundai Sonata, and with an all-wheel-drive option, so may see some uptick as sales momentum of the new car builds.

Amongst the Europeans, Volkswagen, well stocked with new models, posted a 32.9% rise to 24,332 units, BMW was up 13.7% to 17,971 and Daimler group volume rose 1.5% to 15,857. Porsche was up 0.9% to 1,531 cars.

US light vehicle sales rose 9.9% in the first two months of the year to 1,474,736. The domestic brand rose 17.2% to 1,125,232 while imports were down 8.4% to 349,504. Total car sales rose 16% to 760,905 while trucks were up 4.1% to 713,831.

Ford has made the most gains of the Detroit Three, up 34.9% to 255,179 but GM’s tally of 287,894 (up 13.1%) was ahead. Chrysler was down 3.3% to 140,680.

Import volume leader Toyota was down 12.4% to 198,823 units while Honda was up 3.9% to 148,150, Nissan up 22.8% to 132,761 and Hyundai group up 11.5% to 110,682.

Volkswagen led the Europeans (+36.6% to 48,861) ahead of BMW (+10.8%; 33,381) and Daimler (+12.4%; 31,301).

In the model stakes, the US love of large pickup trucks continued in the first two months of 2010 with Ford’s F-series (60,525) and GM’s Chevy Silverado (42,594) ahead of the top-placed car, Honda’s Accord (39,046). Chevrolet’s Malibu was the top US brand car in fifth place (31,589), behind the Nissan Altima (34,834) and Toyota Corolla/Matrix line (34,117).