There was widespread optimism about February US light vehicle sales but even the most daring of forecasts fell short of reality.

February’s seasonally adjusted annualised rate (SAAR) soared to 15.0m, the highest since February 2008, as total sales volume rose 15.8% to nearly 1.15m deliveries. Adjusting for this year’s extra selling day, the growth was still a very healthy 11.2%.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Chrysler and Volkswagen blazed the way with gains of 35.1% and 36.8%, respectively. Triple-digit increases in sales of the Chrysler 200 and 300 helped total passenger car sales more than double from February 2011. The Beetle and US-built Passat did the trick for Volkswagen, giving the top German automaker its best US February since 1973.

Ford reported a 10% improvement with sales of the Focus soaring 106% as it became the best-selling American-badged car. Lincoln sales rose by 11.6%.

General Motors reported one of the month’s few shortfalls: sales fell 2.9% and the General gave up 2.6 points of market share. The sell-down of discontinued models and a 19% cut in incentives spending were the culprits.

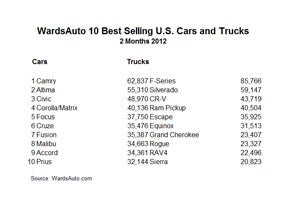

With the exception of Mitsubishi, the Japanese automakers were all back in fighting trim. Subaru reported record monthly sales and Mazda enjoyed its best February since 1994. Toyota, buoyed by big gains in sales of the Yaris, Avalon and Prius, reported a 7.9% improvement; Honda sales climbed 7.8%, propelled by the Civic and the redesigned CR-V which reached US showrooms in December. The Altima helped drive Nissan’s results up 19.9%.

Hyundai and Kia posted new February records. The Kia Optima nearly tripled its February 2011 sales.

Audi and Daimler set new monthly benchmarks, but BMW was February’s best-selling luxury brand.

All of the European brands finished in the black except, of course, Saab, where dealers are selling off existing inventory. Both Jaguar and Land Rover made nice gains. Porsche’s new 911 is doing well but dealers really need the new Boxster.

Volume among the premium brands grew at about twice the pace of the rest of the market.

With petrol prices making the news on a daily basis, a shift to more economical vehicles would be expected. Passenger cars did claim the majority of sales in February, rising from 48.7% last year to 52.3% this year, but compact and larger cars posted more growth than the subcompacts.

Hybrids still don’t seem to be gaining much traction: Toyota has success with them, especially with its Prius family, but other brands don’t fare as well: Honda hybrid sales fell more than 40%. By contrast, Audi, Mercedes and Volkswagen all reported solid growth in diesel sales, a phenomenon that leaves one wondering when the rest of the automakers, especially those with European market diesels handy, are going to take the hint.

Sales of the Chevrolet Volt more than tripled from last February while the Leaf seems to need recharging. Total electric car sales hit 1,545 in February.

While 2012 is off to a strong start, the industry still remembers what happened in the second quarter of 2011. Forecasts for the year are rising but at a cautious rate.