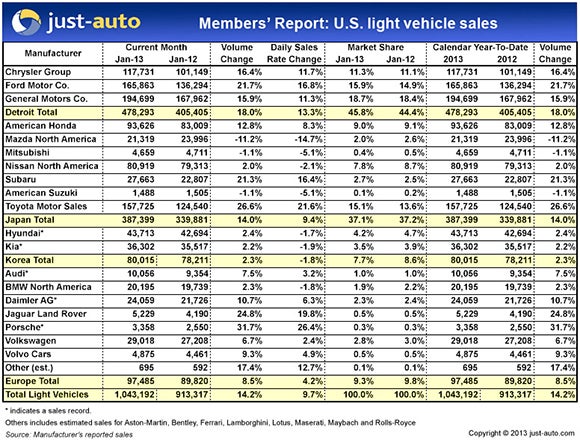

The surge that provided a strong end to 2012 continued into January as US light vehicle sales rose 14.2% to about 1.04m. The seasonally adjusted annualised rate came in at 15.29m, off just slightly from December’s 15.37m, and well ahead of the 13.98m figure reported in January 2012.

Leading the way were the Detroit automakers, which all posted double-digit growth and teamed up to take an additional 1.4 points of market share. The trio was led by a 21.7% gain from Ford, where a 39.3% jump in car sales lifted total Ford brand deliveries by 23.3%. While fleet sales were likely a major factor, Ford actually sold more passenger cars than SUVs and crossovers in January. The new Fusion, despite some issues, was the best-selling US-brand car.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Lincoln continues to be Ford’s Achilles Heel with sales off 18.2%. Lincoln was near the bottom of the premium segment, coming in 10th of 12 brands; trailing both Volvo and Land Rover.

Chrysler sales rose 16.4% last month. Once again, the story was passenger car sales with volume up 50.4% compared to January 2012. 36.8% of total Chrysler Group sales went to cars: last year, that figure was 28.5%.

Despite concerns about a flubbed launch and the need for more power under the hood, sales of the Dodge Dart continue to improve. The volume isn’t where Chrysler CEO Sergio Marchionne wants it, but the Dart is one of the strongest performers out of all the new vehicles introduced in 2012. New models that have been announced should bring more shoppers into Dodge showrooms.

General Motors 15.9% improvement was driven in part by powerhouse finishes at Buick and Cadillac. Buick got a nice bump from its Verano clone of the Chevrolet Sonic and the new ATS and XTS boosted Cadillac’s volume by 47.0%.

Increases in light truck sales also helped the General beat analyst estimates. The Silverado and Sierra pickups had the largest gains of any full-size American pickups.

Toyota enjoyed the largest margin of any of the major automakers and also picked up 1.5 points of market share. Big jumps in sales of the Corolla and Avalon and a 60% gain in Lexus passenger car sales help the top Japanese manufacturer put pressure on Ford for second place in the standings. Toyota was just 8,138 sales behind Ford in January.

Subaru didn’t set any new records, but it reported a 21.3% increase in sales. Honda continued its recovery with a 12.8% improvement built on a 75.2% blowout in Accord sales.

While the improvements were small, Hyundai and Kia both set monthly sales records helped by volumes of the Elantra and Optima.

Mercedes-Benz started 2013 with a new January sales record and a healthy lead over BMW, which finished January just 302 sales ahead of a resurgent Lexus. Audi claimed another new sales record as it passed Acura to take the No. 5 spot in the luxury rankings.

Volkswagen sales continue to grow: VW outsold the Buick, Cadillac and Chrysler brands in January. New subsidiary Porsche brought home another monthly sales record.

Automakers have a 15-million-sale target for 2013. If Washington can demonstrate some direction and leadership that will encourage businesses to take the risk of real growth, it should be possible.

|