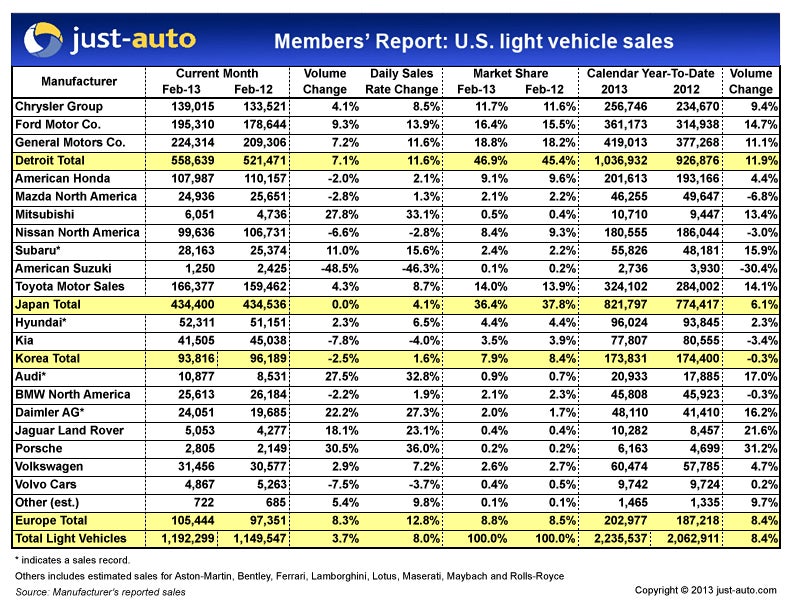

Severe weather and government shenanigans couldn’t keep Americans from visiting dealer lots last month. February light vehicle sales were up 3.7%, surpassing 1.19m and producing a SAAR of 15.38m units. This is the fourth consecutive month the SAAR has been above 15m.

Ford ended the month 9.3% ahead of February 2012 as the Fusion saloon and Escape crossover set new sales records. Ford had the best results of the Detroit automakers and its best February in six years. Despite a big Super Bowl ad spend, Lincoln again delivered disappointing numbers, hampered by a shortage of the new, and heavily promoted, MKZ saloon.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Things were much better for Cadillac: the new ATS was the brand’s best-selling car, helping it achieve a 20.3% improvement. Combined with a boost from Buick and big jumps in sales of the Silverado and Sierra full-size pickups, General Motors’ volume was up 7.2% over last February.

Chrysler reported the smallest gain of the Detroit Three due to the selldown of the Jeep Liberty (Cherokee) and a steep drop in sales of the Grand Cherokee. Fiat/Chrysler CEO Sergio Marchionne warned that the company’s long string of year over year improvements might be at an end as clearance of old products and rollouts of new products reduce turnover in the coming months.

The Detroit automakers grew their market slice by 1.5 points to 46.9%, taking share from the Japanese and Korean companies.

Most Japanese car companies turned in modest performances. Honda, Nissan and Mazda all missed their marks and Toyota gained just 4.3%. Very strong sales of the Accord and a small improvement from Acura couldn’t cover drops in sales of the Civic, CR-V, Fit and Odyssey. Nissan’s Achilles’ heel was its bread-and-butter saloons, the Altima, Sentra and Maxima, all of which were in the red at month’s end.

Mitsubishi finished February with a 27.8% gain, one of the largest improvements reported, as sales of the Outlander, Outlander Sport and Lancer posted good numbers. Subaru came through with another monthly sales record.

Hyundai also posted a record month but Kia stumbled with sales down 7.8% thanks to selloff of the Sedona minivan and shortfalls reported for the Forte, Sorento and Soul. Kia’s decline was enough to bring the Koreans’ market share below 8%.

European manufacturers picked up a bit of market share as Daimler and Audi reported new sales records. BMW Group was tripped up by softness in sales of the 1 series and 3 series as well as the X3 crossover. This was compounded by a 13.6% slump in MINI sales. BMW finished behind Mercedes-Benz for the second month in a row.

Volkswagen brand sales improved, though the gain was small compared to other recent months. With Audi’s sales record and another good month from Porsche, the group’s volume was up 9.6%.

Here in the US, sales of full-size pickups are a useful barometer of the state of the economy as businesses and tradesmen are among the primary buyers. Apparently good weather lies ahead: sales of full-size pickups were up 17.4% last month, nearly five times the growth of the general market.

|