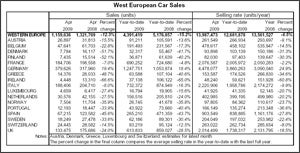

Figures released by JD Power Automotive Forecasting show that the West European car market fell by 12.3% year-on-year in April. However, the weak looking result was in part a result of fewer working days in the month of April this year (due to when Easter fell).

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

JD Power said that after adjusting for working days, April was actually a strong month. Indeed, the data analyst and forecaster said that in the current economic circumstances April sales ‘must be described as of unusual strength’.

It said the seasonally adjusted annual selling rate rose to almost 14m units in April, as the ‘explosive’ performance of the German car market offset losses in other countries. Without Germany’s scrappage incentive inspired growth, JD Power said that the underlying

level of demand would be more than 2.5m units a year below this.

German car sales were up by 19% in April, to produce one of the best April results on record.

The Italian and French markets also continue to benefit from their own scrapping incentive schemes, with Italian sales improving. The Italian market achieved a seasonally adjusted annualised rate of sales of 2.2m units in April, a large improvement on recent months.

The Spanish market also bounced back a little following dire results in the early months of 2009. The selling rate improved to over 900,000 units/year, though it is still clearly very weak, JD Power maintains.

JD Power also said that UK sales ‘surprised on the upside’ as OEMs set out incentives ahead of the government scrapping incentive scheduled to start in mid-May.

However, JD Power cautioned that while it expects incentives to continue to support sales while they are in place in 2009, it is likely that the impact will moderate as the year progresses.

This is already evident in falling incoming incentive claim rates in Germany for

example, it said, also warning that rising unemployment across the region will dampen sales further this year.

And it further warned that if incentives expire as planned, there will be a strong negative impact on the market in 2010.

JD Power is forecasting that car sales in Western Europe will reach 12.65m units this year, 7% below last year and almost 15% off the 2007 market of 14.8m units.