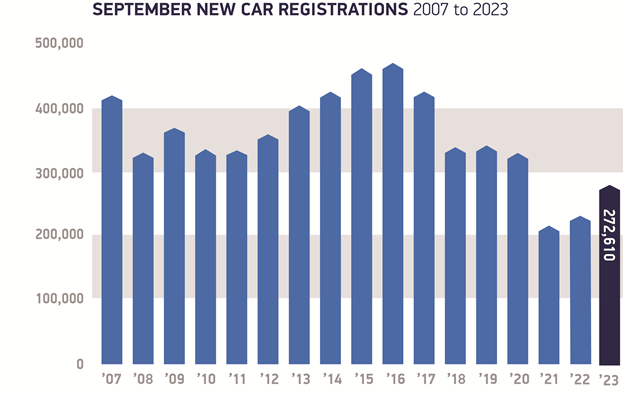

The UK new car market grew 21.0% in September with 272,610 registrations in the month, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

The 14th consecutive month of growth was also the second busiest of the year after March, with the new number plate delivering its traditional market surge despite a challenging economic backdrop.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

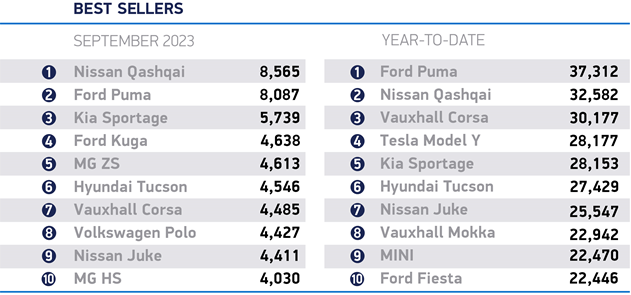

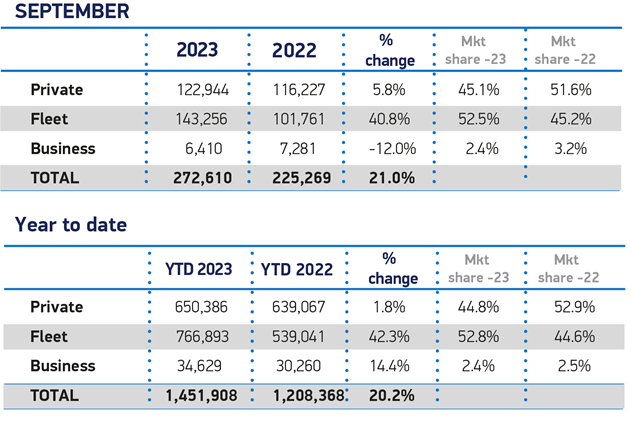

Growth continued to be driven by large fleets, which rose 40.8% to 143,256 units to reach a market share of 52.5%. The SMMT said this represents a market rebalancing after constrained supply in 2022 restricted deliveries to business and fleet customers. Private consumer demand, meanwhile, also grew, up 5.8% to 122,944 units.

As a result, the industry enjoyed its best September since 2020, although registrations remain around a fifth below pre-pandemic levels.

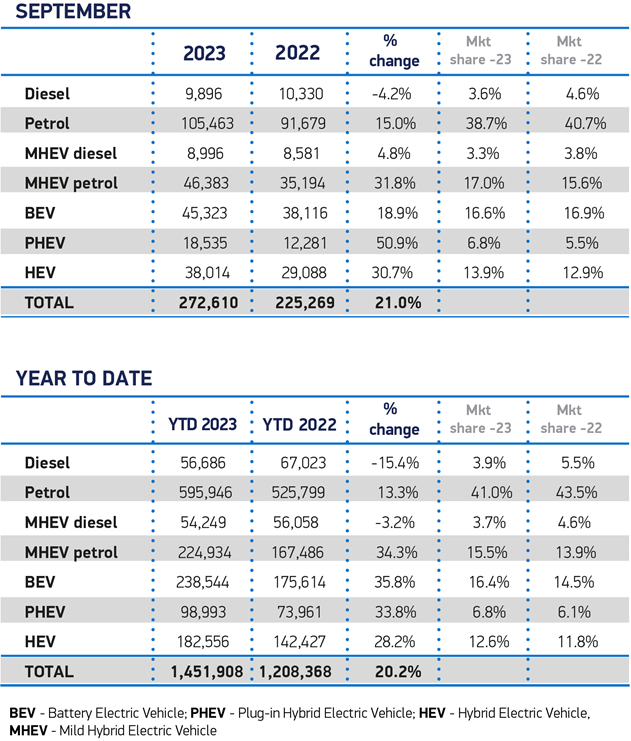

Electrified vehicle uptake continued to grow in the month, with plug-in hybrid vehicles (PHEVs) up 50.9% to take a 6.8% market share and hybrid electric vehicles (HEVs) up 30.7% to account for 13.9% of all registrations. Battery electric vehicles (BEVs), meanwhile, recorded their 41st consecutive month of growth – with 45,323 drivers making the switch, an 18.9% uplift. Given this growth was less than the overall recorded by the market, however, BEV market share slipped back slightly to 16.6% from 16.9% a year ago.

BEV volume increases were driven entirely by fleet purchases, which rose by 50.6%. Conversely, private BEV registrations fell 14.3% with less than one in 10 private new car buyers opting for electric during the month. The SMMT said that such a decline ‘underlines the importance of providing these motorists with purchase incentives and other mechanisms to stimulate demand’.

Despite an end of sale date now aligned with other major markets, the SMMT said the UK still has the most challenging zero emission vehicle (ZEV) transition timeline. The trade association notes that the recently published Zero Emission Vehicle Mandate require ZEVs to comprise half of each manufacturer’s new registrations within five years, and 80% by 2030. Achieving this, it said, will depend on private buyers making the transition, along with business and fleet customers. However, unlike in the other major markets working towards a 2035 end of sale date, UK private motorists have no purchase incentive to encourage them to invest in electric mobility.

Mike Hawes, SMMT Chief Executive, said: “A bumper September means the new car market remains strong despite economic challenges. However, with tougher EV targets for manufacturers coming into force next year, we need to accelerate the transition, encouraging all motorists to make the switch. This means adding carrots to the stick – creating private purchase incentives aligned with business benefits, equalising on-street charging VAT with off-street domestic rates and mandating chargepoint rollout in line with how electric vehicle sales are now to be dictated. The forthcoming Autumn Statement is the perfect opportunity to create the conditions that will deliver the zero emission mobility essential to our shared net zero ambition.”

Richard Peberdy, UK Head of Automotive for KPMG, noted the key role of business purchases. He said: “Personal car ownership still makes up just under half of the UK car market, but the growth of new car sales has understandably been hit this year by the cost of living crisis and a higher cost of car financing.

“Some motorists’ car choices will however be captured by the growth in business and fleet vehicle data, in the form of company car ‘user-choosers’ and salary sacrifice arrangements through employers. Therefore, fleet and business purchases certainly continue to drive the growth in the UK car market, with electric vehicles a key part of this – aided by low benefit-in-kind tax and high write-down allowances. There are no such Government incentives for private car sales – but EV prices are dropping as more EV brand competition enters the market, while more EV stock entering the used market is also leading to EV price corrections.”

Peberdy also said that insufficient charging infrastructure remains a barrier to higher BEV sales, despite the UK Government’s Zero Emissions Vehicle Mandate. He said: “More competition and lower pricing is key to increasing EV adoption and ensuring that the battery electric market share of 16% rises in order to meet the 22% target set for 2024 by the Zero Emissions Vehicle Mandate. Availability of charging points on residential streets remains a major barrier to transition to EVs for the many people who don’t have off-street parking. And ensuring that on-street chargepoint numbers increase is also key to the UK meeting the 22% ZEV target next year. The Government might also look at the disparity between VAT charged at 5% on home charging versus the 20% charged for on-street charging.”