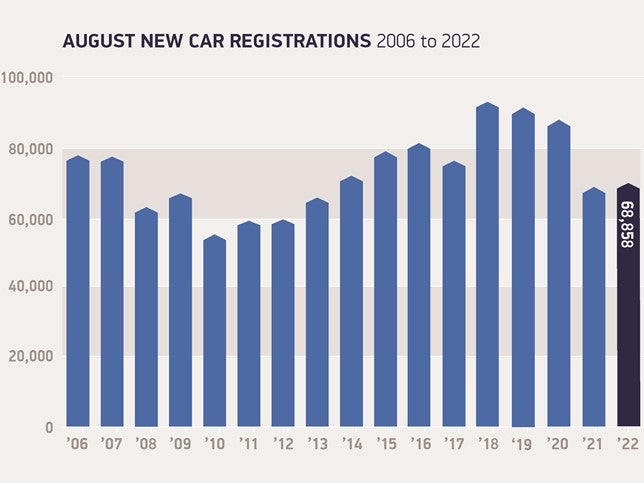

The UK new car market rose by 1.2% in August, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

The year-on-year growth posted in the month, albeit slight, is the first seen since February, with some 68,858 new vehicles joining the road during what is typically the second quietest month of the year as many buyers choose to wait for a ‘new’ numberplate in September.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Despite the growth, August volumes were still the weakest for the month, bar 2021, since 2013 as supply chain pressures continued to constrain the market, the SMMT said.

Large fleet registrations fell by 1.6%, although this was offset by a 3.2% increase in deliveries to private consumers. Business customers saw the largest increase of 26.6%, but the sector is small in volume and subject to volatility.

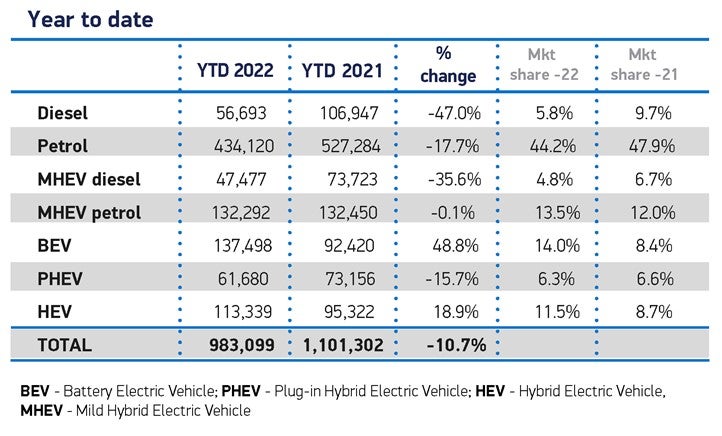

Overall growth in the month was driven primarily by battery electric vehicles (BEVs), which recorded a 35.4% increase in volumes and a 14.5% market share. However, growth in this segment is slowing, with a year-to-date increase of 48.8%, whereas at the end of Q1, BEV registrations had been up by 101.9%.

Plug-in Hybrid (PHEV) registrations fell by -23.1% to comprise 5.6% of monthly registrations. As a result, plug-in vehicles accounted for one in five (20.2%) of August’s registrations. Hybrid electric vehicle registrations remained relatively stable, falling by -0.7%.

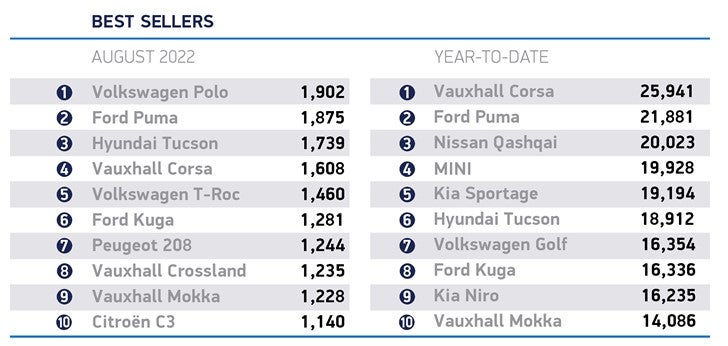

Superminis remained the most popular vehicle class, growing market share to 34.0% as 7.4% more of them were delivered to customers than in August 2021. Multi-purpose, luxury saloon and lower medium vehicles also recorded growth of 31.0%, 1.5% and 1.3% respectively, while registrations of all other segments declined.

Year to date, registrations are down by 10.7% on last year at 983,099 units – more than a third (35.3%) lower than during the first eight months of pre-pandemic 2019 – demonstrating the scale of the challenge ahead in terms of recovery.

Mike Hawes, SMMT Chief Executive, said: “August’s new car market growth is welcome, but marginal during a low volume month. Spiralling energy costs and inflation on top of sustained supply chain challenges are piling even more pressure on the automotive industry’s post-pandemic recovery, and we urgently need the new Prime Minister to tackle these challenges and restore confidence and sustainable growth.

“With September traditionally a bumper time for new car uptake, the next month will be the true barometer of industry recovery as it accelerates the transition to zero emission mobility despite the myriad challenges.”

Responding to SMMT new car registrations data for August, Richard Peberdy, UK Head of Automotive, KPMG, said: “A slight easing of global supply shortages is leading to a welcome increase in UK car production and new car sales. But a rising cost of living threatens consumer appetite. Whilst rising energy and other inflationary costs are putting pricing under pressure. The remainder of 2022 is set to further challenge the UK car industry, despite the welcome easing of component availability.”

GlobalData forecasts that the UK car market will decline slightly to a low of 1.6 million units in 2022, with a slow recovery to 1.79 million units next year – still well adrift of the pre-pandemic market of 2.3 million seen in 2019.