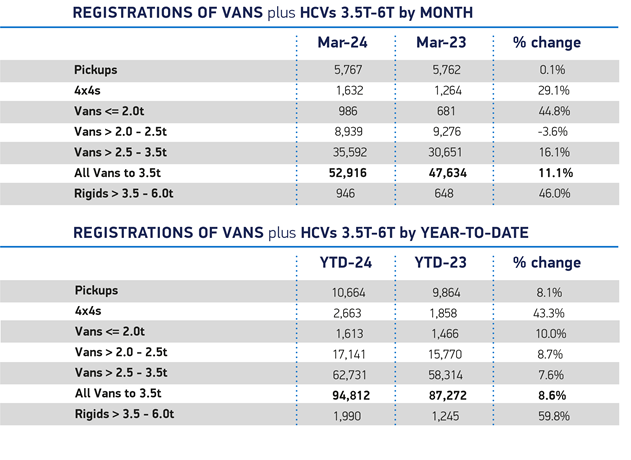

52,916 new light commercial vehicles (LCVs) (plus another 946 3.5-6-tonne ‘rigids’) were registered during what the Society of Motor Manufacturers and Traders (SMMT) described as “a bumper March for fleet renewal” as more businesses upgraded than in any other month during the past three years.

In the UK, the registration plate ‘year identifier’ digits change twice yearly on 1 March and 1 September.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Q1 2024 volume was 7.7% below Q1 2019, the pre-pandemic peak.

SMMT said registrations were driven by demand for the largest vans weighing more than 2.5 tonnes to 3.5 tonnes, up 16.1% to take 67.3% of the market.

However, the largest percentage increase was for the smallest vans, up 44.8% to 986 units while demand for medium size vans fell 3.6% to 8,939 units.

Pickup truck volume increased 0.1% to to 5,767, compared with a particularly strong month last year while demand for 4x4s rose 29.1% to 1,632 units.

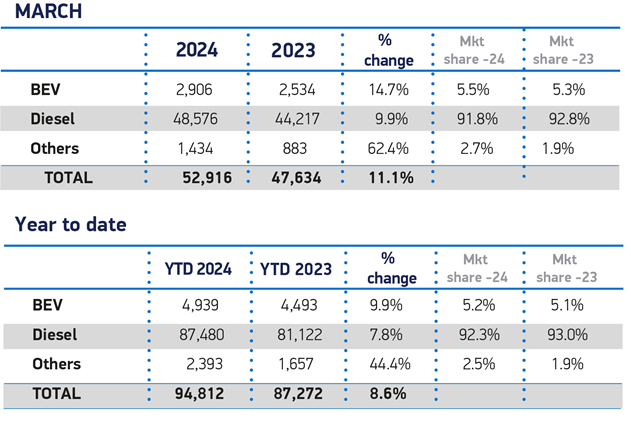

Sales of battery electric vans (BEVs) rose 14.7% to 2,906 units for a 5.5% slice of the LCV market, up only slightly from 5.3% a year ago.

The SMMT repeated its call for “urgent action” needed to improve the confidence of operators to switch to the growing number of BEV models on offer.

“Maintaining existing purchase incentives is essential, but urgent action is also needed to address the concerns of some businesses,” the lobby group said in a statement.

“This includes tackling charging anxiety by ramping up van suitable public infrastructure across the UK so that operators have full confidence to charge wherever and whenever they need.

“At the same time, with the cost of VAT on public charging four times higher than private or home charging, this disparity presents another obstacle for businesses planning to transition to a net zero fleet.”