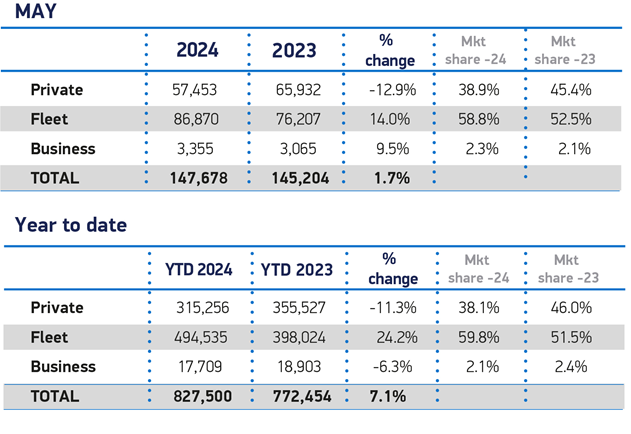

The UK new car market marked its 22nd consecutive month of growth as registrations rose 1.7% in May, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

With 147,678 units reaching the road, it was the best May market performance since 2021, although it remains down some 19.6% on 2019.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Fleets and businesses continued to fuel market growth, up 14.0% and 9.5% respectively, narrowly offsetting a 12.9% decline in private retail uptake.

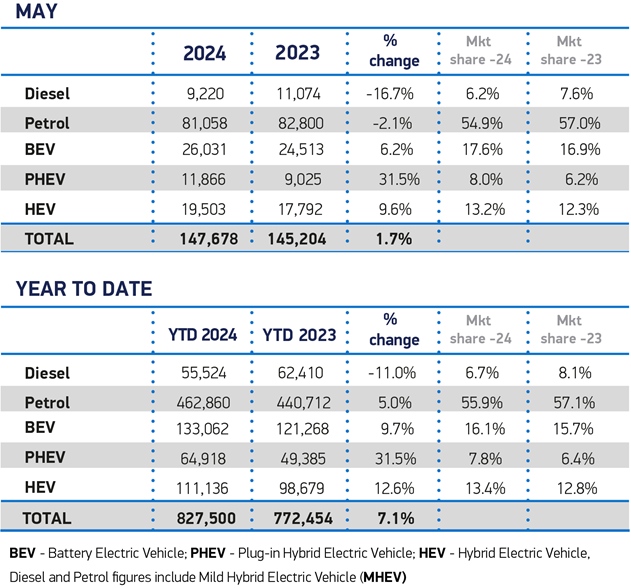

While deliveries of both petrol and diesel cars fell, demand for electrified vehicles rose, with plug-in hybrids (PHEVs) recording the highest growth of all powertrains, up 31.5% to reach an 8.0% market share, and hybrids (HEVs) rising 9.6%, maintaining their status as the third most popular fuel type after petrol and battery electric at 13.2% of the market.

Battery electric vehicle (BEV) registrations also outperformed the market, rising 6.2% to claim a 17.6% market share, up from 16.9% in the same month last year. Uptake is still driven by the fleet sector, where volumes rose 10.7%. Private retail BEV uptake, meanwhile, fell by 2.0% (just 98 registrations short of May last year). This performance, although encouraging, is still below the trajectory mandated on manufacturers by government in its Vehicle Emissions Trading Scheme, which demands 22% of new vehicles sold this year by each brand must be zero emission.

With a choice of more than 100 EV models now available, and a raft of compelling offers, manufacturers are dedicated to driving change, but meeting targets will require more support, the SMMT says.

The SMMT also warns that manufacturer discounting cannot be sustained indefinitely as it undermines the ability of companies to invest in next generation technologies. The market performance underlines the need for the next government to provide private consumers with meaningful purchase incentives, the trade association maintains.

While some private buyers can access some of the benefits enjoyed by business buyers through salary sacrifice schemes, the SMMT says providing universal access to incentives would dramatically increase BEV uptake and accelerate the decarbonisation of road transport. The SMMT suggest that a temporary halving of VAT on new BEV purchases, combined with a cut in the VAT levied on public charging from 20% to 5% – in line with domestic use – would drive up BEV demand, putting more than a quarter of a million BEVs on the road instead of petrol or diesel cars over the next three years.

Mike Hawes, SMMT Chief Executive, said: “As Britain prepares for next month’s general election, the new car market continues to hold steady as large fleets sustain growth, offsetting weakened private retail demand. Consumers enjoy a plethora of new electric models and some very attractive offers, but manufacturers can’t sustain this scale of support on their own indefinitely. Their success so far should be a signpost for the next government that a faster and fairer transition requires carrots, not just sticks.”

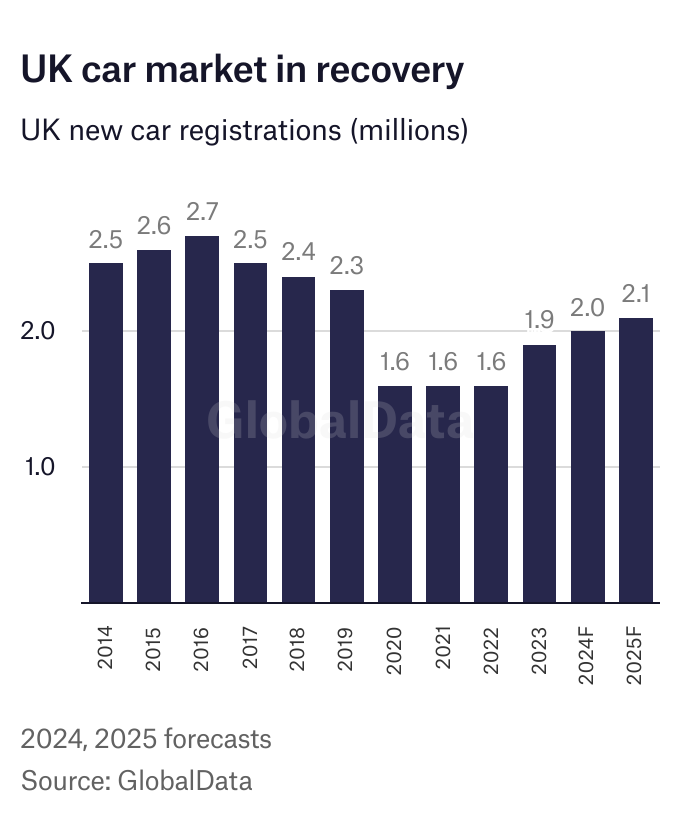

GlobalData forecasts the UK car market will grow by around 3% to 2m units in 2024. That would follow an 18% rebound in 2023 as supply constraints caused by the global semiconductors crisis eased.

GlobalData analyst Jonathon Poskitt told Just Auto: “The UK car market pace this year points to a continuing moderate recovery. Interest rates are still at historically high levels, although they are expected to edge down significantly later this year.

“Weak private buyer demand is a real concern though, particularly as fleets hit high renewal rates for electrified vehicles.”

Richard Peberdy, UK Head of Automotive for KPMG, also highlighted the importance of fleet sales in the UK market generally and for BEV sales. He said: “Growth continues for the UK’s new car market, but fleet and business buying remain the drivers. “Fleets are also driving the growth in electric vehicle market share, leading industry players to continue to call for the kind of consumer incentives that have helped to boost business EV buying.”